As the layer-2 sector continues to grow, the adoption of rollup technology is becoming more massive. Developers continue to innovate to create better scalability, security, and decentralization. Recently, AltLayer has come with “restaked rollups” technology. They also had unique features such as rollups-as-a-service (RaaS) and ephemeral rollups. This technology is claimed to increase the security, decentralization, interoperability, and scalability of a rollup. What is AltLayer? How does it work? Find out the full explanation in the following article.

Article Summary

- 🌐 AltLayer is a decentralized protocol that facilitates the launch of native and restaked rollups with both optimistic and zk rollup stacks.

- 🏆 AltLayer’s restaked rollups can improve security, decentralization, interoperability, and scalability by enhancing rollups through the EigenLayer restaking mechanism.

- ✨ AltLayer offers restaked rollups with three primary services: VITAL for decentralized verification of rollups, MACH for fast finality of transactions, and SQUAD for decentralized sequencing.

- 👁️ Another feature AltLayer has is a codeless Rollups-as-a-Service (RaaS) that makes it easy to create custom rollups. There are also ephemeral rollups that provide rollup usage flexibility for dApp developers.

- 🪙 The ALT token, as the native token in the AltLayer ecosystem, can be used to pay transaction fees, access exclusive features, and participate in governance.

What is AltLayer?

AltLayer is a decentralized protocol that facilitates the launch of native and restaked rollups with both optimistic and zk rollup stacks. As for restaked rollups, it is a unique concept that enhances existing rollup frameworks such as OP Stack, Arbitrum Orbit, and ZKStack.

With restaked rollups, the rollups will be reinforced by EigenLayer restaking mechanism. Thus, it can enhance security, decentralization, interoperability, and scalability. AltLayer is a pioneer in combining the simplicity of rollup stack with advanced network security.

The Team Behind AltLayer

Dr. Yaoqi Jia is the man behind the creation of AltLayer. As the CEO of AltLayer, Yaoqi has a vast amount of experience in the crypto industry. He was formerly a director at Parity Asia and co-founder/CTO at Ziliqa.

AltLayer has also received a lot of support from well-known venture capital and crypto investors. Some of them include Polychain Capital, Jump Crypto, Binance Labs, Polkadot founder Gavin Wood, and former Coinbase CTO Balaji Srinivasan.

How Does AltLayer Work?

