Bitcoin’s recent pullback to $60,000 from its all-time high of $73,000 challenges investor confidence as the much-anticipated halving event nears. In this analysis, we’ll explore potential price projections for Bitcoin in light of current market conditions.

As usual, the Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- ✍🏻 BTC reached the Fibonacci 1.0 extension resistance level at $71,375. Breaking the price point is expected to push to new price levels.

- 📉 The Commerce Department’s Census Bureau reported a 0.3% decline in new home sales, reaching a seasonally adjusted annual rate of 662,000 units last month.

- 📈 There was a 1.4% uptick in durable goods orders in February.

- 💼 Initial Jobless Claims in the US decreased by 2,000 in the week ending March 23.

Macroeconomic Analysis

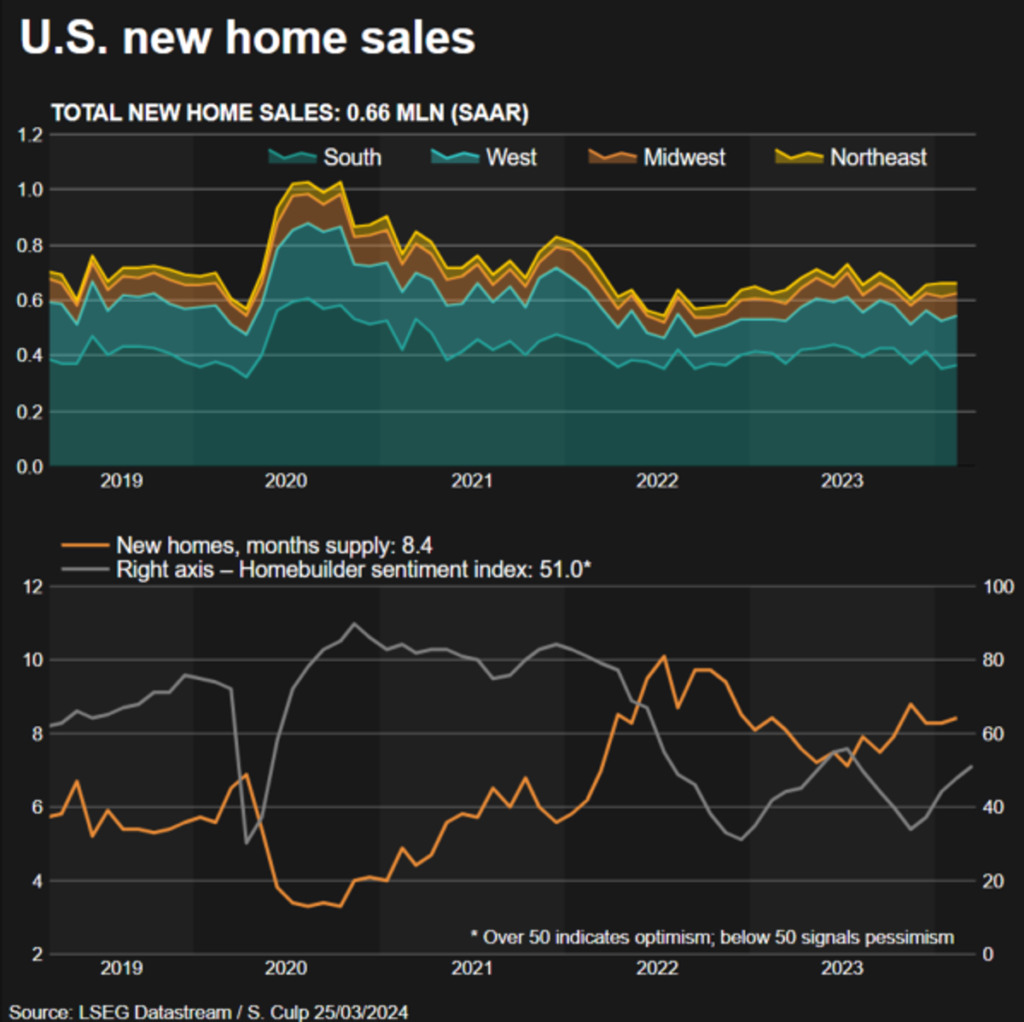

New Home Sales

February saw an unforeseen decline in the sales of new single-family homes in the United States, attributed to a rise in mortgage rates during the month. However, the overall trend remained robust, driven by a persistent shortage of existing homes in the market. The Commerce Department’s report on Monday highlighted that last month’s median price for new homes was at its lowest point in over two and a half years, coinciding with an increase in supply, the highest since November 2022. Builders are responding by intensifying construction efforts, implementing price reductions, incentives, and downsizing floor plans to enhance housing affordability.

The Commerce Department’s Census Bureau reported a 0.3% decline in new home sales, reaching a seasonally adjusted annual rate of 662,000 units last month. This figure represents a slight adjustment from the previously reported sales pace for January, which was revised upward to 664,000 units from 661,000 units.

