Emotions can be one of the factors that affect a trader’s decision-making, risk management, and profits. The right mindset is often needed for more optimal trading. Moreover, the mindset of trading when the market is bullish and bearish can differ. What are the differences? How can you train your emotions to have a better mindset? Check out the full review in the following article.

Article Summary

- 🧠 In crypto, the right mindset determines the success of trading. Of course, the trading mindset during a bear market will be different from bull market conditions.

- 🧘♂️ Traders must be able to adapt to market conditions and change their mindset accordingly. The mindset of trading in a bear market won’t get you profit in bullish market conditions and vice versa.

- 📊 In a bear market, the mindset is to be realistic by looking for potential projects based on quantifiable metrics. So when the market turns bullish, the project will skyrocket and provide promising returns.

- 🚀 When the market is bullish, the mindset is opportunistic by looking for projects surrounded by speculation. Behind the speculation is hype and FOMO that can lift the price.

What is Trading Mindset in Crypto?

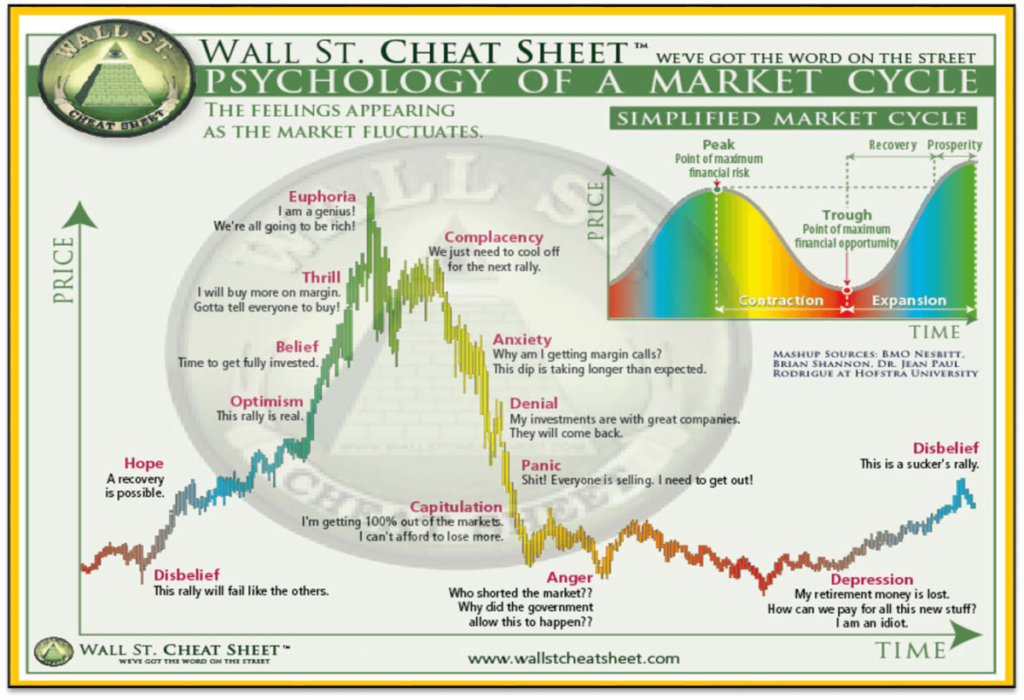

When it comes to crypto trading, a trader’s mindset and psychological state play an important role in decision-making. By analyzing the mindset or psychology of traders, we can identify and find explanations behind their overall patterns or motives.

Metrics such as the fear & greed index are one way to measure market participants’ sentiment and psychological state. However, it is still a general market sentiment. You need evidence-based observation and experience to identify the psychology of market participants.

Fortunately, Bitcoin and the crypto market as a whole have their unique cycles and flows. This makes it easier to identify market conditions and the psychology of the participants.

We can determine the most suitable trading mindset by knowing the signs of whether the market is bullish or bearish. The mindset of trading during a bear market will differ from the mindset during a bull market, and vice versa. The following section will explain the trading mindset for each market condition.

Find out how to identify bull and bear markets in this Pintu Academy article.

Trading Mindset in Bear Market

In a bearish market, money and liquidity are scarce. There is not much speculation that can lift prices. Under these conditions, the trading mindset of market participants becomes more realistic.

With this mindset, many traders look for projects with solid revenue streams and high user activity and numbers. In other words, market participants will invest in projects where metrics can be measured. Projects with good fundamentals are expected to have much more promising potential in the future.

Considering that every bull market has a new narrative, looking for projects that have the potential to fit into that narrative can be one of the trading mindsets. Moreover, developers’ teams often use the bear market period to create new projects expected to be “the big thing” in the next bull run.

