After the drama-filled bear market of 2022, the first quarter of 2023 breathed a wind of fresh air into the market. The cryptocurrency market finally saw a significant increase in the first quarter and this was reflected in the prices of major assets such as Bitcoin and Ethereum. Bitcoin and various other cryptocurrencies climb to pre-FTX crash. With such a significant price recovery, many argue that the worst of the bear market is behind us. Unfortunately, the global economy is still in bad shape. There are also several major bankruptcies in the US banking sector and fears of a recession. This Q1 2023 crypto market report will cover everything over the past three months and look at what will happen in the second quarter of 2023.

Article Summary

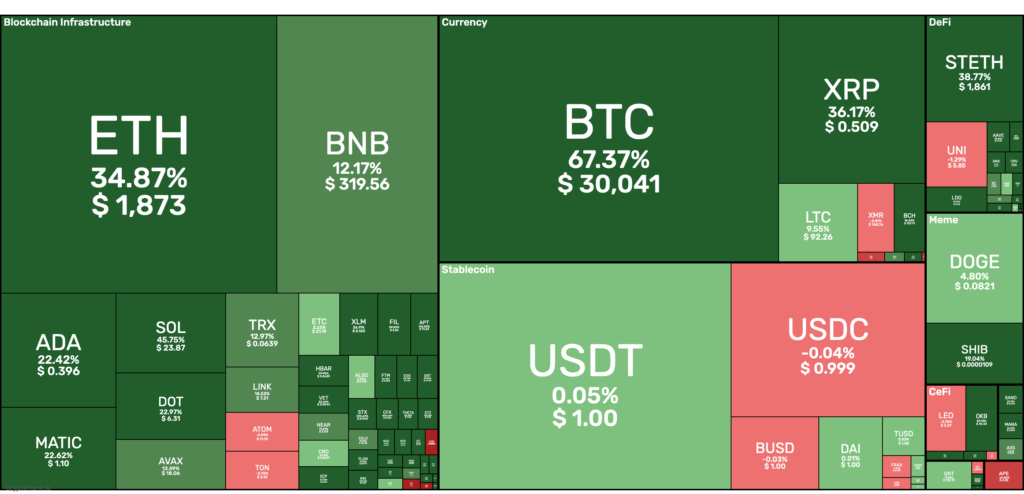

- 📈 The crypto market experience very positive price movements in the first quarter of 2023. Bitcoin rose more than 60%, ETH 34%, and the overall crypto market saw a dramatic rise.

- 📱 Some of the narratives in the altcoin sector in the first quarter were the AI crypto project narrative, the Hong Kong/China crypto asset narrative, NFTs in Bitcoin, and Ethereum’s layer 2. So, several altcoins rise by hundreds of percent within two months. Furthermore, some of these narratives are still strong even into the second quarter of 2023.

