Every year, the crypto market goes through various trends. These trends are built on narratives involving a group of protocols, projects, or policies. As a result, cryptocurrencies that fall into these trend categories will experience drastic price increases in a short period of time. In one particular category, a price appreciation of more than 1,000% is typical. This category of assets is commonly referred to as meme coins. Meme coin assets are extremely volatile, even by crypto standards. In every stage of the market cycle, there is always a period where a number of meme coins suddenly trend and become the center of attention of many traders. This period is commonly referred to as meme coin season. So, what is meme coin season? How can you take advantage of it and avoid meme coin scam? We will discuss it here.

Article Summary

- 🤡 Meme coins are a category of crypto assets that use popular memes as imagery and are supported by an enthusiastic online community. With extremely high price volatility, meme coins are often the center of attention for crypto traders, usually in periods called “meme coin season”.

- 🌊 No one knows for sure why there is a meme coin season. However, some analysis indicates that meme coin season usually coincides with market top signals when the market turns bearish.

- 📱 Bubble Maps and Dextools are platforms for on-chain data analysis which is important to avoid rug pull and pump and dump risks on meme coins.

- 📈 Trading meme coins come with a high risk, with very high price volatility and the potential for large losses. However, some traders manage to capitalize on this opportunity with the right strategy.

- 🧠 The basic principles of buying meme coins are to understand the risks, buy in small amounts, and understand the cycles of meme coins. In addition, it is important not to be greedy and always take profits when conditions allow.

Meme Coin Season

First of all, what is a meme coin? Meme coin is the name given to a category of assets that use popular memes and are supported by an enthusiastic online following. This category of crypto assets is also a very risky investment with very high price volatility. In addition, meme coins also usually do not have any use and people buy them purely as speculative assets. Some of the most popular meme coins today are DOGE, SHIBA, and PEPE.

