Ethereum successfully completed the network transition from Proof of Work (PoW) to Proof of Stake (PoS) on September 15, 2022. The crypto community has been anticipating this event for a while. The Ethereum community believes that this improvement will ultimately increase the price of Ether (ETH) in addition to greatly reducing its energy consumption. Then, what changes in Ethereum after The Merge? What are the impacts of The Merge Ethereum? What effects does The Merge have on the miners, large institutions, and the price of ETH?

Article Summary

- 🔗 By changing the system from PoW to PoS, Ethereum’s energy consumption is reduced by 99.95%, making it an eco-friendly blockchain.

- ⛽️ New Ether (ETH) issuance rate reduced after The Merge. However, the burning rate of gas fees is decreasing along with the declining number of transactions on the Ethereum network due to the current bear market condition. This causes the ETH supply to continue to increase after The Merge.

- 📉 With the continued increase in its supply, ETH is not yet considered as a deflationary asset. At the time of writing (23 September 2022), the price of ETH was at $1,357, down about 17% in five days from $1,636.

What Happened To Ethereum After The Merge?

1. Ethereum Becomes a Green Blockchain

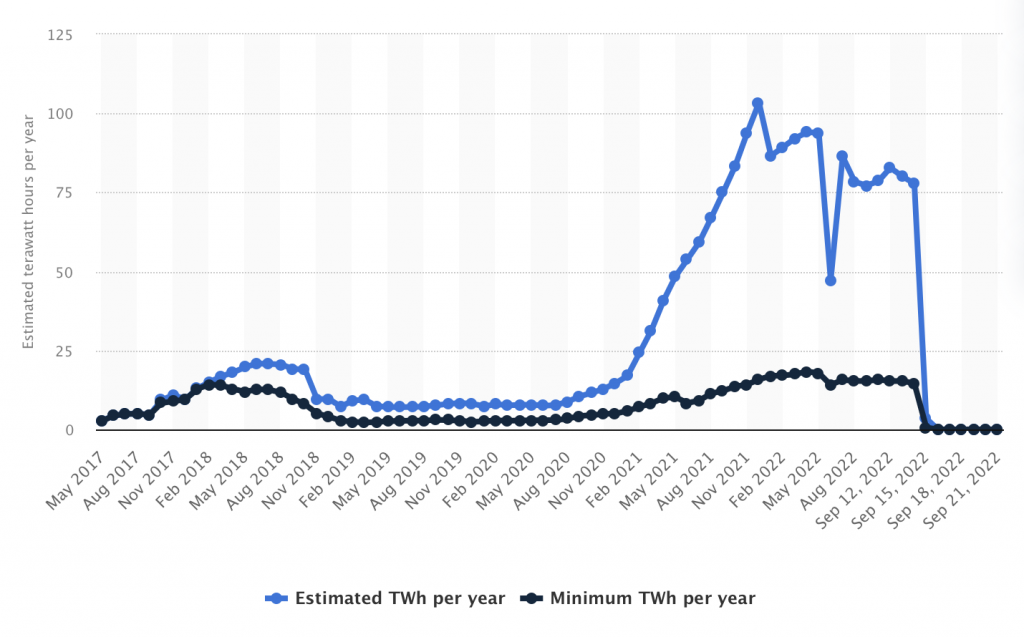

One of the biggest criticisms of the widespread adoption of crypto is its negative impact on the environment. By changing the system from PoW to PoS, Ethereum is estimated to have reduced its carbon footprint by 99.95% of the total energy used. Thus, The Merge makes Ethereum 2000x more energy efficient than when Ethereum was still using the Proof of Work system. Ethereum has now become a green blockchain.

In the PoW system, previously Ethereum required a special computer to mine ETH which consumed a lot of electricity. However, currently, the expenditure of electrical energy needed to create blocks on the Ethereum network is only equivalent to the energy expenditure of using a laptop in general for each node which is 0.01 TWh/yr.

Referring to the graph from Statista above, it can be seen that the energy consumption used by Ethereum in running the mechanism on blockchain decreased sharply on 15 September 2022 or when The Merge is implemented to 0.6 TWh/yr and on 16 September 2022 to 0.01 TWh/yr. This is one of a positive impacts of The Merge Ethereum on the environment which has been of particular concern to the crypto world.

Read What is Ethereum ‘Merge’? to understand more about The Merge Ethereum impacts and watch this video.