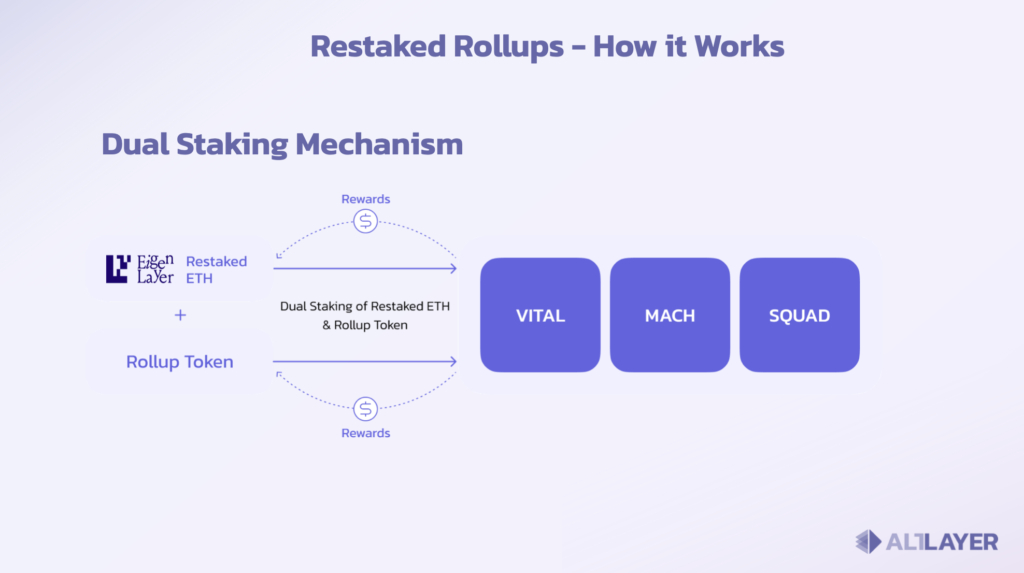

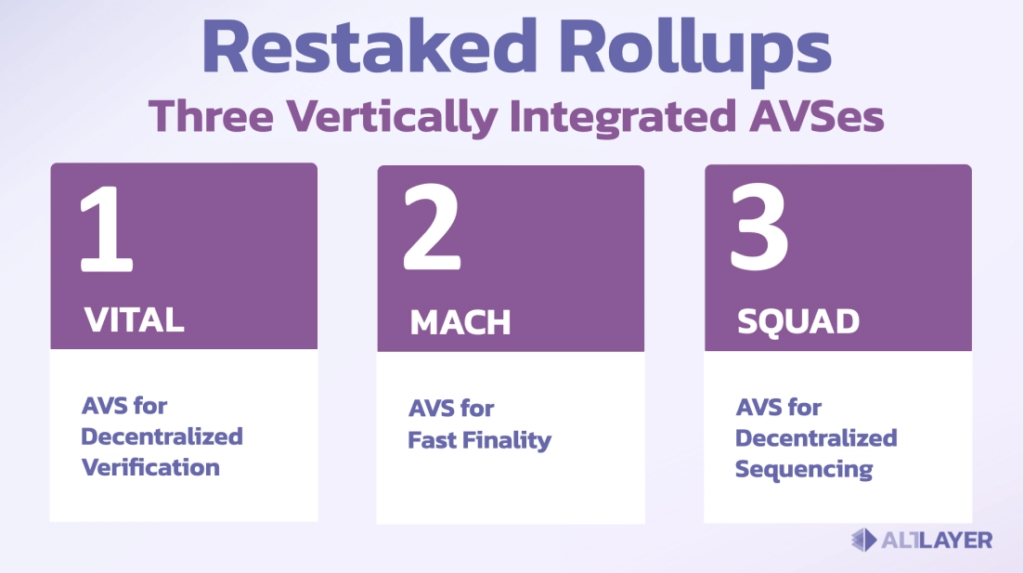

AltLayer’s restaked rollups work by incorporating EigenLayer’s restaking mechanism. EigenLayer improves decentralization, security, interoperability, and efficiency. Within the restaked rollups are three sets of Actively Validated Services (AVS). This AVS is vertically integrated and created based on demand for specific rollups.

Each of these AVS offers various functions, including decentralized verification of rollup state, fast finality, and decentralized sequencing.

- For decentralized verification services, AltLayer uses VITAL. It ensures the correctness of the rollup’s state. VITAL involves its community in verification to keep it decentralized. The system can also handle fraud and Zero-Knowledge (ZK) proofs. As a result, VITAL can provide strong L1-level security guarantees.

- To offer fast finality, AltLayer has MACH. MACH can significantly reduce transaction finality. A transaction that usually takes 13 minutes on Ethereum can be reduced to under 10 seconds. It can also improve cross-rollup interoperability and provide additional verification and security layers.

- For decentralized sequencing, AltLayer leverages SQUAD. In SQUAD, the AltLayer community acts as sequencers and stakers to make decentralized sequencers. This approach reduces the risk of single points of failure. It also increases the utility of L2 tokens and mitigates censorship risk.

When combined, they create a more secure, efficient, and user-engaging rollup environment. This is in line with AltLayer’s vision of creating a decentralized and collaborative blockchain ecosystem. So far, the three AVSs are still on AltLayer’s private testnet and are targeted for public use through the testnet in the first quarter of 2024.

