Cardano is dubbed as the ‘3rd generation’ cryptocurrency after Bitcoin (BTC) and Ethereum (ETH) that uses proof-of-stake (PoS) technology. This is because it has one of the most environmentally friendly and more secure blockchain networks. Similar to Ethereum, the Cardano platform has a smart contract feature that just became active in September 2021.

Read also: Getting to know Ethereum and the smart contract feature

One of the things that make Cardano unique is that the team behind it took a peer-review approach in developing the entire system. This means that every feature and change will be developed through a rigorous peer-review process by academics and experts before being implemented.

Cardano’s native cryptocurrency is ADA, taken from the name Ada Lovelace, the first computer programmer. As of October 2021, ADA has a market cap of $71 billion dollars which places it as the 4th largest crypto asset in the world. ADA has a maximum supply of 45 Billion ADA with around 33 Billion already on the market (October 2021, Coinmarketcap).

History of Cardano

In 2015, Charles Hoskinson, one of the co-founders of Ethereum, started developing a blockchain project which he named Cardano. Hoskinson wants to develop a new generation of crypto that is more environmentally friendly, sustainable, and has a good scalability system. He also wants to build and develop Cardano using a scientific approach with a peer-review process that relies on experts in their fields.

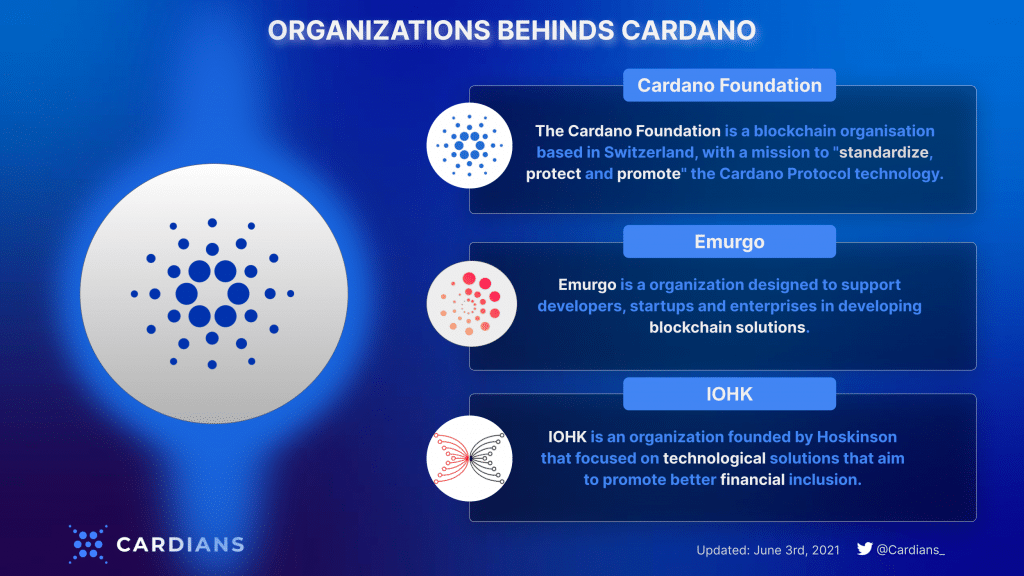

Cardano was launched on 29 September 2017 with support for ADA transactions. Cardano’s operations and development are not governed by a single organization. Instead, it is managed by three separate and independent organizations. First, the Cardano Foundation, which regulates and oversees the development of Cardano. The second is IOHK, which designed the Ouroboros system and Cardano’s proof-of-stake blockchain algorithm. Lastly, Emurgo manages Cardano’s strategic partnerships with various organizations.

The Cardano Roadmap divides the development of the Cardano ecosystem into stages named after a famous British author.

- Byron – Cardano’s initial foundation stage includes the implementation of ADA transactions.

- Shelley – Cardano’s decentralized development via the Ouroboros system and PoS algorithm.

- Goguen – Implementation of smart contracts that allow applications to be built on the blockchain Cardano.

- Basho – Network optimization phase focusing on Cardano’s interoperability with other blockchain networks and increasing scalability.

- Voltaire – Distribution of Cardano’s governance tokens and transition of Cardano’s development from organization-driven to community-driven.

How Cardano works

Proof-of-stake (PoS)

Cardano’s native coin, ADA, is not mined like Bitcoin but is minted through the PoS system. In Proof-of-stake, the system does not require a miner but is replaced by a validator. Validators are selected by the network depending on how many ADA assets they have. If they are chosen to validate transactions in the block, they bet or stake their ADA to verify all transactions. If the blockchain verifies the validator’s block is correct, they will get an incentive in the form of ADA.

Ouroboros

Ouroboros is the algorithm that runs Cardano’s proof-of-stake system. It is the first blockchain protocol created by peer-reviewed research by academics. This algorithm is used by the Cardano network to secure, validate transactions and create new ADA.

Ouroboros is considered an efficient PoS system because it divides its block creations process in a given time into something called epochs and slots. So, epoch is essentially a time period that usually lasts for 2 or 3 days which is further divided into several slots. Each slot has a slot leader who acts as a validator creating new blocks. When each slot in an epoch has been successfully verified by the network, the epoch is declared complete and all slot leaders will elect the next slot leader.

This verification system is low emission and more environmentally friendly because each epoch limits how many slot leaders can verify transactions. Furthermore, the algorithm is also capable of allocating the necessary epochs and slots in a given time according to network density. This limits the number of active nodes which saves unnecessary electricity. This restriction and selection are done randomly according to the algorithm. This is very different from the proof-of-work system which does not limit the number of miners who want to verify transactions.

