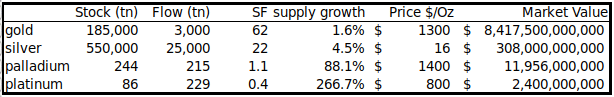

Stock to Flow is a method to count the abundance of a particular commodity. This method is commonly used for natural resources or commodities such as gold or silver. Stock to Flow will calculate the value of certain commodities based on their scarcity. The higher the stock to flow ratio, the better that commodity to store value. The lower the stock to flow ratio, the worse that commodity to store value.

As an example, gold has a high stock-to-flow ratio because gold supply is limited year after year. Whilst wheat and other perishable goods have a low stock-to-flow ratio because the value of this commodity is from being consumed. Therefore, gold is a good commodity to be stored as an asset while wheat is more suitable as tradable goods or for consumption.

How to calculate stock to flow

As an example, gold has a total supply of 190,000 tonnes of gold that ever been mined. However, there are around 2,500-3,200 tonnes of gold that are mined every year, therefore the stock-to-flow ratio of gold is:

- Stock-to-flow of gold (SF) = 190,000 tonnes/3,200 tonnes per year = 59

This means it takes 59 years to acquire 190,000 tonnes of gold. If the total new gold supply is increasing to 3,300 tonnes, then the stock-to-flow ratio will be 57.

The higher stock-to-flow ratio means the commodity is more scarce. At the moment, gold is considered to be the most scarce asset in the world in comparison to other commodities.

Bitcoin stock to flow

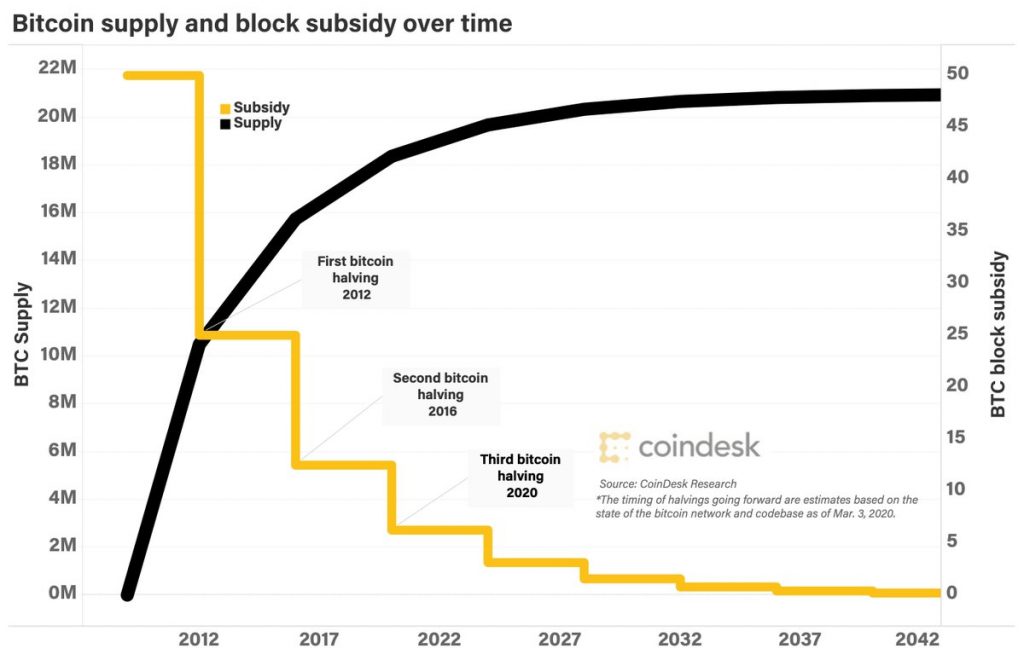

By calculating the Bitcoin stock-to-flow, we can compare the value of bitcoin with other rare commodities such as gold and silver. At the moment, there is already 18,700,000 BTC that have been mined (as of 2021). As we know the amount of new Bitcoin will be reduced every 4 years through the halving cycle. So if we calculate, in 2017, Bitcoin stock-to-flow ratio is 25. After the 2020 halving, the Bitcoin stock-to-flow ratio becomes 50. And by 2024, the Bitcoin stock-to-flow ratio becomes 121. We can say that bitcoin is a more scarce asset than gold.

Source: coindesk.com

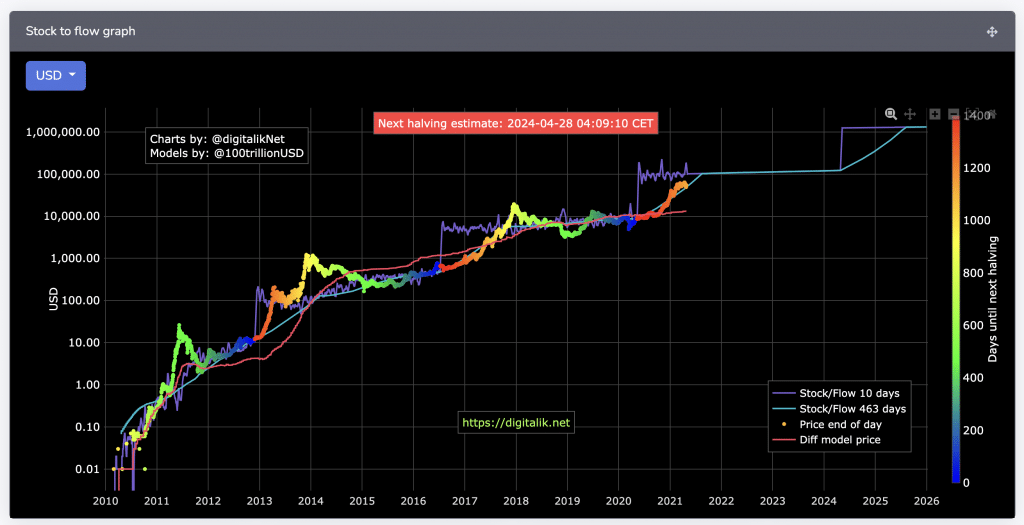

Predicting Bitcoin prices with stock to flow models

Some people use the stock the Bitcoin stock-to-flow as a reference to predict future Bitcoin prices. We can predict the price of Bitcoin in the future because the supply of Bitcoin is set inside the Bitcoin protocol. We can see that the stock-to-flow ratio will be doubled every halving and the Bitcoin price is increased 10x every halving. The stock-to-flow model gained its popularity from Bitcoiners because so far it can predict the price of Bitcoin from time to time.

An investor can predict the Bitcoin price will increase periodically through the stock-to-flow model as shown in this chart below.

Source: Bitcoin Stock to Flow Model – S2F Live Chart (PlanB) https://digitalik.net

Stock-to-flow critics

Stock-to-flow model can only see the price from its scarcity, however, in reality, price is driven by multiple aspects apart from its scarcity. The market has a big role in determining prices. The person with a pseudonym Plan B changed his model and his data range to include other assets such as gold and silver.

Volatility is another factor to be reconsidered to see the value of an asset. If an asset has a predictable volatility therefore we can also predict the value of that asset. Bitcoin has a high volatility therefore the value of the asset cannot be estimated with certainty.

Source

Plan B. Modeling Bitcoin Value with Scarcity. 2019

Plan B. Bitcoin Stock-to-Flow Cross Asset Model. 2020