After the Merge update in September 2022, many parties are waiting for the next Ethereum update. The update after the Merge is highly anticipated because it enables an important feature, unstaking. Through the scheduled update on April 12th, users can finally withdraw their ETH assets stored on the Ethereum staking system. Initially, this update was called the Shanghai upgrade, but it has now been changed to Shapella (Shanghai+Capella). So, what is Ethereum Shapella? What is the potential impact of Shapella on the crypto market? This article will provide a complete discussion of Shapella.

Article Summary

- ⚙️ Ethereum Shapella is the merger of two updates to the Ethereum layer, Shanghai for execution and Capella for consensus. Shapella will launch on April 12, 2023.

- 💻 Shapella will be the first Ethereum update since the Merge in September 2022. This update will enable unstaking, making Ethereum’s staking system more flexible.

- 📈 Ahead of Shapella, ETH reached a price range of $1,900 US dollars, its highest point since August 2022.

- 🧠 Many consider that the Shapella Upgrade could create a bullish or bearish scenario for the crypto market. If not many ETH investors withdraw staking assets, Shapella could be a catalyst for ETH and the LSD sector. Conversely, if Shapella creates panic among investors, it could impact the crypto market as a whole. Shapella also coincides with the US CPI and FOMC reports.

What is Ethereum Shapella?

Ethereum Shapella is the name for the Ethereum update that will take place at 22:27:35 UTC on April 12th, 2023 (approximately April 13th at 5:30 AM WIB). Shapella is a combination of two updates on the Ethereum layer, namely Shanghai for execution and Capella for consensus. In terms of content, Shapella has the same changes as those already described in the Ethereum upgrade Shanghai.

Read more about Shanghai Upgrade on Pintu Academy

As for the name change from Shanghai to Shapella, it was actually the Ethereum development team who first referred to it as Shapella rather than Shanghai. They believed that the term Shapella was more accurate because this update happened on two layers.

Shapella will allow all validators to make full or partial withdrawals of their locked ETH in staking. Therefore, all users who entrust their assets to validators can also withdraw their ETH assets in staking. Shapella is the first update on the Proof-of-Stake (PoS) layer of Ethereum since the Merge.

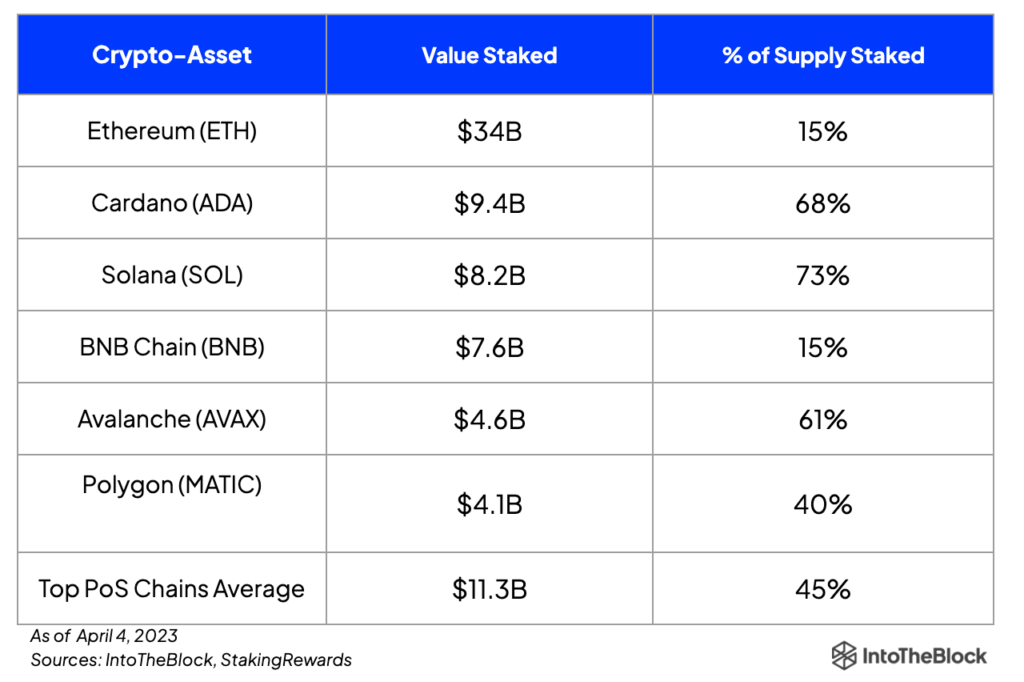

Moreover, Shapella also has the potential to create significant volatility in the crypto market. Currently, around 18.2 million ETH are locked in Ethereum staking (15% of the total ETH supply). Validators can choose to only withdraw their staking profits (partial withdrawal) or withdraw all locked assets (32 ETH + profits).