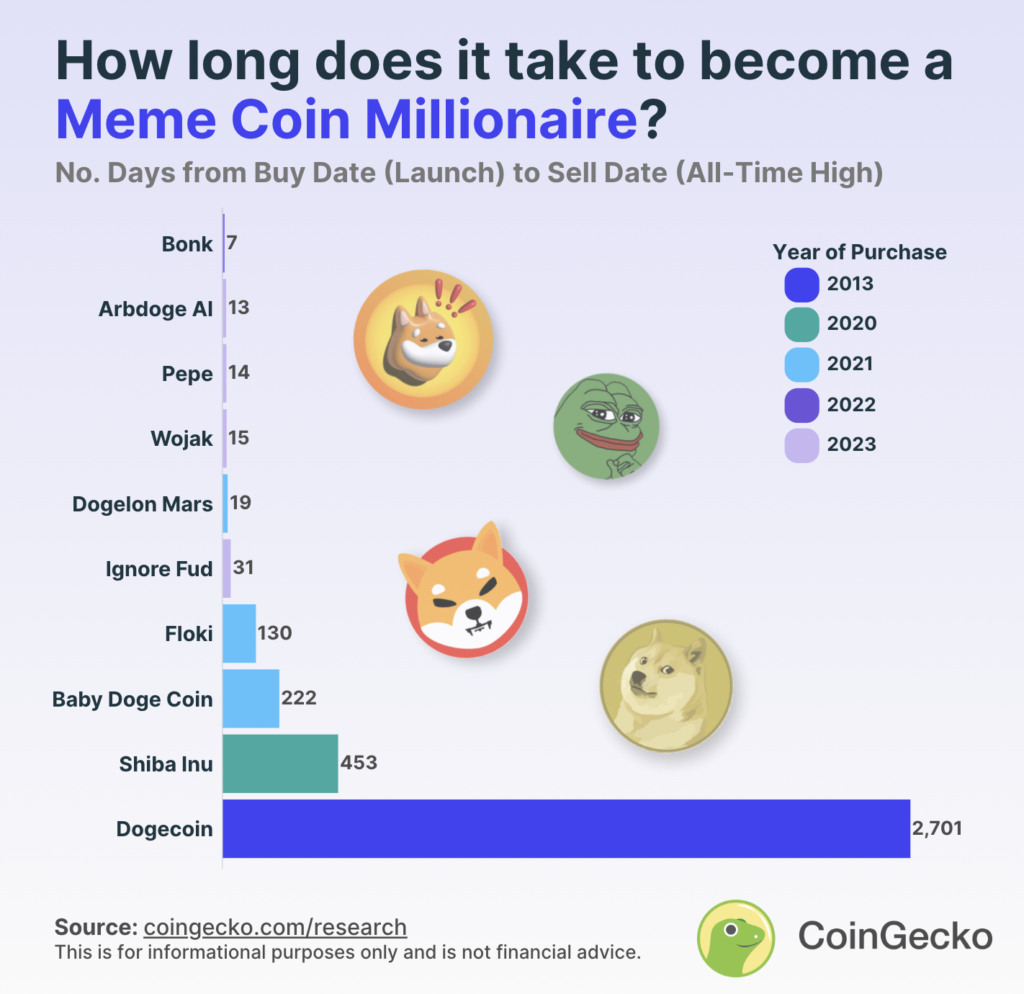

Even with the same high price volatility and risk of loss, many people buy meme coins because of their potential. As in the image above, meme coins can attract many buyers because of their potential to make meme coin millionaires. On Twitter, many people shared how some traders managed to earn millions of US dollars by buying meme coins before they became popular.

The crypto community's latest obsession is the PEPE meme coin. PEPE managed to rise more than 10.000% in the space of a few weeks.

Are these stories true? Accounts like @lookonchain use on-chain data to track it. A better question to ask is how many people have become millionaires and what percentage of the total buyers? The people who do this usually don’t just buy one meme coin and it’s basically like gambling or throwing darts blindfolded.

Why is there a Meme Coin Season?

So, why is there a meme coin season? What causes it? The truth is that no one knows why in every cycle there is always a new meme coin trend. In fact, this occurs so often that some traders use it as a signal. They see meme coin season as an indicator of the crypto cycle because there is a certain pattern.

Some analysis explains that the meme coin season usually coincides with a market top signal and then the market will turn bearish. In early May, the total trading volume of meme coin assets reached $2.3 billion in a week. This is the highest meme coin trading volume since May 2021. This meme coin season was led by the PEPE coin, featuring the popular meme character Pepe the Frog. PEPE’s rise triggered the rise of hundreds of other meme coin assets.

As in the chart above, in two situations where meme coin trading volume reached a high point, BTC experienced a decline. The meme coin season turned out to be a bearish sign for the crypto market. It was a top signal that occurred before a reversal to the downside for BTC. So, is this what will happen now? Or it’s different this time?

