Bull market periods are always the most anticipated events by crypto traders and investors. The main reason is the potential for lucrative profits. But how can you maximize your returns? Here are five tips that you can apply to maximize your trading during the bull market!

Article Summary

- 🔎 The first step when trading in a bull market is to switch the mindset from bear to bull market. This will make the trading strategy more effective.

- 🥇 To maximize profit opportunities, traders should be able to identify and enter the S2 phase or trend change as early as possible.

- 🏆 Successful trading in a bull market is also influenced by choosing the token winners in sectors or narratives that will boom during the bull market.

- ⚡ Don’t forget to set the price targets and use indicators such as resistance points and fibonacci extensions for maximum results.

Preparation for Trading During a Bull Market

Before a bull market begins, the market will go into a transition phase first. This period is the most favorable for traders and investors to start adapting to the new situation. One of them is to switch the trading mindset. Keep in mind that the trading mindset during a bull market will be different from the mindset during a bear market.

Changing this mindset is important to determine your trading success during a bull market. You can find out the difference between the two and how to change the mindset in this Pintu Academy article.

Technical and strategic aspects are the other preparations that are needed. Starting from preparing and building capital for trading, then making a list of crypto assets to buy, determining trading strategies, and managing risk.

Why is it important? And how do you prepare for it? You can learn all in the following article.

How to Trade During a Bull Market

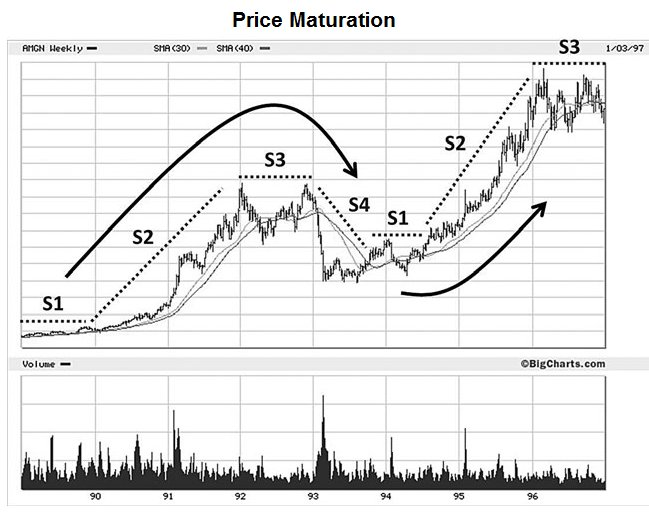

When trading in a bull market, the first thing to do is identify what stage the crypto market is currently in. We can identify the four stages in a trend.

The first stage (S1) is an accumulation area. This phase usually lacks significant news and catalysts, so prices tend to move sideways. However, this phase offers the greatest profit opportunities.

The second stage (S2) is a directional trend. In this phase, the price starts an upward trend due to a positive catalyst. This phase confirms the end of the sideways trend and is the most suitable opportunity to enter the market.

The third stage (S3) is high volatility. Generally, the news and related hype is very high. This phase offers limited profit opportunities. The fourth phase (S4) is the crash. The trend reverses, and a major correction occurs.

The easiest way to identify the stage is to look at the BTC price movement. As long as the price of BTC has not yet moved up and entered the S2 phase, the majority of other cryptos will also not have moved up.

S2 is the best stage to trade because 90% of your profits can be made during this phase. Therefore, avoid trading in the S1/S3/S4 phase to reduce the risk of making mistakes.

There are five bitter lessons you can learn from the mistakes made during the bull market. Read the following article to avoid these mistakes.

5 Trading Tips During a Bull Market

Having successfully identified that the crypto market is entering the S2 phase, here are five tips to maximize your trading during the bull market.

1. Get In as Early as Possible

Take a look at the stage chart in the previous section. The best way to increase your potential profit is to enter as early as possible in the S2 phase. Ideally, traders open a position when the asset prices break out from the S1 phase. During the S2, the price will be in the uptrend until the phase has ended.

The ETH price chart above can serve as an example. The green circle is the initial phase of S2. It is characterized by the crossover of the Exponential Moving Average indicator, both of which are then bullish. After that, ETH moved up by more than 2,000% during S2.