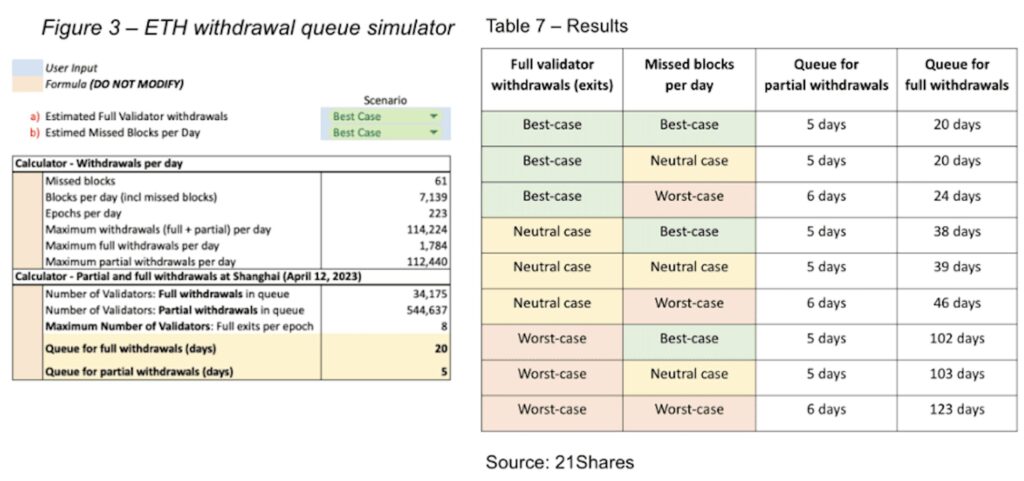

However, one important piece of information about Shapella is that staking asset withdrawals cannot be done instantly. The withdrawal speed also differs for full and partial withdrawals. Ethereum imposes a limit of 16 partial withdrawals per block. This means that there will only be 115,200 withdrawals per day. The table above was created by @elindinga on Twitter as a simulation of the Shapella withdrawal process. As in the image above, Partial withdrawals will take five days and full withdrawals will take 20 days. Ethereum imposes a long withdrawal delay to ensure network security because validators play a crucial role in processing transactions.

Why is Shapella important?

Many believe that Shapella will have a significant impact on the Ethereum staking market. Individual and institutional users previously reluctant to stake will think twice now that Shapella allows them to withdraw their ETH at any time. As seen in the table above, Ethereum has a relatively small staking percentage compared to most other blockchains. Shapella will remove the biggest barrier to staking ETH.

Furthermore, Shapella is also an important catalyst for the Ethereum Liquid Staking Derivatives (LSD) sector. If Shapella successfully increases the staking percentage, the ETH staking rewards will automatically decrease because of the growing number of participants. LSD will become the destination for users who want to increase these rewards. For example, frxETH from Frax Finance can offer a 7% interest rate due to the Frax incentive system. Furthermore, 33% of the total staked ETH is in Lido Finance, the largest LSD application on Ethereum.

Two Potential Scenarios for Ethereum Shapella

The amount of ETH locked in staking is equivalent to $34.38 billion US dollars. With Shapella, there is a potential for significant selling pressure to enter the crypto market. This could come from validators who want to sell their staking profits since 2020 (when the beacon chain was first launched), investors who want to withdraw their profits and staked assets, and institutional investors. On the other hand, Shapella can also be a bullish catalyst where many investors buy ETH for staking in LSD platforms like Lido.

Below, we will look at the impact of Shapella from two potential scenarios: a bullish scenario and a bearish scenario.

1. Bullish Scenario

In a bullish scenario, we see Shapella as an event that can increase investor interest in Ethereum. Shapella will bring new demand for ETH. This new demand will offset the selling pressure coming from stakers who are selling their ETH. The fact that ETH has been able to maintain its price at $1,800 also shows the strength of ETH towards Shapella.

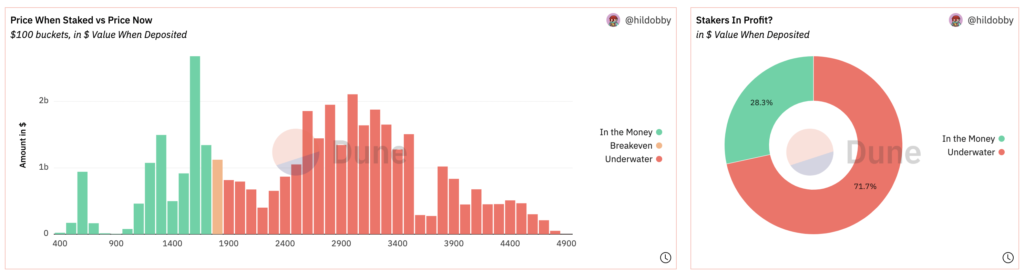

In addition, from the selling pressure perspective, the sale of ETH from staking will not happen simultaneously and will take several days. Lido will also delay its withdrawal feature until at least early May. Considering Lido has 33% of ETH staking, this is significant. Furthermore, the data from Dune shows that the majority of investors who are staking are in an unrealized loss position. Around 71% of stakers are facing unrealized losses. This reduces their motivation to sell ETH from staking.

