Altcoin is the name given to a category of crypto assets other than Bitcoin, with Ethereum being the largest altcoin. Many traders and investors prefer to invest in altcoins because it is more profitable than BTC. However, out of thousands of altcoins, there are only a few that end up becoming successful projects. The list of altcoins that make it to the top 10 crypto projects list is always changing from cycle to cycle. As a result, many experienced traders create their own altcoin investment strategies to look for projects with high potential. One strategy is to choose new altcoin assets over old ones. This article will explain the altcoin investment strategy and the reasons behind it.

Article Summary

- ⚖️ Altcoin is a term for crypto assets other than Bitcoin. There are currently around 10,000 altcoins in the crypto industry. However, only a few altcoins eventually become successful projects and make it to the top 10 crypto list.

- 📈 Many experienced traders create their own altcoin investment strategies, one of which is to choose new altcoin assets over old ones. This is based on the cyclical pattern of bull-bear markets where every bull market inevitably has a basket of new best performers.

- ⚙️ New altcoins have a new base of token holders and do not have the “bagholder problem”, a condition where many owners of assets have unrealized losses and are waiting to sell them at a breakeven price point.

- 🌊 The crypto industry is a very dynamic industry with changing trends. New trends usually result in new protocols that become the main focus of the crypto community.

- 🧠 While some old altcoins have potential, data shows significant changes in the list of top crypto assets. Some older cryptocurrencies may not reach their highest prices again, so doing fundamental and technical analysis before investing is important.

Altcoin Investment Strategy

Altcoin is a name for all crypto assets that are not Bitcoin. There are more than 10,000 altcoins in the crypto world (according to CMC). The profitability of altcoins is much greater than Bitcoin with the risk of a deeper price correction. Therefore, Altcoins represent a linear proportional ratio of profit and risk. Experienced investors usually already have a list of altcoins with high potential for the next bull market.

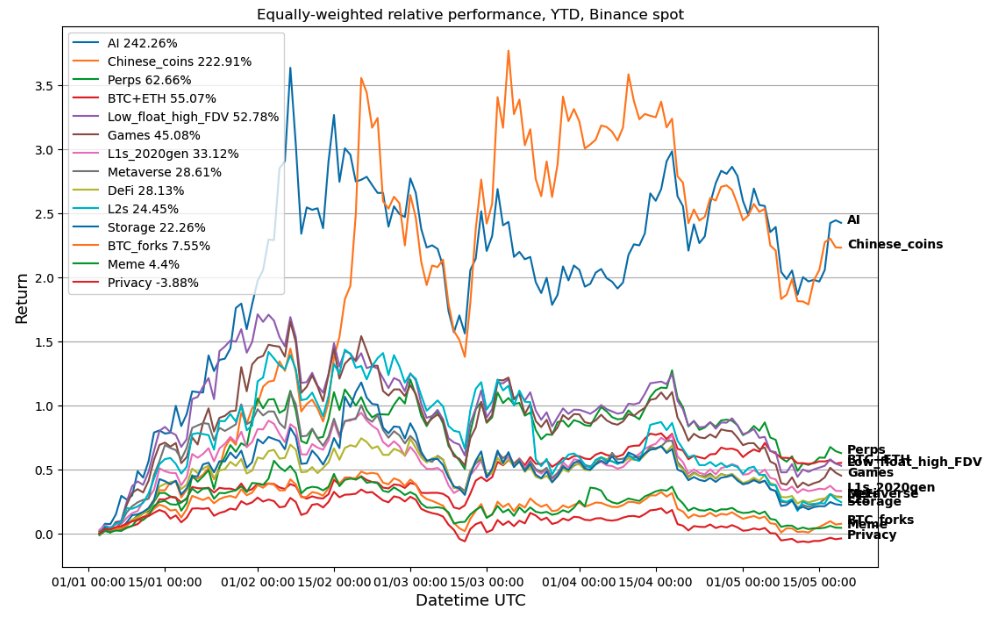

However, with so many altcoins to choose from, trends in this sector usually move quickly. For example, in early 2023 the popular altcoins were LSD sector assets like LIDO and FXS. Then, the trend suddenly shifted to AI (Artificial Intelligence) altcoins and then to altcoins from China and Hong Kong. In a few weeks’ time, altcoin trends can change.

