EigenLayer has introduced a new technology called restaking, which has led to the emergence of a new sector known as liquid restaking. This sector attracted crypto players’ attention thanks to its lucrative yield potential. Among these protocols, EtherFi stands out as the largest, making it the top choice for many investors. But what exactly is EtherFi, and what sets it apart? Check out the full coverage in the following article.

Article Summary

- 🗳️ EtherFi is a non-custodial decentralized liquid restaking protocol on the Ethereum network. It allows users to stake their ETH and retain complete control over their keys.

- ✨ By retaining control of the keys of their staked ETH, EtherFi users can avoid the risk of counterparty involvement with node operators and protocols.

- 🏆 Features in EtherFi include Automatic Restaking on EigenLayer networks, and Liquid, an automated DeFi vault strategy.

- 🪙 ETHFI is the native token on the EtherFi platform. It serves as the governance token and regulates the use of Ether.fi reserve money requests changes to the ETHFi token function and determines other platform policies.

About ETH Liquid Restaking

Before getting into EtherFi and ETH liquid restaking, we must understand the concepts of liquid staking and restaking. Both are closely related to how EtherFi works. Liquid staking is a concept where users get tokens representing their staked assets. Then, those tokens can be used in various DeFi activities to earn more yields.

While restaking is a concept developed by EigenLayer. The ETH tokens obtained from traditional or liquid staking platforms can be restaked on the EigenLayer. This is done to secure other protocols by utilizing the security provided by EigenLayer. At the same time, it also offers potential returns for its stakers.

Read this article about liquid staking and EigenLayer to help you understand more about them and how they work.

However, the problem with liquid staking is that users hand over their ETH without getting their keys. As a result, users have no control over their staked ETH. This can be a problem. In the event of counterparties or smart contract issues on the liquid staking platform, users could lose their ETH.

“Not your keys, not your coins” is a phrase that aptly describes the problem of liquid staking. EtherFi is here to solve that problem.

What is EtherFi?

EtherFi is a non-custodial decentralized liquid restaking protocol on the Ethereum network. It has an innovative approach because users get returns on their ETH staking and have complete control over their keys. This means that if the protocol is at risk of attack or the node operator has a problem, EtherFi users can retrieve their ETH.

In its operation, EtherFi integrates with EigenLayer and its native restaking. This allows EtherFi users to earn additional rewards apart from Ethereum staking returns. This integration also enables users to perform restaking without locking their assets, giving them flexibility.

As a liquid restaking platform, users will get LST tokens as eETH when staking their ETH on EtherFi. Users can use the eETH on various DeFi protocols on Ethereum.

In addition, EtherFi also has a unique feature called T-NFT and B-NFT tokens. It offers incentives and flexibility for stakers and node operators. With these various incentives and rewards, EtherFi can be an option for users who want to earn interest.