Why is Cardano important?

Cardano has always been referred to as the third generation of cryptocurrency after Bitcoin and Ethereum. Many analysts say that Cardano can encourage the transition of crypto assets to be low-emissions and sustainable. Here are 2 reasons why Cardano has such an important role.

Cardano is an eco-friendly crypto asset

One of the biggest advantages of Cardano is that it is an eco-friendly cryptocurrency. If we compare it to Bitcoin and Ethereum, Cardano’s electricity usage per year is much smaller.

Cardano: Six gigawatts per hour

Bitcoin: 130 terawatts per hour

Ethereum: 50 terawatts per hour

*One terawatt is equal to 1,000 gigawatts

This is possible because Cardano uses a proof of stake (PoS) system to verify transactions. This verification system maintains energy use by limiting the number of computers that can verify transactions at one time. As a result, this system is more efficient than Bitcoin and Ethereum 1.0’s proof-of-work (PoW) systems which do not limit the number of miners.

Created based on research and scientific approach

Cardano was developed from a research project on blockchain and cryptocurrency. Cardano Foundation, the organization that regulates and oversees the development of Cardano, takes a scientific approach through a series of tests and reviews conducted by experts in the cryptocurrency world.

This scientific approach is considered something innovative in the crypto world because only Cardano has implemented this. Theoretically, this approach will ensure that all changes and features implemented in the network will serve to address a specific problem in the community.

What can you do with ADA?

Investment

Similar to other crypto assets, you can choose ADA as your investment instrument. ADA is currently ranked in the top 10 crypto assets by market capitalization with a value of $66.6 billion (as of October 2021). According to Coinmarketcap, ADA has consistently been in the top 10 since its launch in 2017. The price of one ADA token as of October 2021 is $2.

Currently, the utility of ADA is still limited, unlike Ethereum, which already has a massive use case. However, many investors in the crypto world have high confidence in the project, especially judging by its development approach and organizational structure. However, the actual success of the project remains to be seen as we all know that the crypto world can be very unpredictable.

Staking

Staking is one of several ways to get passive income using your crypto assets. This method can only be done in a blockchain network that uses a proof of stake (PoS) verification system. Cardano has only launched the staking feature for ADA since early 2021. In the staking process, you will deposit your money into a pool of funds, which is then used to verify PoS transactions.

By joining this validator pool, you become a delegator for the staking process. Your money is delegated to a validator of your choice, and you will get incentives according to the proportion of money you stake. It is always recommended to carefully research where you will delegate your money as untrusted validators can cause you to lose your money.

NFT

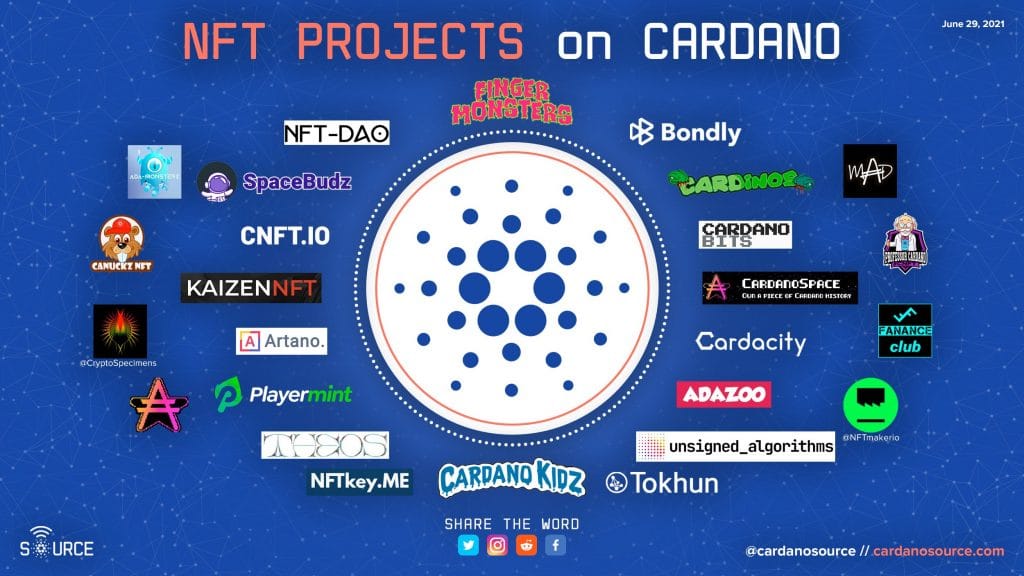

As a blockchain that features a smart contract program, Cardano unlocks the potential for the increasingly popular NFT market. Currently, you can only buy NFT using ADA in a few small marketplaces that specifically make NFT for the Cardano network. The first and largest marketplace that sells Cardano NFTs is Cnft.io.

Read also: What is NFT and how does it work?

However, as is the case on the Ethereum network, the NFT market on Cardano will continue to grow as Cardano’s functionality continues to develop. The Bondly company has also started to develop a Cross-chain bridge that can connect the blockchain of Ethereum and Cardano. The development of bridges between blockchains has the potential to accelerate the growth of the NFT market on Cardano for digital artists who prefer the Cardano network over Ethereum.

How to buy ADA?

You can check Cardano price here. Start investing in ADA by buying them in Pintu app. Through Pintu, you can buy ADA and other crypto assets in an all-in-one convenient application. Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Sources: