Perpetual trading has gained significant popularity among traders due to its flexibility and potential for profit. This type of trading allows you to capitalize on both bullish and bearish markets. Leveraging can further amplify your gains, but it’s important to understand the associated risks. Find out more about perpetual futures trading in the following article.

Article Summary

- 📜 Perpetual futures is a type of derivative that allows traders to speculate on the price movement of an underlying asset, in this case cryptocurrency, without any expiration date or deadline.

- 💸 With perpetual trading, traders can profit both when the market is bullish by opening a long position, or when the market is bearish by opening a short position.

- 🤑 Perpetual trading supports leverage, which can amplify a trader’s profit potential. But on the one hand, leverage also comes with a high risk of liquidation.

What is a Perpetual Trading in Futures?

To understand perpetual trading, we must first grasp the concept of derivatives. It is the underlying principle of perpetual trading. Essentially, derivatives are financial products whose value is derived from another asset, in this case, crypto assets.

One form of derivative product is a futures contract. In a futures contract, each contract has a specific expiration date and a predetermined price. Additionally, there are also perpetual contracts or perpetual futures. Perpetual futures is a derivative asset that tracks the price of its underlying cryptocurrency without an expiration date. This means traders can hold their positions indefinitely. Through perpetual futures, traders can gain exposure to the price movements of their assets without having to own them.

You can trade perpetual futures on centralized exchanges (CEX), such as those offered on Pintu or decentralized exchanges (DEX) like dYdX.

Learn more about how decentralized perpetual trading works in the following article.

How Perpetual Futures Works

To determine the contract’s price, perpetual futures use an index price derived from the prices of various exchanges. A mechanism known as the funding rate is used to keep the perpetual futures price aligned with the spot price. We’ll discuss the funding rate in more detail later.

Unlike spot markets, where traders can only profit from the price increases, perpetual markets allow traders to profit whether the market goes up or down. In other words, perpetual trading offers the potential for profit in both bullish and bearish markets.

There are two primary positions in perpetual trading:

- Long Position: Traders open a long position when they expect the crypto price to rise. Once the price increases, they can close the position to realize a profit.

- Short Position: A short position is the opposite. Traders borrow and sell crypto from the exchange, expecting the price to drop. They then repurchase the cryptocurrency at a lower price and return it to the exchange, keeping the difference as profit.

Elements in the Perpetual Trading

Some of the mechanisms listed below are essential elements to ensure perpetual trading works.

Funding Rate

The primary purpose of the funding rate is to prevent significant price discrepancies between perpetual futures and the underlying spot market. When the perpetual futures price deviates substantially from the spot price, the funding rate comes into play to help bring the prices back into alignment by incentivizing traders to take positions that counteract the current market trend, thereby reducing the price gap.

The funding rate can be either positive or negative.

- A positive funding rate occurs when the perpetual trades above the spot price. In this case, long position holders pay a fee for short positions; by imposing additional funding charges on the long position holders, it encourages people to factor in the additional cost and potentially long less or even go short if the funding rate is very high.

- A negative funding rate occurs when the perpetual trades below the spot price. Here, short position holders pay a fee to long position holders; opposite to a positive funding rate, a negative funding rate may encourage people to short less, and hence removing some of the selling pressure to allow the futures prices to return increase back to the level of the index price.

Funding rates can help you execute perpetual trades more optimally. Learn how here.