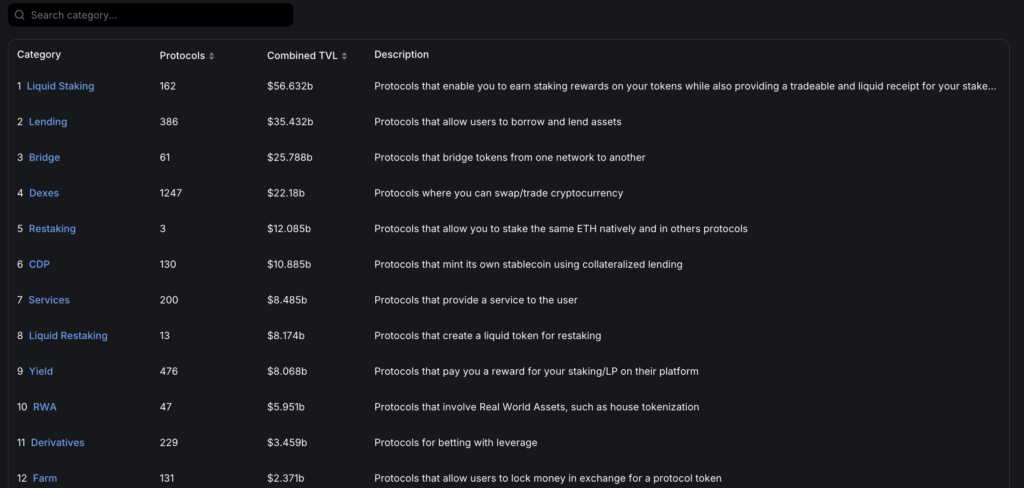

The liquid restaking sector is experiencing rapid growth due to the increasing demand. Based on Defi Llama data, the sector’s Total Value Locked (TVL) has reached US$ 7.66 billion at the time of writing. This figure has increased more than 26x compared to the end of 2023, when it was only US$ 280 million.

EtherFi is the leader in this sector, with a TVL of US$ 3.11 billion or around 892,000 ETH in stake.

How does EtherFi Work?

EtherFi enables users to securely stake Ethereum through Operation Solo Staker, promoting a non-custodial approach. The operation allows anyone to run nodes via two ‘paths’.

Path 1 is to run nodes permissionless through Distributed Validator Technology (DVT). In DVT, validator keys are distributed across multiple node operators to reduce risk while promoting network decentralization. To run Path 1 requires hardware and a minimum collateral of 2 ETH. EtherFi will help with technical support and the remaining 30 ETH.

On Path 2, called Operation Solo Staker, users do not need to provide ETH collateral. EtherFi will provide all 32 ETH. Stakers only need to set up hardware, do KYC, and commit to being nodes for two years.

EtherFi's technical structure is specifically built to support a decentralized staking environment. Each node operator can enter their public key through a smart contract. At the same time, stakers can choose operators to supervise validator nodes.

Furthermore, EtherFi is also implementing an auction system to determine the allocation of staking opportunities for operators. This is to ensure greater fairness and transparency for network participants.

Curious and want to try your luck as a validator? Find out the explanation in the following article.

EtherFi’s Feature

The following are some of the EtherFi’s key features:

Automatic Restaking

EtherFi has implemented an Automatic Restaking feature that makes ETH that has been staked in EtherFi will generate additional rewards. EtherFi does this through native liquid restaking integrated with EigenLayer. This is also what distinguishes EtherFi from other liquid restaking protocols.

If other protocols have to wait for EigenLayer to raise caps first to deposit their users’ tokens, EtherFi doesn’t need that. This is because native restaking directly on EigenLayer does not require caps.

Users can validate various software modules outside the Ethereum network through this integration to maximize their revenue at EigenLayer points. This ultimately helped push EtherFi TVL to rank first in the liquid restaking sector.

Liquid

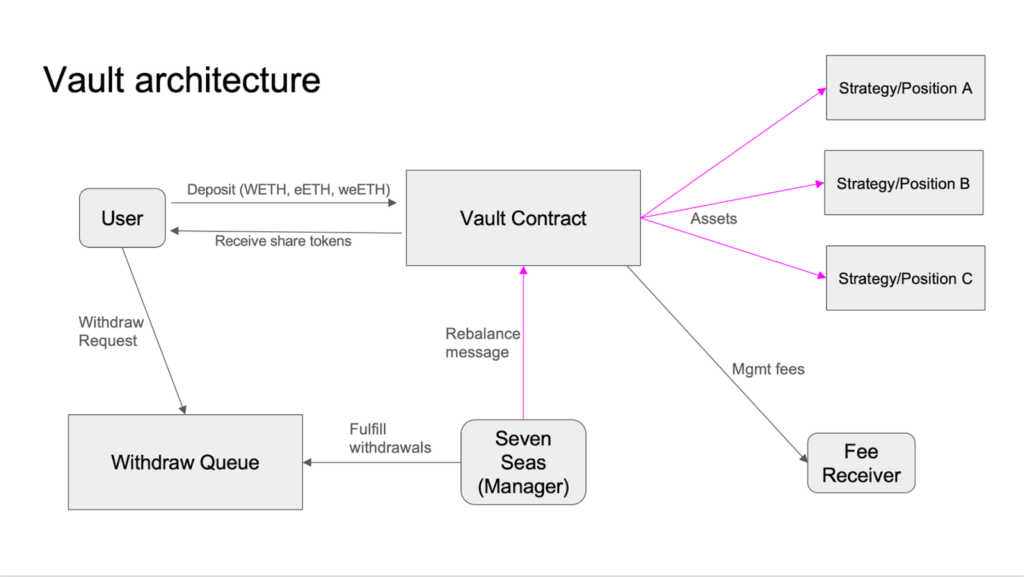

Liquid is an automated DeFi vault strategy that provides EtherFi users with additional returns on their eETH through investments in the DeFi ecosystem. To use it, users simply deposit eETH, weETH, or WETH. Behind the scenes, the vault will allocate it across various DeFi positions.

The vault will add new integrations over time, growing alongside eETH DeFi. It also will add additional protocols that the vault can allocate. This aims to ensure the Vault remains competitive.

Meanwhile, the strategy implemented at Liquid was provided by Seven Seas. Seven Seas established a reputation as one of the top vault builders in DeFi. Their vaults have facilitated over $10 billion in LST DEX volume and have exposure to $600 million in LST through leveraged staking. They are also directly incentivized by many well-known DeFi projects.

T-NFT and B-NFT

The distinguishing factor of the staking method in EtherFi is the implementation of T-NFT (transferable non-fungible token) and B-NFT (bound non-fungible token) tokens. Whenever there is a new validator node, the stakers will get both tokens. The T-NFT is transferable, while the B-NFT is linked to the staker (nontransferable).

Both tokens act as proof of ownership of the ETH that has been staked. It also has a vital role in securing validator keys between validators. As for B-NFT is specifically linked to the user holding the validator key to ensure security and responsibility.

EtherFi’s Advantages

🔐 Non-Custodial. EtherFi is the only non-custodial Ethereum staking platform. This gives users complete control over their keys, reducing the risk of attacks or operator node problems.

🤑 Lucrative Returns. Thanks to its integration with EigenLayer, users can earn additional returns from restaking. Thus, users can earn yield from ETH staking and native EigenLayer restaking.

🌐 Vast Ethereum DeFi Ecosystem. eETH earned from staking in EtherFi can be used in various DeFi in the Ethereum ecosystem. Moreover, the Liquid feature can help EtherFi users increase the returns that can be obtained.