Therefore, you need a strategy if you want to invest in altcoins. The simplest thing is to make a list of altcoins that you think have potential. Then, you can divide these altcoin assets into their respective sectors such as LSD, DeFi, DEX, or metaverse altcoins.

Read more about several strategies for investing in crypto at Pintu Academy.

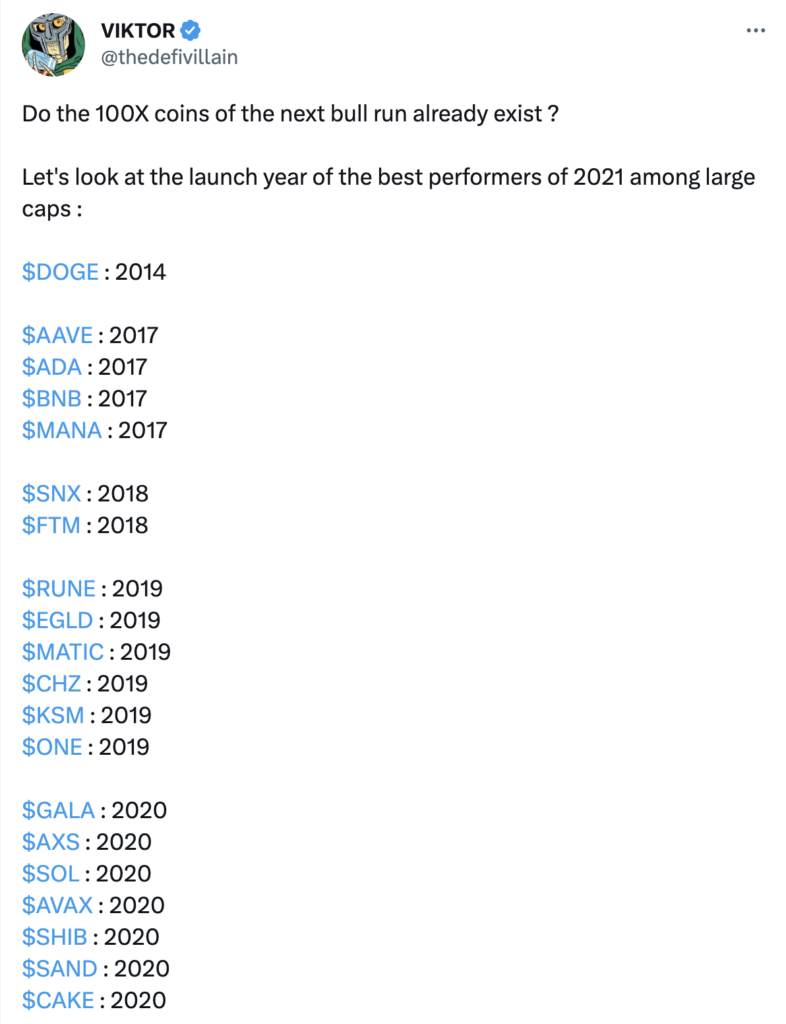

One strategy is to choose new altcoins and not invest in assets that were popular in the previous bull market. This strategy relies on the assumption that new altcoin assets are bound to get more attention. Also, the data shows that every bull market has a new set of best-performing altcoins. The bear market cycle teaches that some altcoins will never return to their highest prices again in the next bull market.

Altcoin Investment Risks

- 📉 Drastic price correction: The main risk of investing in altcoins is the drastic price correction compared to Bitcoin. In a bear market, most altcoins will experience a 50-99% price correction. You need to understand the phases and cycles of the crypto industry to avoid this.

- ⚖️ Too many choices: There are thousands of altcoins in the crypto world and most of these projects will not be used by many users. You should be able to pick a few worthwhile altcoin projects. Invest in assets that have real users and clear functionality.