Leverage

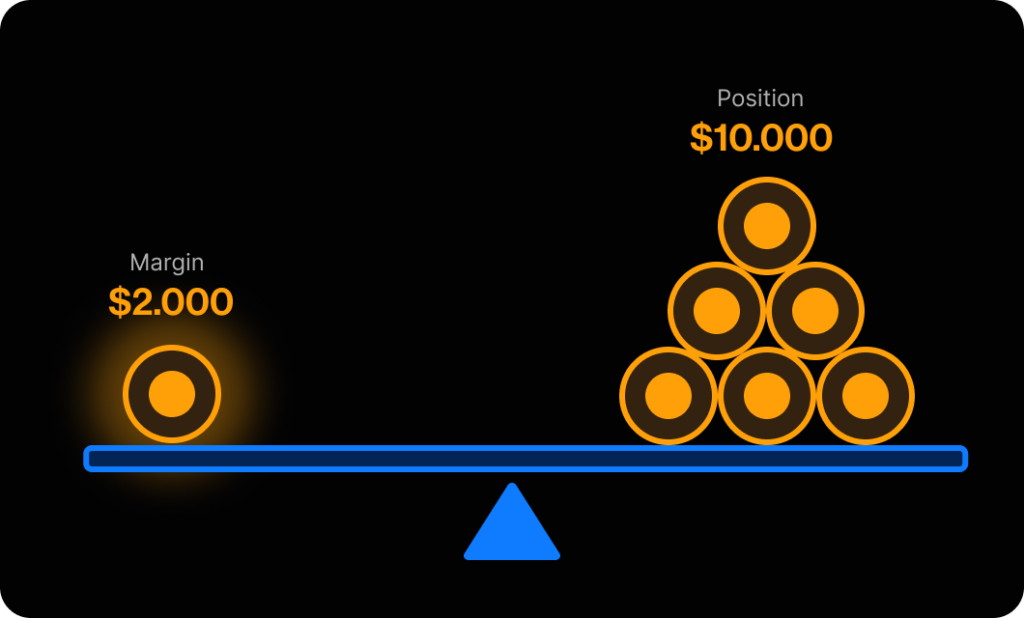

While you need to have 100% of your funds in advance to trade spot, perpetual futures allows you to use leverage, which means that you only need to put up a fraction of the order value instead. For example, if you want to buy $100 worth of BTC in spot, you will need to have $100 in purchase power. However, buy $100 worth of BTC through a 25x perpetual futures, you will only need to produce the initial margin, which is just 4% of the $100 (i.e. $100 / 25), or simply $4. In this example, trading perpetual futures has reduced the amount of capital needed by 96%!

The advantage of using leverage is that it amplifies your potential profits (i.e. you only need to provide $4 to gain the PnL exposure to $100). But as you will quickly see, leverage can be a double edged sword, so while it boosts your potential profits significantly if you predicted the market correctly, if the market goes against you, you have a high risk of being liquidated and losing all your funds in a cross margin account. We will go through margin and liquidation risks in detail in the subsequent sections.

Margin

Margin is essentially the collateral that you put up against the exchange to cover for the potential losses that your position may suffer. Remember from the previous example, you only provided $4 of margin to open a $100 BTC position, the $4 is used to cover for any losses that the position may suffer, and you can see that if the $100 BTC position loses more than $4, you will actually have no money left to cover for any additional losses – so this is the fundamental reason why Exchanges like CFX will setup thresholds to make sure that this does not happen and that your position will be closed before losing more than $4.

There are 3 main margin concepts to pay attention to when trading perpetual futures:

- Initial Margin – this is the amount of funds you must have in your account in order to open a new position. This is usually defined as a % of the position value you are trying to open. The % may vary depending on the leverage you are using. In our example of 25x, the initial margin is 1/25 or 4% of the value you are trying to trade.

- Maintenance Margin – this is the amount of funds that you must maintain to avoid having your position closed. Usually this amount is set to be 1/4 of your initial margin. So with 25x leverage, the maintenance margin will be 1%. In other words, to open a $100 position, you need to start with $4 of Initial Margin, and need to make sure you don’t let your margin account drop to $1 or the Maintenance Margin threshold, otherwise your position will be liquidated and you will lose all your funds.