AltLayer’s Feature

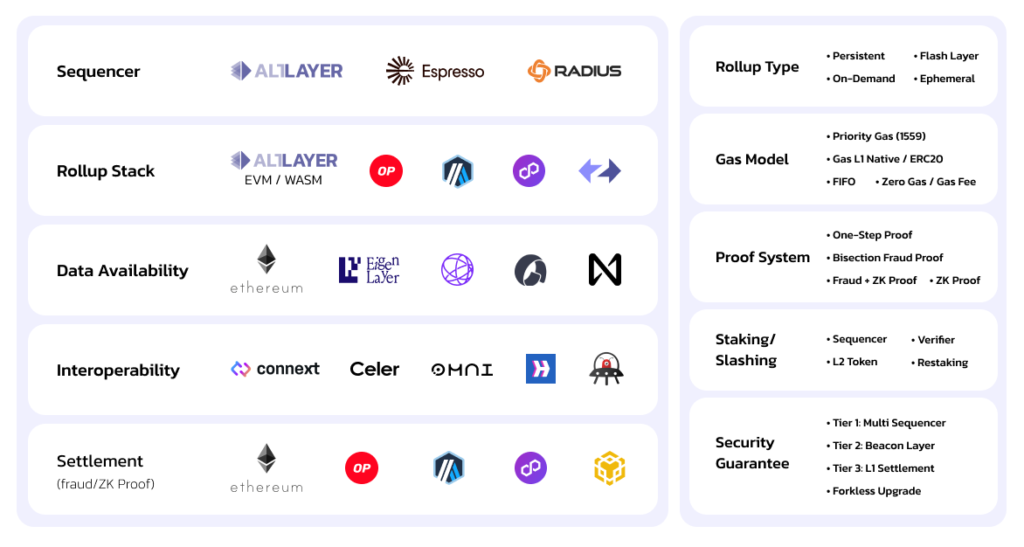

In addition to restaked rollups, AltLayer also offers two other features. First, it is a versatile, no-code Rollups-as-a-Service (RaaS) launchpad that allows not only developers but also those with little to no coding experience to spin up a customized rollup within 2 minutes with only a few simple clicks. In other words, developers only need to set parameters. The AltLayer’s launchpad will create an app and platform-specific rollup within minutes.

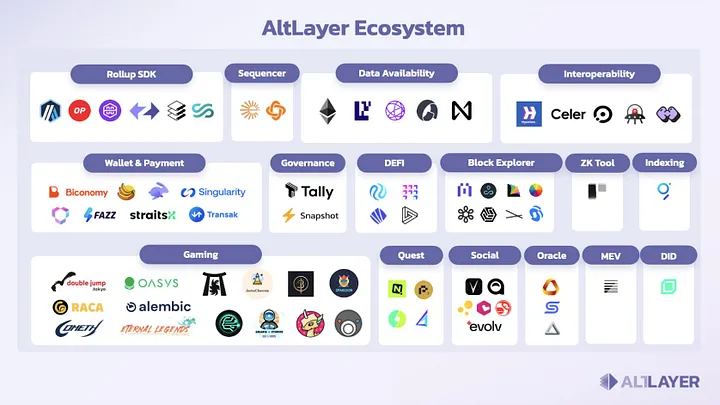

The RaaS product is designed for a multi-chain and a multi-VM world and hence will have factory support for EVM as well as WASM. It also supports different rollup SDKs such as OP Stack, Arbitrum Orbit, Polygon zkEVM, ZKSync’s ZKStack and Starkware, and different shared sequencing services such as Espresso and Radius. Lastly, AltLayer supports multiple DA layers such as Celestia, EigenLayer, and Avail.

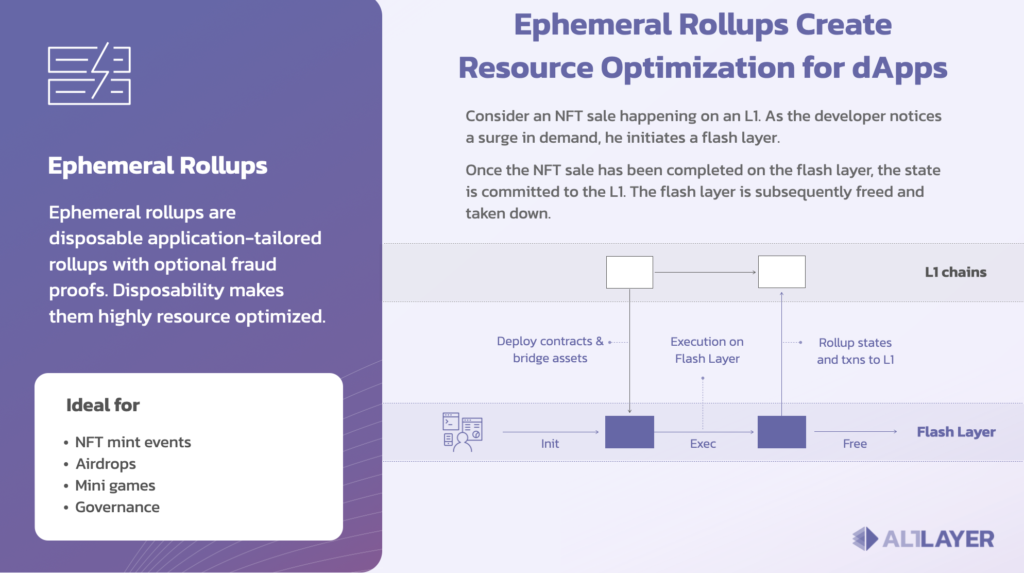

Secondly, another significant innovation from AltLayer is the concept of ephemeral rollups. With ephemeral rollups, there are three benefits that dApp developers can gain.

- Quickly spin up a fast and scalable application-tailored rollup secured by a Layer 1

- Use the rollups for as long as needed.

- Used rollups can be disposed of by executing an “end-of-life” settlement on Layer 1.