How to Avoid Meme Coin Scam and Rug Pull

1. Using Bubble Maps

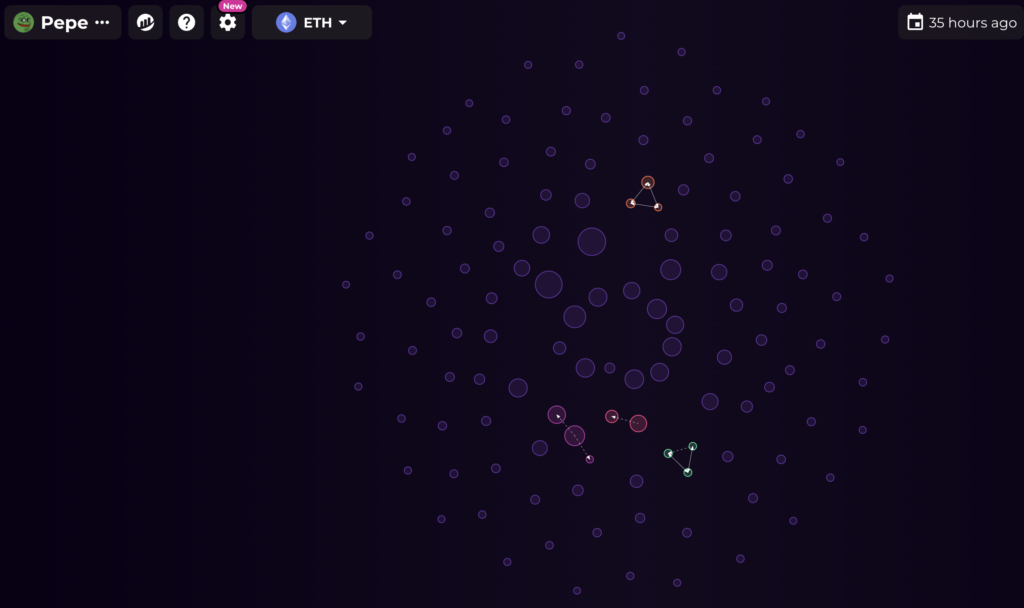

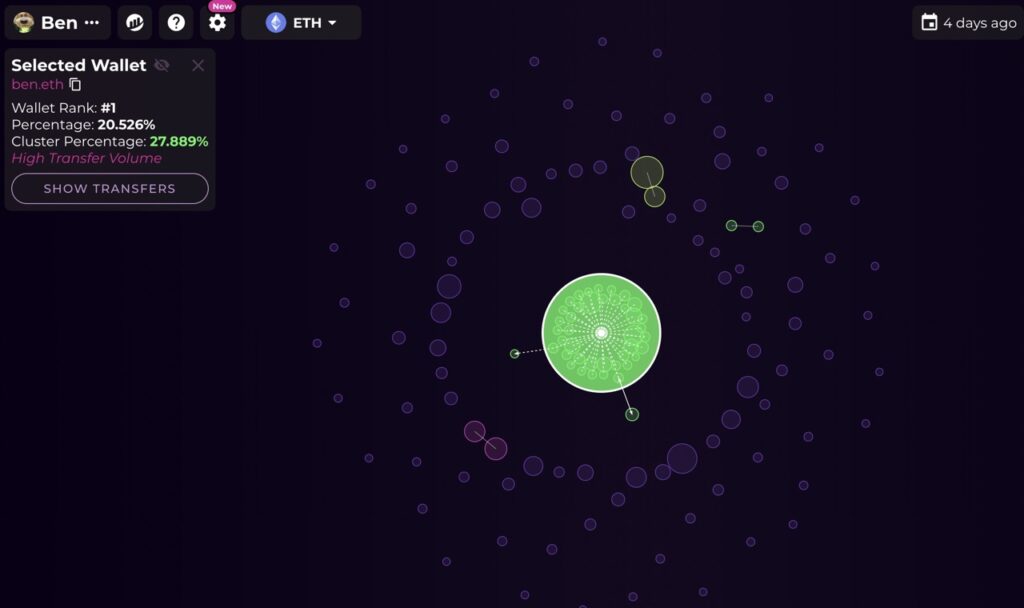

Bubble Maps is a platform that visualizes the on-chain data of a crypto asset. The platform is multi-chain, supporting crypto assets from the Ethereum, BSC, Fantom, Arbitrum, Chronos, Avalanche, and Polygon blockchains. You can see a list of active addresses that hold crypto assets on these blockchains (represented as a bubble). As in the PEPE Bubble Maps above, Bubble Maps also shows the transaction history between two addresses that hold large amounts of tokens. This is shown as a colored bubble with an arrow pointing to another bubble.

Basically, we want to avoid the coin rug pull meme where bubbles are concentrated in just a few addresses. In Bubble Maps for PEPE, we can see that the majority of the bubbles are separated, indicating different addresses. In contrast, the Bubble Maps for BEN below is an example of a meme coin with a high risk of rug pull and pump and dump. The green bubble in the center controls almost 28% of BEN’s total supply and could destroy the price in an instant.

Bubble Maps gives beginner crypto users the opportunity to easily view on-chain data. With this, you can find out the risk of a crypto asset without going through a complicated process.

2. Analyze On-Chain Data Through Dextools

One of the other essential things before trading meme coins is to look at each token’s on-chain data. Unlike Bubble Maps, we will look at other on-chain data such as the number of transactions, smart contract security, and trading volume. There are two platforms to do this, Dextools and Dexscreener. We will use Dextools as it has a simpler interface and more data.

For each trading pair, Dextools will display on-chain data on the left. In addition, Dextools has a scoring system for each asset. The score indicates basic security parameters such as smart contract verification, honey pot risk, and whether the token owner can drain the liquidity pool or not. If an asset’s score is low, you shouldn’t buy it. Dex tools can help you avoid assets that have the potential to rug pull and scam. It is also very easy to use.