💡 Important to note: initial margin is only locked for open orders. Once an open order is filled and converts into an open position, only the maintenance margin is locked. So if you start with a $4 margin balance, when you open a $100 new order, all $4 of the margin balance will be locked. However, once the order is filled and you now have a $100 position, only $1 will be locked. The remaining $3 of margin balance will actually be freed up to deploy again, but by re-using the $3 available margin, you will be be increasing your leverage to beyond 25x, which is not advisable.

3. Margin Usage Ratio – margin usage ratio, which is a key value that Pintu provides its users is a way for you to keep track of the overall risk level of your position. As you open more positions and use more leverage, this ratio will increase. If this ratio reaches 100%, you will be liquidated. This is a more intuitive way to understand the overall health of your account and the risk of liquidation.

| Action | Margin Balance | Initial Margin | Maintenance Margin | Available Margin | Margin Usage |

| A | B | C | D = A – B – C | C / (C + D) | |

| Deposit Margin | 🟢 Increase | No change | No change | 🟢 Increase | 🔴 Decrease |

| Withdraw Margin | 🔴 Decrease | No change | No change | 🔴 Decrease | 🟢 Increase |

| Negative PnL | 🔴 Decrease | No change | No change | 🔴 Decrease | 🟢 Increase |

| Positive PnL | 🟢 Increase | No change | No change | 🟢 Increase | 🔴 Decrease |

| Open New Order | No change | 🟢 Increase | No change | 🔴 Decrease | 🟢 Increase |

| Open New Position | No change | No change | 🟢 Increase | 🔴 Decrease | 🟢 Increase |

| Cancel Open Order | No change | 🔴 Decrease | 🟢 Increase | 🔴 Decrease | |

| Close Open Position | No change | No change | 🔴 Decrease | 🟢 Increase | 🔴 Decrease |

💡To help our users avoid liquidation, Pintu will send margin call alert to traders when their margin usage ratio exceeds certain threshold such as 50% or 75%. But it is up to the traders themselves to take the initiative to lower this % by either closing new open orders or partial closing their positions, or just to simply add more margin to the account.

Liquidation

Liquidation is the most significant risk associated with perpetual trading. It occurs when a trader is unable to maintain the required maintenance margin. Once liquidated, the entire balance in the trader’s futures account will be lost.

The primary factor influencing liquidation is the level of leverage used. Higher leverage levels result in a lower tolerance for price fluctuations. In simpler terms, the higher the leverage, the greater the risk of your position being forcibly closed.

For instance, if you open a $500 BTC/USDT position using 10x leverage, a 10% drop in the price of BTC would result in a $50 loss, wiping out your initial investment. The exchange would then liquidate your position to prevent further losses

The Advantages and Disadvantages of Perpetual Trading

Advantages of Perpetual Trading:

- ⌛ No expiration date. This allows traders to hold their positions for an extended period.

- 💰 Profit in bullish and bearish markets. Perpetual trading enables traders to profit regardless of whether the market trends up or down.

- 🏦 Deeper liquidity. In some cases, perpetual markets can have deeper liquidity compared to spot markets.

- 💡Higher potential profits and increased capital efficiency. Leverage allows traders to amplify their potential gains and use their capital better.

Disadvantages of Perpetual Trading:

- ☠️ Higher risk of liquidation. The use of leverage increases the risk of losing your entire investment.

- 🔍 Complex risk management. Managing margin requirements and the risk of liquidation requires careful risk management.

The most important factor in perpetual trading is risk management. Learn how to do that here.

Conclusion

Perpetual trading offers opportunities for traders interested in speculating on the future price of crypto assets without expiration dates. With leverage, perpetual trading also presents the potential for higher profits than spot trading.

However, perpetual trading also carries higher risks compared to spot trading. Traders must be more careful in managing leverage usage, margin requirements, and risk management strategies. If miscalculated, a trader’s futures account can be liquidated, resulting in the loss of all invested capital. Therefore, in-depth research, understanding how the system works, and having a clear risk management plan before engaging in perpetual trading are essential.

How to Buy Crypto on Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.