However, many traders who perform well during bear markets struggle when the market switches to a bullish phase, especially in the early stages. That mindset doesn’t apply to bull markets. Bull and bear markets have different characteristics. Ultimately, only traders who can adapt and adjust their mindset will perform well when market conditions have reversed.

Trading Mindset in Bull Market

Bull markets have a contrary situation. Under these conditions, money and liquidity are abundant. The prices of various crypto assets will be driven by speculation. As a result, the trading mindset of market participants becomes opportunistic and filled with greed.

When the market is bullish, potential projects that slowly grew during the bear market will show their results. Moreover, the injection of new liquidity and investors will further increase the price.

For example, the Injective (INJ) price at the beginning of 2023 was still around US$ 1.5. Then, thanks to the recent rise in BTC, the INJ price was already at US$ 17.12 as of November 8, 2023.

In addition, many innovative new projects will emerge when the market is bullish. Unlike projects from bear markets, the metrics of these projects are not yet quantifiable. However, these projects will achieve millions or even billions of valuations easily.

One of the reasons is the combination of new projects whose concepts still need to be understood by many people. But still, everyone says amazing things about that concept that will revolutionize an industry. As the market is filled with greed and an opportunistic mindset, it encourages a sense of optimism that will lift the valuations of various projects.

In most cases, during a bull run, when the project starts generating revenue and the metrics can be measured, it turns out that the performance is not that dazzling. The valuation is then recalculated and adjusted, eventually ending the hype and FOMO. The asset price drops and adjusts its valuation accordingly.

Is it true that a crypto bull market is on the horizon? Here’s a guide to identify it.

The Fate of Traders with the Wrong Mindset

Market participants who manage to capitalize on the momentum will make huge profits. This is because they will take profits when the asset price falls. However, some will get stuck because they become exit liquidity of those first investors.

Meanwhile, investors with a bear market mindset will miss that opportunity. They are too busy waiting until a project can be measured. However, when those metrics can be measured, they realize that the project may already be overvalued. It’s too late for them to enter because the hype and FOMO momentum is already gone.

Therefore, forget about considering metrics such as user, transaction, and revenue number when looking at a project in a bull market. Riding speculation was the best and most optimized way to trade when money and liquidity were abundant. As market conditions have changed, the trading approach must also be adjusted. If not, then you will be left behind.

Tips to Master the Psychology of Trading

When it comes to the trading mindset, the biggest question is how to master it. The answer is certainly not easy because emotions are involved in trading.

So, the easiest way to form a trading mindset is to control those emotions. The following are some tips that can be applied to manage emotions and master a trading mindset:

1. Set Risk Tolerance Limit

By determining the maximum risk tolerance limit, traders will have a wiser mindset. For example, Dimas is willing to accept a 25% loss. He can still hold his position as long as his trade has not lost to that level. If it turns out that the asset falls beyond this limit, then Dimas will immediately cutloss. This method can help traders have a calmer mindset when facing turmoil or losses.

Here’s how to do risk management when trading crypto.

2. Use Automation.

Another way to limit emotional involvement when trading is to use automation. One way is to automatically utilize the limit order feature to sell and buy. By setting the target price from the start, the system will do the buying and selling process so that emotions will not be involved.

Want to know how to use limit orders? Here’s a guide to using limit orders.

3. Use Journal Trading.

Keeping a trading journal is one way to master a trader’s mindset. By recording and evaluating all positions taken, traders can identify mistakes or strategies that work. These things can help traders become more objective and recognize their abilities.

Want to keep a trading journal? Relax, Pintu Academy has prepared a guide here.

4. Do Practice with Paper Money.

Using paper money is recommended if involving real money can affect a trader’s emotions and mindset. With a demo account, traders can simulate trading and test their strategies. Once they know what strategies and methods are suitable, it will help them have a calmer mindset in the real market.

Conclusion

A trading mindset in crypto is essential as it influences traders’ decisions. In a bear market, traders’ mindset tends to be realistic and choose investments based on solid metrics. While in a bull market, the mindset will be opportunistic and dominated by speculation and greed. A trader’s success depends on adapting to changing market conditions.

To form the right mindset, traders must control their emotions. To eliminate emotions, traders can set risk tolerance limits, use automation, and practice with demo accounts to develop strategies without emotional pressure. Finally, keeping a trading journal can also be a solution to make the mindset more objective in viewing trading.

Buy Crypto Assets on Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

Reference

- Res Degen, Trading in the bull vs trading in the bear, Twitter, accessed on 7 November 2023.

- dYdX Blog, Understanding Trading Psychology and its Application in Cryptocurrency, accessed on 7 November 2023.

- Jan Barley, Mastering the Market in 2024: A Guide to Crypto Trading Psychology, Coin Bureau, accessed on 7 November 2023.