Thus, ephemeral rollups are highly resource-optimized rollups designed to give developers an apps-specific rollup and a general-purpose Layer 1. So far, ephemeral rollups have been used in various sectors, ranging from mini-games to game tournaments, NFT minting, and so on.

AltLayer Advantages

- 🌐 Decentralized verification mechanism. There are still many app-specific rollups that do not have a large ecosystem to ensure the availability of validators. As a RaaS provider, AltLayer provides a decentralized verification mechanism to ensure the availability of validators that detect and prove the state of a rollup.

- ⚡ Faster finality. Ethereum is the settlement layer used by most rollups. Unfortunately, as an L1, it has a relatively slow finality of around 13 minutes. AltLayer through MACH technology seeks to bring faster finality, under 10 seconds.

- 🔐 Decentralized and flexible sequencing. By decentralizing the sequencing process, AltLayer lowers the risk of single points of failure. It also increases the utility of L2 tokens and mitigates the risk of censorship.

ALT Token as Investment

ALT is a native token that supports AltLayer’s ecosystem growth and user participation. It can be used to pay transaction fees, access exclusive features and services, and participate in AltLayer governance. In addition, users who stake ALT can become Aggregate Verifier Services (AVSs).

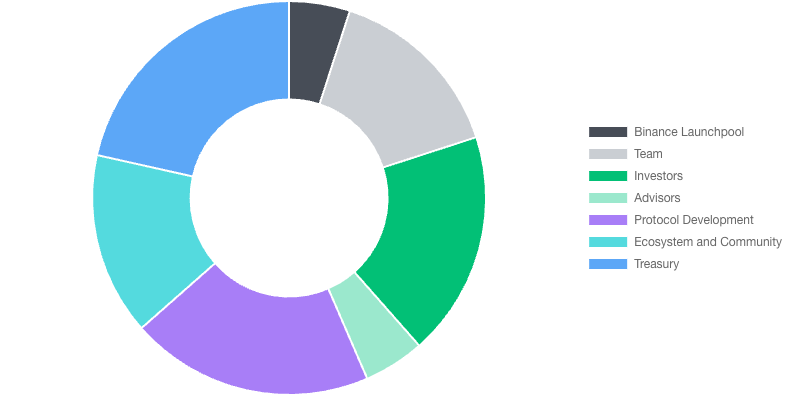

ALT tokens have a total supply of 10 billion, of which only 11% or 1.1 billion ALT is circulating in the market. In terms of allocation, the portion of ALT for the development team and investors is relatively high, reaching 38.5% of the total supply. Meanwhile, protocol development and ecosystem and community development account for 20% and 15%, respectively. The remaining 21.5% is reserved for treasury.

When launched on January 25, 2024, the ALT token was at US$ 0.35. Having strengthened to US$ 0.46, ALT is now trading at US$ 0.34 as of February 9, 2024. Meanwhile, ALT currently has a market capitalization of US$ 376 million.

As a new token, ALT holds a lot of potential. The modular and RaaS platform sector is already filled with various protocols and has stiff competition. Nonetheless, AltLayer has advantages with their restaked rollups technology. With this innovation, AltLayer and ALT could potentially benefit from the narrative surrounding the modular sector in the next bull market

Furthermore, the AltLayer development team is also making progress and keeps innovating. They are currently making AltLayer able to support non-EVM stack rollups such as WASM/Move rollups or Bitcoin rollups. In addition, AltLayer also plans to integrate modular stacks such as EigenDA with Arbitrum Orbit, Celestia with Arbitrum Orbit, and Avail with Op stack. These innovations and developments are expected to be a positive catalyst for AltLayer.

Conclusion

As a new protocol, AltLayer has managed to gain attention in the crypto industry. This is due to their innovative technologies, such as restaked rollups and the RaaS platform. Both technologies not only improve the functionality of rollups. In fact, through their three integrated AVS, namely VITAL, MACH, and SQUAD, AltLayer also enhances the decentralization, security, interoperability, and efficiency of a rollup. However, as a new project, AltLayer still has a long way to go to prove its capabilities as a restaked rollup and RaaS platform.

How to Buy ALT Token on Pintu

After knowing what Neon AltLayer is, you can start investing in ALT by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for ALT.

- Click buy and fill in the amount you want.

- Now you have ALT!

In addition to ALT, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- AltLayer Docs, What is AltLayer? accessed on 7 February 2024.

- AltLayer, Introducing Restaked Rollups, Medium, accessed on 7 February 2024.

- Jed Barker, What is AltLayer? Data Wallet, accessed on 7 February 2024.