- ⚠️ Fraud and Hacking: Another big risk of altcoin investing is hacking and fraud. Unlike the battle-tested Bitcoin, many altcoin projects have security that is vulnerable to hacking or negligence from the development team.

- 📱 Fast trend changes: The altcoin sector is very dynamic, with constantly changing trends. If you don’t keep up with the crypto market, you could end up buying altcoin assets that are stagnant in price as liquidity starts to move to the next trend. To make significant gains in altcoins, you need to keep up with evolving trends.

Why are we better off investing in new altcoins than old ones?

This investment strategy capitalizes on the pattern that occurs in every crypto industry’s bear-bull market cycle. The best-performing assets usually change with each bull market. In fact, some of these projects are usually newly created in bear markets. This altcoin investment strategy stems from several accounts on Twitter that argue that new altcoins usually perform better than old ones. Below are some explanations for why we should invest in new altcoins.

1. New User Base

New altcoin assets born in the 2022-2023 bear market will definitely have a new token owner base. Compare this to many older altcoin projects such as Solana, Fantom, and Avalanche whose owner base is bound to range from new to those who invested in the previous bull market (2020-2021).

This problem is commonly referred to as the bagholder problem. The bagholder problem is a problem created by many owners of assets that are losing money and waiting to sell at breakeven. This problem applies to crypto assets that have gone through a full cycle or more (2021 and previous years). This can happen because these owners bought the asset in the middle of a bull market when the price was very high.

In addition, the bagholder problem will also be visible on the price chart. Assets with bagholder problems will usually have a lot of resistance because there are many price points where the owner will sell to cover losses. The image above is a visualization of the resistance and support points of an asset. The big red dots represent the key sell price of many bagholders.

New altcoin projects do not have a bagholder problem because they were launched in the middle of a bear market. New assets also don’t have much resistance so in a bull market it is easier to enter the price discovery stage and the price can increase by more than hundreds of percent. These assets have a base of new token holders who (usually) want to wait to get a huge return on their investment.

2. New Cycle Means New Trend

The crypto industry is a very dynamic one. Protocol trends, new L1 projects, and trends related to the tech industry often come and go. As mentioned, trends in the altcoin sector move even faster. These recent trends also usually result in new protocols that then become the main focus of the crypto community. For example, “DeFi Summer” in 2020 was a DeFi trend where many new projects such as PancakeSwap, SushiSwap, and Yearn Finance took center stage.

The figure above shows that the top-performing assets change every cycle. There are only a few assets that manage to survive multiple cycles and reach new highs. Assets like Ethereum that manage to survive are the exception, not the rule.

Case study: If at the beginning of 2023, you bought L1 assets like SOL, FTM, and AVAX, your average profit would be around 100-300% on each asset. Meanwhile, if you buy new assets in the AI category and Hong Kong narratives such as AGIX and CFX, you will gain over 1000% from each. The beginning of 2023 is a perfect example of how new assets perform much better than old altcoin assets.

What About Old Altcoins?