Other Economic Indicators

- Durable Goods: Durable goods orders in the United States increased by 1.4% in February, surpassing forecasts of a 1.1% increase and signaling a stronger-than-expected economic outlook for the first quarter. The recovery was particularly pronounced in the transportation sector, which grew by 3.3% after a significant decline in the previous month, with civilian aircraft orders jumping by 24.6%. This increase in durable goods orders, which include items lasting three years or more, coupled with early signs of recovery in business spending on equipment, provides an optimistic view of future economic growth. This optimism is further supported by the anticipation of an interest rate cut by the US central bank later this year, which would positively contribute to the manufacturing sector, a 10.3% contributor to the economy.

- Jobless Claim: The latest weekly data released by the US Department of Labor (DOL) on Thursday showed that there were 210,000 initial jobless claims for the week ending March 23. This figure was slightly lower than the revised 212,000 claims from the previous week and beat market expectations of 215,000. Additionally, the report provided more insights, indicating that the advance seasonally adjusted insured unemployment rate was 1.2%, while the 4-week moving average dropped to 211,000, decreasing by 750 compared to the revised average of the previous week. According to the publication, the advance number for seasonally adjusted insured unemployment for the week ending March 16 was 1,819,000, marking an increase of 24,000 from the revised level of the previous week.

BTC Price Analysis

Following a notable upward trend spanning two weeks, Bitcoin has paused its bullish momentum in the market. After reaching a recent all-time high of $73,700 on March 13, BTC corrected and consolidated above $60,000, experiencing a retracement of 15.4%. This retracement briefly led to a local low of $60,800 on March 20 before bouncing back to $70,000.

On the weekly chart, BTC price have reached the 1.0 Fibonacci extension resistance level at 71,375. Breaking beyond this point and establishing definite support at this level would propel BTC to new levels.

Notice that the MVRV bands have reached the upper bound of what is often associated with resistance points where investors start to capitalize on their profits.

Furthermore, the market’s behavior reflects heightened profit-taking activities, evident in the locking of over $2.6 billion in realized profit through on-chain spending during BTC’s ATHs. Significantly, approximately 40% of this profit-taking activity stemmed from long-term holders liquidating their positions in GBTC Trust, while the remainder was attributed to short-term traders capitalizing on market momentum.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long-term holders’ movement in the last 7 days were higher than the average. If they were moved for the purpose of selling, it may have a negative impact. Investors are in a belief phase where they are currently in a state of high unrealized profits.

- 🏦 Derivatives: Long-position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Ethereum Founder Calls for Memecoin to be Utilized for Positive Purposes. Ethereum co-founder Vitalik Buterin has called on the crypto community to channel their interest in memecoins towards more constructive initiatives, such as impactful philanthropy. In a recent blog post, Buterin observed the evolution of memecoins, from their initial popularity sparked by Dogecoin to a subject of debate due to their volatility and controversial influence. He highlighted the shift away from the original purpose of cryptocurrencies towards a memecoin trend often associated with negative themes like racism. However, Buterin proposes “charity coins” and “Robin Hood games” as a way to transform memecoins from mere financial speculation into tools for supporting meaningful social causes. Thus, memecoins could demonstrate the potential to contribute to societal well-being and a more equitable distribution of wealth through blockchain technology. This innovative approach is a call for the crypto community to prioritize projects that are not only entertaining but also have a positive social impact.

News from the Crypto World in the Past Week

- BlackRock is optimistic about an Ether ETF. BlackRock CEO Larry Fink expressed confidence that an Ether ETF could be approved despite the U.S. Securities and Exchange Commission (SEC) potentially classifying Ether as a security. This classification would increase regulatory oversight of the second-largest digital asset. The SEC is currently considering Ether’s status and has contacted several related companies. Despite these concerns, Fink expressed optimism about the possibility of an Ether ETF during an interview with Fox Business. BlackRock has had great success with the launch of its Bitcoin ETF, the iShares Bitcoin Fund (IBIT). IBIT has raised over $15 billion in assets in just 2.5 months, making it the fastest-growing ETF product in history. While some in the industry worry that the SEC may not approve an Ether ETF, the success of IBIT and Fink’s confidence in the long-term viability of Bitcoin and potentially other digital assets indicate a bullish outlook for the future of these investment vehicles.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- dogwifhat (WIF) +107%

- Mantle (MNT) +60%

- Bitcoin Cash (BCH) +39%

- Internet Computer (ICP) +34%

Cryptocurrencies With the Worst Performance

- Fantom (FTM) -11%

- Kaspa (KAS) -3.9%

- Akash Network (AKT) -2.10%

References

- Helena Braun, BlackRock’s Fink Says an Ether ETF Is Possible Even if ETH Is a Security, Coindesk, accessed on 30 March 2024.

- Assad Jafri, Vitalik believes memecoins should be used for philanthropy and social impact, Cryptoslate, accessed on 30 March 2024.