The growth of the crypto market today is inseparable from the rapid development of decentralized finance or DeFi applications built on the Ethereum blockchain. One of them is Uniswap.

Uniswap is a decentralized exchange application that facilitates exchange transactions of ETH and ERC-20 tokens—the most frequently used token standard on the Ethereum blockchain.

In September 2020, Uniswap released UNI token, a governance token or token that gives its holders the right to vote on changes to the Uniswap protocol. In DeFi or decentralized finance projects, a governance token is required to distribute rights to users so that the platform remains decentralized.

As of July 2021, UNI is the DeFi token with the largest market cap in the world, with a value of $8.6 billion.

What makes UNI tokens so popular and widely held as an investment asset? To find out more about the fundamental aspects of UNI token, let’s read the explanation below.

How does Uniswap work?

Currently, asset trading is dominated by centralized exchanges or operated by companies. These companies act as bridges between buyers and sellers. This means, to make a trade, users deposit their funds or assets to these exchange companies and give them the access to sell or to buy other assets on our behalf.

As a decentralized exchange, Uniswap automates this process using smart contract on the Ethereum blockchain. Anyone can trade ERC-20 tokens (such as USDT, BNB, LINK, DAI) without having to entrust their funds to any party.

You may be wondering, how does Uniswap do the automation to bridge users who want to buy assets with those who want to sell their assets?

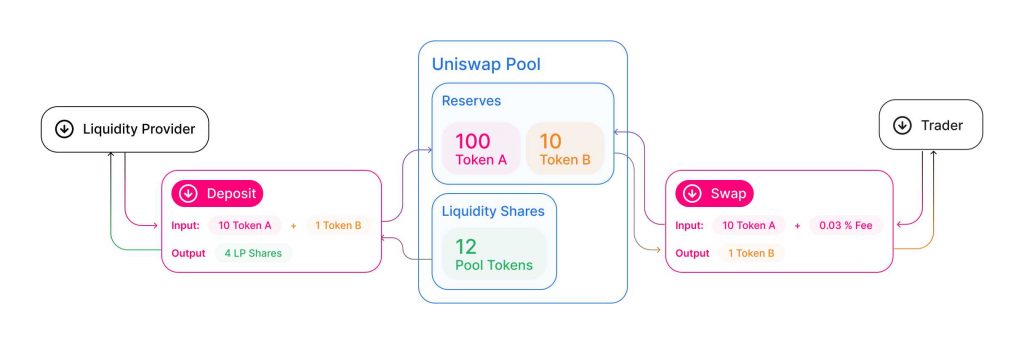

Uniswap uses a system called Automated Market Maker (AMM). With AMM, Uniswap bridges the needs of traders with liquidity providers. The mechanism used by Uniswap is described in the illustration below.

Basically, anyone can become a liquidity provider by depositing a pair of tokens into the liquidity pool. Below is the example.

As shown in the illustration above in the liquidity provider section, if you want to be a liquidity provider at Uniswap, you have to deposit two types of tokens at once.

For example, you choose to deposit ETH and DAI. First, enter the amount of ETH you want to deposit. For instance, you want to deposit 1 ETH. Then Uniswap will calculate the amount of DAI that you also have to deposit, which is equal to the amount of 1 ETH, which is 1780 DAI (price as of July 2021).

The ETH and DAI that you deposited will be put into the DAI/ETH liquidity pool, which will be used if a user wants to exchange ETH with DAI or vice versa. You will get a DAI-ETH token which represents ownership of the assets in the pool. This token is used when you want to withdraw assets from the pool.

Uniswap uses the formula x*y = k to keep the liquidity constant. Thus, for every transaction made by users, Uniswap charges a fee that will be located in the liquidity reserve to keep the number of tokens contained in the liquidity pool stable, despite transactions or activities that reduce or adds tokens.

Then, how does the application work when someone wants to trade? Here’s an example.

You want to buy ETH using DAI. Using the above formula, the amount of ETH is x, while the amount of DAI is y, while k is the amount of x*y or the amount of ETH*DAI in the pool, which must always be constant. Now consider the trader’s section in the illustration above.

If you buy 1 ETH with DAI, the amount of ETH in the DAI/ETH liquidity pool will decrease by 1, and the amount of DAI will increase by 1780 DAI (price as of July 2021). To keep the amount of k or the liquidity in the DAI/ETH pool constant, Uniswap charges an additional fee for every purchase of ETH tokens with DAI. So, the larger the amount of ETH you want to buy, the higher the additional fees that must be paid in DAI.

By becoming a liquidity provider or depositing assets in Uniswap, you will receive incentives in the form of a share of the fees paid by traders when making transactions. The amount of incentive fee that you get is equivalent to the proportion of the number of tokens you keep in the liquidity pool. If you put assets totaling $100 in a liquidity pool containing $10,000 worth of assets, you will own 1% of the assets in that pool, and earn 1% of all fees traders pay when trading in that pool.

How to use Uniswap?

First, you need an Ethereum wallet and some ether (ETH). Once you have a wallet, you can directly link your wallet with Uniswap and use it to deposit liquidity or exchange tokens. You need to remember that every transaction on the Ethereum blockchain requires a fee called a gas fee to be paid to the miners for the transaction to take place. Therefore make sure you have enough ETH to run the transaction.

Uniswap Development

In May 2021, Uniswap launched Uniswap v3, an update of the previous version of Uniswap. With this update, Uniswap gives liquidity providers more power to determine the price range of the assets they deposit and provides fairer compensation according to the level of risk taken by liquidity providers. This means that with this update, liquidity providers can get more profit with fewer asset deposits.

Who is the founder of Uniswap?

Uniswap was founded by Hayden Adams in 2018. Adams completed his studies at Stony Brook University in the United States with a Bachelor of Mechanical Engineering in 2016. After graduating from college, Adams took a job as an engineer at Siemens before finally founding Uniswap in 2018.

How big is UNI’s market cap?

As of July 2021, UNI has the highest market cap of any DeFi tokens in the market, with a value of $8.6 billion. A total of 587,325,426 UNI tokens are circulating in the market in July 2021, with a maximum supply of 1,000,000,000 tokens. The price of one UNI token as of July 2021 is $14.5. To check the current UNI token price, you can click the following link.

How to get UNI tokens?

After reading the explanation above, if you are interested in investing in crypto assets such as UNI, you can you can download Pintu, a crypto exchange app that has been registered with BAPPEBTI. With Pintu, you can start to invest in crypto from as little as IDR 11,000 and invest equal sums of assets at regular intervals with Dollar Cost Averaging (DCA) feature. Simply download Pintu and click the “DCA” feature that you can find on the app’s home page.

Source:

“How to DeFi?”, CoinGecko (2020)