2. Less Issuance of New ETH

Prior to The Merge, new ETH issuance was given to miners whose role was to secure the network and process transactions. Most of them then resell it to cover operational costs such as electricity. This cycle contributes to inflation and ETH selling pressure. These miners are basically the most valuable “employees” for Ethereum and they get well rewarded for it.

The Ethereum mining system has now been replaced by a proof-of-stake mechanism. New ETH is issued in exchange for validators who secure the network and process transactions. However, this reward figure is very much smaller than the number miners get. Miners in a proof-of-work system typically receive around 13,000 ETH per day and about 4,931,000 ETH per year.

Now, according to real-time data from the UltraSound Money website, there will be only 603,000 new ETH per year, or about 1,600 per day. If we calculate the ETH issuance rate, 603k is 12% from 4931k which means ETH issuance is now reduced by about 88% from before. However, the number of new ETH issuances and supply growth is not something stable, it changes according to various factors such as percentage staking rewards and network activity.

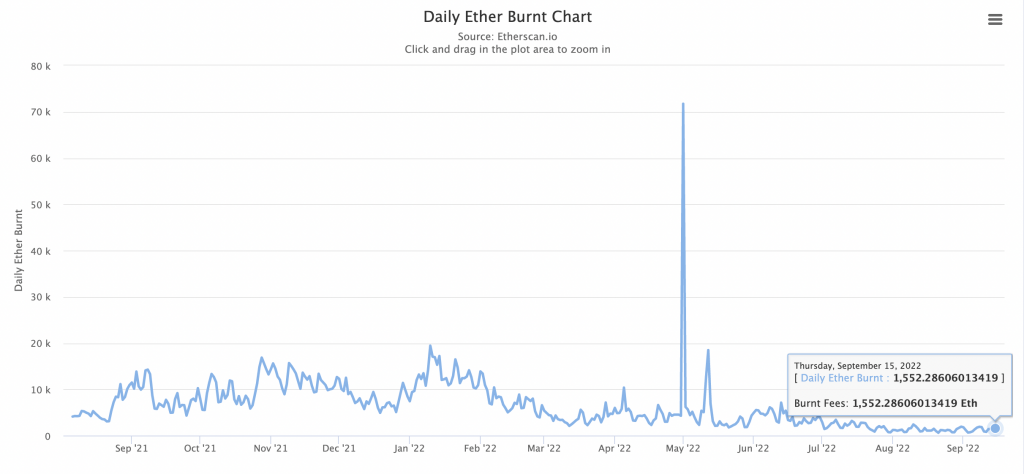

Additionally, in August 2021, Ethereum Improvement Proposal (EIP)-1559 was implemented. The EIP-1559 upgrade burns a portion of the gas fee on each transaction. The calculation of gas burning rate involves the activity and density of the Ethereum network. In addition, as in the image below, ETH burning has decreased significantly since 2021. The EIP-1559 mechanism burned around 35,315 ETH in the past month, around 1,100 per day. However, this figure has not been able to match the level of new ETH issuance after The Merge (1,600 ETH). As can be seen in the chart below, there was a decrease in the volume of ETH burning caused by reduced transactions on the network in line with the current bear market conditions.

The Merge was previously projected to make ETH a deflationary asset. This is because the issuance of new ETH will be significantly reduced with no more rewards for miners. Does this mean that ETH will become a rarer and more valuable asset? This might happen. However, despite the reduced supply, the number of burning gas fees also decreased along with the decline in transactions on Ethereum.

In fact, 8 days since The Merge (23 September 2022), the ETH supply has actually increased by around 4,736. The new ETH figure also exceeds the ETH burn rate of gas costs. This is because the demand side of the use of Ethereum is in a downward trend due to the bear market. In the long term, this decline in ETH issuance and burning could have a positive impact.

Ethereum (ETH) Price

ETH price after The Merge has not shown a positive price movement. In fact, on the day of The Merge’s last September 15, ETH price had dropped by around 10% in 4 hours. When this article was written (23 September 2022) the price of ETH was at the level of 1,309 US dollars.

In addition to selling pressure from miners, this is also caused by market conditions that are still in the bear market. As explained in the previous point, less transactions on the Ethereum network result in less ETH being burned.

The movement of ETH price after the Merge also shows that many investors see this as an event ‘sell the news’. Although some people predict the price of ETH will increase after the Merge to reach 5,000 US dollars, the possibility of course can happen, but probably not in the short-term.