Several tips before you buy Meme Coin

1. Understand the Risks

The image above represents 99% of the meme coins that exist in crypto. As you can see, the rise and fall of meme coin assets can be quite dramatic. Many successful traders who buy meme coins like PEPE or DOGE actually buy dozens of other meme coins before finding the one that pumps.

Trading meme coins is very similar to gambling because we cannot rely on fundamental values or technical analysis. Therefore, meme coins carry a very high risk. Two aspects that almost all successful meme coins have in common are a very loyal community of owners and the name of the coin being related to a popular meme.

2. Buy in Small Quantities

This is a standard principle in buying meme coins to mitigate the risk of your coin failing to increase. Many traders use this strategy when buying meme coins. Usually, they will spread $100 dollars to several assets that they think have potential. This strategy is done so that we don’t suddenly lose a large amount of money. Meme coin assets can experience a -50% drop in a day and rise 100% the next day. Trading in small amounts minimizes potential losses.

In addition, another important thing in meme coin trading is to take a profit. This really depends on your trust in the meme coin. The general principle is not to be greedy (very important in meme coin trading) and don’t forget to take your initial capital.

3. Understand the Meme Coin Cycle

Cryptocurrency cycles can happen in a short period of time. Bitcoin has a four-year cycle, the altcoin cycle happens in a few months, and meme coins can complete a full cycle in just a few days. As in the image above, the Twitter account @milesdeutscher shared what he thinks is a top signal for PEPE. For experienced traders, a sign that a meme coin is about to start going down can be seen when big influencers start buying.

If we talk about phases, meme coins only have two phases: early adopters and FOMO. In the early adopter’s phase, the people who buy are usually those who are experts in trading meme coins (or insiders in the case of a pump and dump meme coin). In the FOMO phase, the asset is already trending everywhere and this attracts many first-time buyers who get trapped as the price drops dramatically.

Conclusion

The crypto market goes through various trends that change every year, one of which is the “meme coin” trend. Meme coins are a category of crypto assets that usually use popular meme characters. Meme coins usually have high volatility and often have no function or use other than as speculative assets. Examples are DOGE, SHIBA, and PEPE.

Meme coin season refers to the period when meme coins become popular and traders start to pay attention. This often triggers drastic price increases and can lead to high profits, but also high risks. Interestingly, meme coin season can also be used as an indicator in the crypto market cycle as it usually coincides with a market top signal and the market will turn bearish.

Some ways to avoid losses in buying meme coins include using Bubble Maps to view the on-chain data of a crypto asset and analyzing on-chain data through platforms such as Dextools. Ultimately, trading meme coins is very risky and should be done carefully with sufficient understanding.

References

- Shiro, Selection of the Best Threads – Tokenomics, Indexes, Market Structure, EVM, RWA, On-Chain Analysis, Substack, accessed on 17 May 2023.

- The secret to meme coin trading – The DeFi Investor, Substack, accessed on 17 May 2023.

- Omkar Godbole, Meme Coin Trading Volume Surges to Two-Year High, a Sign of Caution for Bitcoin (BTC) Bulls, Coin Desk, accessed on 17 May 2023.

- Lim Yu Qian, Meme Coin Millionaire, CoinGecko, accessed on 17 May 2023.

- DeFI Saint, “$PEPE success has given rise to a new wave of other emerging”, Twitter, accessed on 19 May 2023.

- 2Lambroz.eth, “Please read this before trading meme coins like $PEPE Complete Guide to “safer” trade meme coins”, Twitter, accessed on 19 May 2023.

- Caff, “You don’t go from 4 figs to 7 figs consistently on memecoins without a plan. Remember that new wallet”, Twitter, accessed on 19 May 2023.

- Miles Deutscher, “$PEPE has changed many lives, after doing a 375,000x in just 21 days. But you can change yours too.”, Twitter, accessed on 19 May 2023.

- dealer.eth, “Don’t get REKT by the meme coin trend. Do you still have FOMO for $PEPE, $APED or $AIDOGE? In this thread”, Twitter, accessed on 19 May 2023.