If the sale of ETH during Shapella does not have a significant impact, the LSD sector has the potential to experience significant growth. LSD platforms will become the choice for staking, especially after seeing the closed staking programs of Kraken and Gemini. In the last few weeks, we have also seen several LSD platforms emerging such as unshETH. Shapella could be a catalyst for the growth and development of the LSD sector.

With Shapella approaching, a new term has emerged in the crypto community, namely LSDfi. LSDfi refers to the DeFi ecosystem built on top of LSD protocols. LSDfi leverages LSD tokens such as stETH, frxETH, rETH, and the like.

Several LSD assets available on Pintu are LDO (Lido Finance), FXS (Frax Finance), RPL (Rocket Pool), FIS (Stafi), ANKR (Ankr Network), and YFI (Yearn Finance).

2. Bearish Scenario

In a bearish scenario, post-Shapella data shows that many validators are performing partial and full unstaking. If this happens, the market is likely to experience a sell-off as many ETH investors sell their assets. The bearish Shapella situation has the potential to bring significant selling pressure from hundreds of thousands of queued ETH waiting to be sold. In this situation, ETH may lose support at around $1,780 and drop to $1,630.

Furthermore, there is negative potential from the macroeconomics in the US. The announcement of the US monthly CPI also occurs on April 12, 2023. A high CPI figure indicates unmanaged inflation and a “risk-off” market condition. As a result, the crypto market will fall again, including ETH.

We can also look at the ETH chart during the Merge for comparison. Just like Shapella, the Merge was an anticipated Ethereum update that was talked about for months before it happened. Everyone was talking about the potential bullishness of ETH post-Merge. However, the price movement told a different story. The Merge became a classic “buy the rumor, sell the news” event, and ETH dropped 33% post-Merge. ETH recovered to approach its previous price level about a month after the Merge.

So, will the movement of ETH during Shapella be similar to the Merge? Or will it be different this time? It depends on your confidence and analysis as an investor.

Final Thoughts

Shapella, the upcoming Ethereum update, has generated a lot of excitement in the crypto community due to its potential impact on the staking ecosystem. The ability to withdraw staked ETH has been a highly anticipated feature, as it could attract more users and increase demand for ETH. However, there is also a potential downside if many investors decide to sell their staked assets, leading to a sell-off in the market.

The impact of Shapella on the market is still uncertain and depends on various factors such as market sentiment, macroeconomic conditions, and individual investor analysis. The previous Ethereum update, the Merge, had a similar level of anticipation and resulted in a classic “buy the rumor, sell the news” event. Whether Shapella will follow a similar pattern or not remains to be seen.

Overall, the crypto market is highly unpredictable, and investors should always do their own research and analysis before making any investment decisions. Shapella is undoubtedly an important development for Ethereum, but its impact on the market can only be determined once it is implemented and its effects become clearer.

How to Buy Cryptocurrency in Pintu

Are you interested in investing in crypto assets? Take it easy, you can buy various crypto assets such as BTC, ETH, SOL, and others safely and efficiently. Furthermore, Pintu has subjected all its crypto assets to a thorough evaluation process, emphasizing the importance of prudence.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to executing transactions, in the Pintu Apps, you can also learn crypto through various Pintu Academy articles updated weekly! All Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Mainnet Shapella Announcement | Ethereum Foundation Blog, accessed on 6 April 2023.

- Lucas Outumuro, Estimating the Impact of Ethereum’s Shapella Upgrade | by Lucas Outumuro, IntoTheBlock, accessed on 6 April 2023.

- Ξliézer Ndinga on Twitter: “We are thrilled to release our Ethereum Withdrawal Simulator The Shanghai upgrade looming, and there will be”, Twitter, accessed on 10 April 2023.

- How Will ETH Shanghai Affect DeFi?, Revelo Substack, accessed on 10 April 2023.

- No Sell-Off After Ethereum’s Shapella Upgrade, Says Analyst, BeinCrypto, accessed on 10 April 2023.

- Nivesh Rustgi, Ethereum, LSD Tokens on the Rise Ahead of Next Week’s Shanghai Upgrade, Decrypt, accessed on 10 April 2023.

- Ibrahim Ajibade, Is ETH Bullish ahead of the Shapella upgrade?, BeinCrypto, accessed on 10 April 2023.