As a cryptocurrency with proven fundamental values, many people say that Ethereum is still considered ‘cheap’ and can be used as a long-term investment. However, this depends on your preference in choosing cryptocurrencies for investment.

4. ETH Staking as The Merge Ethereum Impacts

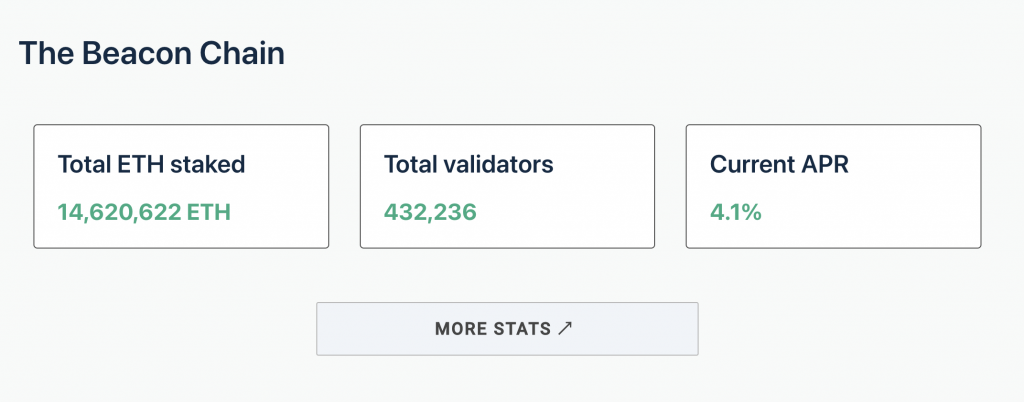

In the staking system, everyone can participate as a validator. But, you need a minimum of 32 ETH and a special application to run the validator function. For ETH holders who want to participate in the staking system but do not have the minimums to stake, there is the option of delegating ETH coins to the validator pool. You will get a few percent of rewards in the form of ETH which amount has been agreed with the validator.

As of September 23, the total ETH staking was 14,620,622 ETH with 432,236 validators. By carrying out its function, the validator gets an interest rate of 4.1% APR (Annual Percentage Rate).

After The Merge, validators will earn rewards from gas tips previously given to miners. From these tips, validators can get even double the amount of APR.

According to data from Nansen as of September 13, 2022, only 11.3% of the total ETH supply is staking. Much less than MATIC (41%) and SOL (77%). This is influenced by several things including the high minimum ETH to become a validator, which is 32 ETH, the staking system that not available for unstaking until the next upgrade, and the small percentage of rewards.

The current ETH staking system does not yet allow users to unstake (unlock their assets). Investors who lock ETH for staking can only unstake when the Shanghai fork takes effect in 2023. Then, when stakers can make withdrawals, it is still unknown and later the amount of ETH that can be disbursed will also be limited per day. It is estimated that around 30 million ETH will enter the market when the unstake feature is implemented during the Shanghai fork.

5. Ethereum Miners Switch to Another Network

After Ethereum has successfully transitioned its network to Proof of Stake (PoS), the Ethereum miners is no longer needed. This is one of The Merge Ethereum most significant impacts. The transaction validation system and network security have been fully implemented by validators with a staking system. This makes the mining machine useless on the Ethereum network.

To keep mining machines running, miners are expected to switch to other altcoins such as ETHW, ETC (Ethereum Classic) and RVN (Ravencoin) by making some system modifications in mining machines to carry out mining. However, the gains are far below when mining ETH.

According to data from Minerstat quoted from Coindesk September 16, 2022, the reward for mining the Ethereum Classic block about 24 hours ago was ETC 0.0186484, or about 70 cents, but in the last hour it dropped to ETC 0.00030658, or about 11 cents. Similarly, RVN miners who earned RVN 30.28478584, or $1.77 per block 24 hours ago, in the last hour fell to just RVN 0.82968431, or about 5 cents.

The decrease is thought to be due to the large number of ETH miners who switch to mining ETC thereby increasing the hashrate which results in increased difficulty to mine a block and generate rewards.

6. Ethereum Concerns Becoming More Centralized

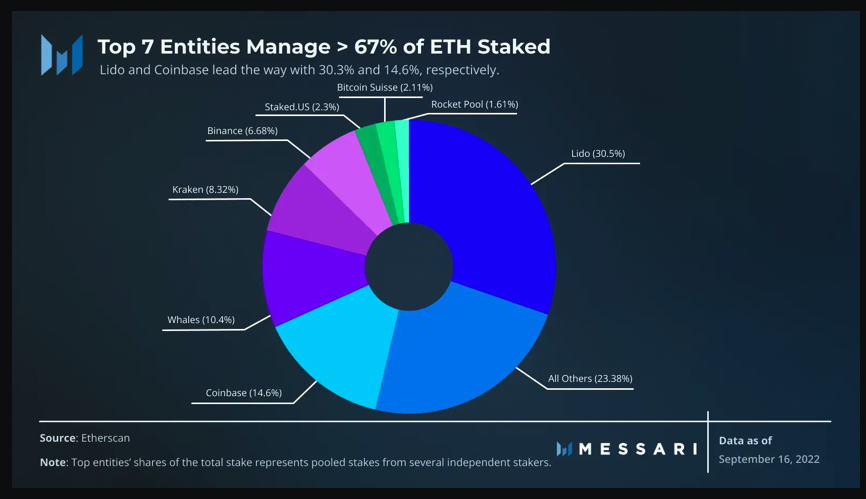

The PoS system should make Ethereum more decentralized because anyone around the world can participate as a validator. However, on September 15, Martin Köppelmann of Gnosis, an Ethereum-based infrastructure company, said that of the 1,000 blocks created, 420 were created by Lido and Coinbase.

Lido is a liquidity provider platform for Ethereum staking and Coinbase is the third largest cryptocurrency exchange in the world. These two platforms control 27.5% and 14.5% of the Ethereum staking network, respectively.

As previously mentioned, to become a validator, users must invest 32 ETH and run a special software which is considered quite complex. Therefore, many users are entrusting their ETH to Lido, Coinbase, and other staking pools to earn rewards without having to become a full-time validator.

If an entity controls 66% of the Ethereum staking network, it will become increasingly difficult for small validators to participate in the network. In addition, security that is centralized to only a few entities increases the security risk for the network. The argument that Proof of Stake makes Ethereum more decentralized seems questionable. Based on the current validator data, Ethereum’s changes have made it more centralized.

Read What is Ethereum and How Does it Work?

7. The Merge Ethereum Impacts Affecting Increasing Institutional Trust in Ethereum

Ethereum is the most widely used smart contract blockchain as of today. The Ethereum network is used by almost 60% of DeFi (Decentralized Finance) platforms such as MarkerDAO, Uniswap, Aave, Curve and others. As of September 2022, the entire DeFi ecosystem is worth $53.86 billion and Ethereum accounts for about 57% of the total value locked (TVL) of $30.8 billion.

In the last two years, several financial institutions have entered the DeFi and Web3 ecosystems to develop their business models, such as Goldman Sachs and Barclays and retail banks Banco Santander and Itau Unibanco.

By implementing Proof of Stake system, Ethereum becomes an eco-friendly blockchain. The Merge provides an opportunity for institutional investors considering Ethereum’s environmental impact to start investing.

Those are some of the changes and impacts of The Merge Ethereum that we can summarize for you as educational material in knowing the technological developments that occur on the Ethereum blockchain.

Find out more about 8 Best NFT Marketplace on Ethereum

Where to Buy ETH?

You can start investing in ETH on the Pintu app. With Pintu, you can buy various cryptocurrencies such as BNB, SOL and ADA.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

You can learn more about cryptocurrencies through the various Pintu Academy articles that we update every week! All Pintu Academy articles are made for educational purposes only, not financial advice.

References

- Jordi Alexander, Is The Merge Overhyped?, Bankless, accessed on 16 September 2022

- MetaMask Institutional and the ConsenSys Cryptoeconomic Research Team, The Impact of The Merge on Institutions, Insight Report, accessed on 16 September 2022

- David Z. Morris, 3 Big Things the Merge Will Change About Ethereum, Coindesk, accessed on 16 September 2022

- Xinyi Luo, Ethereum Already Showing Signs of Increased Centralization, Coindesk, accessed on 17 September 2022

- Frans Felasquez, Ethereum Miner Chandler Guo Predicts 90% of PoW Miners Will Go Bankrupt, Coindesk, accessed on 17 September 2022

- Owen Fernau, Ether Not Quite ‘Ultrasound’ Money As Inflation Persists, The Defiant, accessed on 20 September 2022.