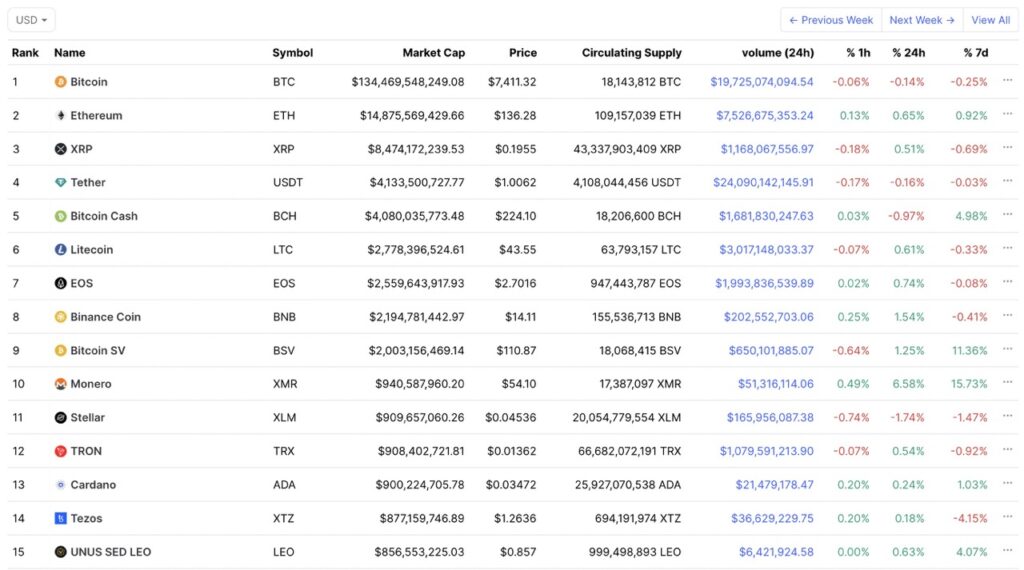

Data from CMC in early January 2020 above shows seven of the 15 assets above are no longer on the top 15 list. The other seven are still around the top 15 but not as high as when 2020 this picture was taken. It is difficult to choose the old altcoin assets that will return to their former positions in the next bull market. For example, EOS, XMR, and XLM have fallen far down on the crypto ranking. EOS is now ranked 43rd, almost on par with another new crypto project Stacks (STX).

One of the data you can look at to find older altcoins with potential is using trading pairs against ETH. This comparison is useful to see where the altcoin stands against ETH as the leader in the altcoin sector. Ideally, look for an asset whose chart is not falling against the ETH price. The SOL/ETH price chart below shows its position in a downward trend against the price of Ethereum. Although bearish, SOL/ETH is still holding support since the FTX low in late 2022.

Many old altcoin projects from the 2021 bull market will not survive to the next bull market phase. However, some assets that have active users and projects can survive just like Ethereum. Don’t forget to look at on-chain data and other network metrics so that you don’t invest in old altcoin assets that won’t reach the ATH (All-Time High) price again.

Also, don’t forget that not all new projects will also experience drastic price increases. Always look at which new protocols and projects are leaders in their sector and look at user data. Fundamental and technical analysis are the most important steps you should take before buying crypto assets.

Conclusion

Altcoin investing has risks such as drastic price corrections and too many altcoins to choose from. New altcoin assets usually have a new base of token holders and do not have a bagholder problem, which is a problem created by many owners of an asset who are losing money and waiting to sell at a breakeven price point. Choosing new altcoins is one of the many altcoin investment strategy.

In the context of cryptocurrency as an investment, the most important things are sometimes not the fundamentals such as technology or speed. As we saw in early 2023, all it takes is momentum and a relevant trend. Many new altcoins have a new base of asset owners and users who are not haunted by the bitterness of the bear market. Projects like these only need momentum and attention from the community to experience drastic price appreciation.

The best-performing assets usually change with each bull market cycle. However, some older altcoin assets still have potential, especially those with active users and projects. You have to do fundamental and technical analysis before buying old or new altcoin assets.

How to Buy Crypto at Pintu

You can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite crypto (like BTC).

- Click buy and fill in the amount you want.

- Now you are a crypto investor!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Crypto Narratives, Important lessons on narratives and trading in the two first months of 2023, Substack, accessed on 30 May 2023.

- @Thedefivillain, “Things you only see in a bull market: $TEL did an 11X in two weeks and went from $300M market cap to $3.3bn.”, Twitter, diakses pada 30 May 2023.

- @Thedefivillain, “This is a question I often ask myself these days. The risk that these L1s become the new $EOS (ie down only vs $ETH after their first bull run) is high. For me: $SOL, $FTM & $AVAX”, Twitter, accessed on 7 June 2023.

- Degentrading, On new shiny things, Substack, accessed on 7 June 2023.

- @Ibattlerhino, “Some of you are really committed to making the mistake of trying to run it back in old coins instead of embracing new coins and it honestly hurts to see”, Twitter, accessed on 8 June 2023.

- @0xMerp, “People wondering why old coins aren’t doing well just look at this chart, tell me which asset you would rather buy”, Twitter, accessed on 8 June 2023.