In the S2 phase, altcoins will outperform BTC’s performance. This is because BTC will generally move up first, while altcoin prices will lag. However, once BTC prices slow down, its altcoin prices turn to rise substantially.

Keep in mind that altcoins have a higher volatility than BTC. It is common for the price to fall 20-30%. Meanwhile, when viewed at a macro level, the positive trend is still intact. For traders who don't have a well-thought-out plan, the pullback can trigger panic that leads to cutloss.

2. Choosing the Potential Narrative

Another factor that determines trading success is choosing the right narrative. Narratives are important because they have a role in shaping public perception and influencing market movements.

If a narrative dominates, the projects related to that narrative will witness significant price increases. For example, in the 2021 bull market, the booming narrative was DeFi Summer. At that time, DeFi projects delivered huge profits for traders.

In each narrative, there will be three groups of tokens that are related to that narrative. The three groups are market leader tokens, mid-cap tokens, and new tokens that were born at the same time as the narrative.

Pintu Academy predicts nine main narratives will dominate the crypto market in 2024. What are they? Find out here.

3. Finding Altcoin Winners

As mentioned earlier, the best altcoin options are tokens that are market leaders in respective narratives. Typically, whales and other big money will jump into this group of tokens when the narrative takes shape. An increase in the token price of the market leader group will also make the token price in other groups rise.

What are altcoin winners? For example, we see that layer 2 sectors and narratives will dominate. Based on research, it is known that Arbitrum (ARB) is the market leader because it has the highest TVL and daily transactions. In addition, it is also developing Layer 3 technology. Given Arbitrum's strong fundamentals compared to other L2 protocols, it has the potential to become a token winner in the L2 sector.

After finding the altcoin market leader in a narrative, look for assets whose price movement is sideways. Why? Because assets whose prices are consolidating have a high chance of breaking out during a bull run.

There are two main ways to do this. First, take a position when the price is at the lower range and trading sideways. Do a DCA if you’re confident in the asset. Second, wait for the asset’s price to have breakouts and be ready for an uptrend. If confirmed, enter a position immediately.

4. Deciding the Optimal Target Price

Once profits start to be made, the question arises of how much profit should be bagged. It’s hard to come up with a definitive answer because every trader has a target. But answering the following questions can help you assess whether the profit is already enough or not.

Has the price increase and the profit earned reached a logical limit? Is it time to take out the initial capital and let the rest go up? Has the narrative of the crypto you own reached its peak? Has BTC broken the ATH level and shown a downward trend?

In addition, several factors can be used to see if the bullish trend will continue or end shortly. These factors include macroeconomic conditions, BTC/ETH position, sentiment, and public euphoria.

5. Using the Right Indicators

If you feel it’s time to take a profit, several indicators can be used as exit points. First is the area of the previous highest resistance. Usually, the price movement will test the previous resistance level. If it fails to break out, the movement will reverse. Meanwhile, if it breaks out the resistance, the price will go to an area that has never been reached.

The second is to use the Fibonacci extensions indicator to predict price ranges in areas that have never been reached. This indicator predicts that the price will continue to rise until it hits the resistance level at 161.8% or 261.8% Fibonacci before eventually going reverse.

In addition to exit points, Fibonacci extensions can also be used for entry points. Usually, the .618-.786 area is used as an area to buy.

Conclusion

Identifying the market phase, especially the S2 or directional trend, is the first step in trading during a bull market. This is the period when most profits can be made. Another factor is to be able to select crypto projects that have a potentially dominating narrative correctly.

However, all profits will only be on paper if traders cannot realize them. Therefore, it is equally important to set price targets and take profits at the right time. Overall, the most important factor when trading in a bull market is patience. Traders should also be prepared to take steps early instead of missing out and opening positions simply because of FOMO without a clear plan.

Buy Crypto Assets on Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Casey Murphy, How Can I Determine the Next Resistance Level or Target Price, Investopedia, accessed on 24 January 2024

- Ansem, Trading altcoins & timing directional impulse moves, X, accessed on 24 January 2024.

- Beetcoin, Price momentum can always be divided into 4 stages, accessed on 24 January 2024.

- Teeznutz11, The Lifecycle of a Narrative Trade 101, Twitter, accessed on 24 January 2024.