ETHFI Token as Investment

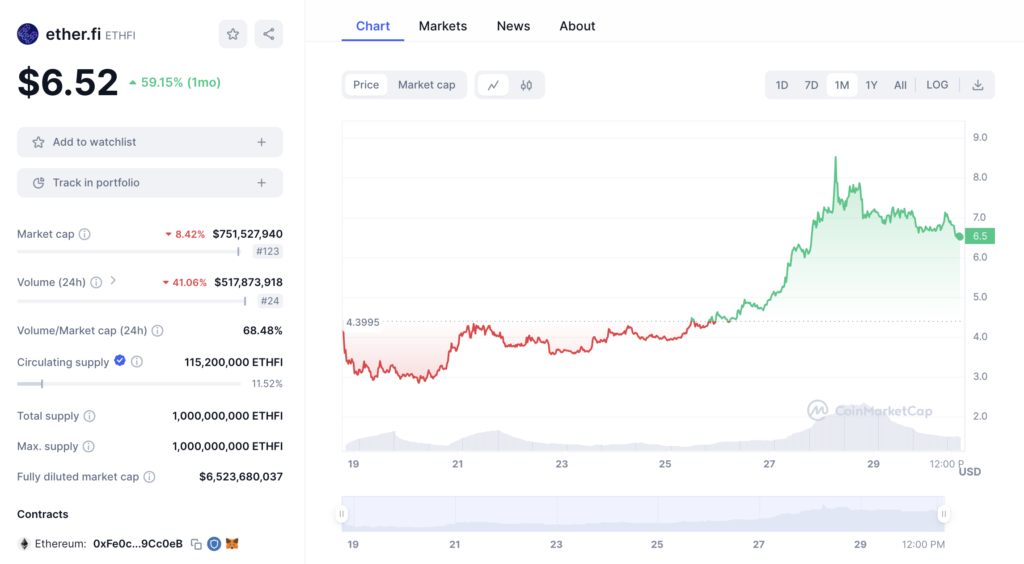

ETHFI is the native token of the EtherFi ecosystem. This token was recently launched through the Token Generation Event (TGE) on March 18, 2023. At the same time, EtherFi also distributed an EtherFi token airdrop campaign. Some criteria are early adopters, solo stakers, eETH holders, etc.

You can check your eligibility for EtherFi airdrops on the following page. For those of you who don't get it, you can join EtherFi's StakeRank season 2 program. By staking your ETH, you can increase your chances of getting an ETHFI token airdrop.

In addition to EtherFi, here are some liquid restaking airdrops you can get using the Pintu Web3 Wallet.

As the primary token on the EtherFi platform, ETHFI serves as the governance token. In addition, ETHFI owners can regulate the use of Ether.fi‘s reserve money, to change the ETHFi token function, and determine other platform policies.

ETHFI has a total supply of 1 billion ETHFI, of which only 115 million ETHFI tokens are currently on the market. In terms of price movement, ETHFI is still trending upward. At launch, ETHFI was at $4.4 and by the time this article was written, it was at $6.52, an increase of 48.18%. Meanwhile, ETHFI’s highest level was at $8.53.

ETHFI Token Potential

As a long-term investment, the value of ETHFI tokens will heavily depend on the restaking sector development, particularly EigenLayer. However, current metrics show that the restaking sector and EigenLayer have promising potential.

Defi Llama data shows that the TVL of the restaking sector is ranked fifth with a total of $12.08 billion, whereas Eigen Layer’s market share is 12.03 billion. Then, the liquid restaking sector is ranked 8th. This figure outperforms established sectors such as yield, derivatives, and farming.

The higher the value of protocols that use Eigenlayer, the higher the profits earned by EtherFi users. In other words, the growth of EigenLayer and restaking will also lift the EtherFi and liquid restaking performance.

But on the one hand, that dependence on EigenLayer can be a potential risk. Vitalik Buterin is concerned that Eigenlayer’s security outsourcing could have a systemic impact. If a large group of validators secure the same network and are subject to slashing, attacks, or hacks, the impact could be systemic and have a domino effect even for Ethereum.

Conclusion

The emergence of the restaking sector has also created a new sector, liquid restaking. Although relatively new, this sector has achieved impressive TVL growth, with EtherFi is becoming the market leader. EtherFi is a liquid restaking protocol where users can stake their ETH and get rewards. In addition, users will also get eETH tokens that can be used on various DeFi platforms.

EtherFi is different from similar platforms because users control their staked ETH keys. This non-custodial approach ensures EtherFi users retain ownership of their ETH despite the counterparty risk on node operators or a protocol. EtherFi also offers other features, such as automated vault strategies, that can provide additional returns on their eETH through investments in the DeFi ecosystem.

How to Buy ETHFI on Pintu

After knowing what EtherFi is, you can start investing in ETHFI by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for ETHFI.

- Click buy and fill in the amount you want.

- Now you have ETHFI!

In addition to ETHFI, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Referensi

- EtherFi Docs, Introduction to EtherFi, accessed on 27 March 2024.

- ether.fi, Staking is Just Beginning, Medium, accessed on 27 March 2024.

- 0xKira, What Is EtherFi? Ethereum Liquid Restaking Protocol, CoinMarketCap, accessed on 27 March 2024