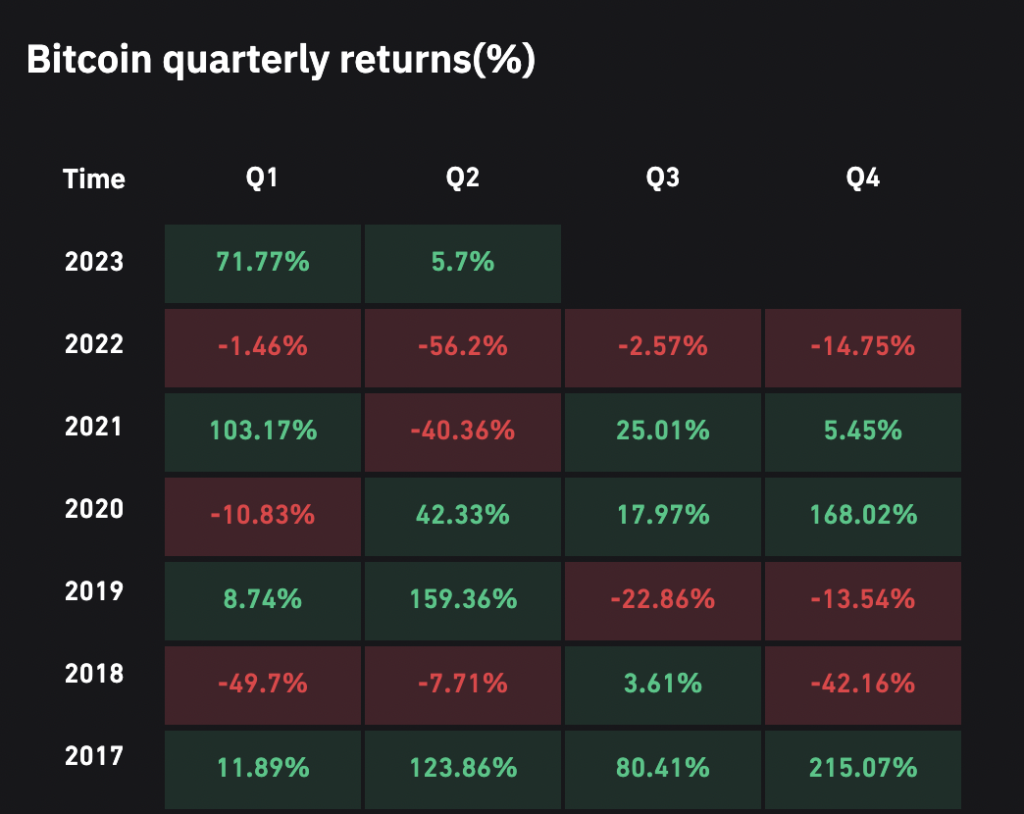

- ⚙️ Bitcoin touches $30,000 dollars at the end of the first quarter. It was also the first green quarter for Bitcoin since 2022, which was negative throughout the year. Q2 will be an important time to see which of BTC and ETH can sustain their current prices.

- 🧠 There are several catalysts in the second quarter of 2023. One of them is Shapella, which already happened on April 12, 2023, and was successful. This event turned out to be a bullish catalyst for ETH and pushed its price upward. In addition, the Fed’s policy at the May FOMC and US CPI data will provide a clearer picture of future market movements.

Cryptocurrency Market Performance in Q1 2023

The year 2023 opened with a wind of recovery for the crypto market. Bitcoin, Ethereum, and various altcoins opened the year in the green. After FTX, Terra, and other bad events, the crypto market moved quickly in early January, not giving much chance to many investors who were still bearish. For investors who were bullish, January was a golden opportunity as many cryptocurrencies saw dramatic gains. Bitcoin even closed January with a 39.63% gain, its biggest monthly gain since October 2021.

With Bitcoin being so bullish, various “narratives” emerge. These narratives are popular news or trends related to the fundamentals of a group of crypto projects. In the first quarter of 2023, some of the trends or narratives were about AI crypto projects, projects from Hong Kong and China, NFTs in Bitcoin, and also the LSD (Liquid Staking Derivatives) sector. These narratives caused the crypto assets that fall into their categories to experience significant price appreciation.

An example of one of the crypto projects in these narratives is Conflux (CFX). CFX saw a rise of over 1000% in the span of two months because it is the only legal crypto project in China.

Beyond the creation of these narratives, the crypto market also faced some significant negative events. Among these were the bankruptcies of several major US banks such as Silvergate and SVB which had implications for one of the largest stablecoins in the crypto industry, USDC. After the FTX incident, the US government (through the SEC) seemed to take an anti-crypto position and tried to prosecute several parties. This can be seen from the government shutting down some CEX staking services and suing BUSD.

In the next section, we will elaborate on some of the key events in the crypto industry during the first quarter of 2023.

What happened in Q1 2023?

1. Crypto AI Project Narrative

In November 2022, ChatGPT was officially launched for everyone to use. In a short period of time, the platform attracted the attention of millions of people and reignited the conversation about the role of AI (artificial intelligence). ChatGPT’s influence can be felt even in the crypto industry. Various parties want to find ways in which crypto can utilize AI technology. This ChatGPT trend sparked a narrative where many investors sought out AI-related crypto projects.

These crypto investors ended up choosing several crypto coins and tokens that use or support AI technology. Some of the “winning” crypto assets from this narrative are SingularityNet (AGIX), Fetch.AI (FET), iExec RLC (RLC), and Ocean Protocol (OCEAN). Among these, AGIX saw a rise of more than 1000%.

However, there are many who doubt the AI narrative. Many argue that this trend will die out on its own because AI and crypto are not compatible. AI is centralized in principle while crypto is the opposite. As in the price chart above, the majority of AI assets then experienced a sharp correction after the narrative was replaced with another one.

2. The Hong Kong and China narrative

The narrative about crypto projects from Hong Kong and China started with news spreading about how Hong Kong will legalize crypto trading on June 1, 2023. This then grew into conversations about the opening of the crypto industry in China. This narrative was also reinforced by various crypto projects from Hong Kong that began working with several large crypto projects such as Cardano.

Read more about the situation in Hong Kong’s crypto industry.

Like the story in the AI narrative, many crypto investors and traders began looking for projects from China/Hong Kong or had strong ties to the region. This is also reinforced by the opinions of some figures such as Cameron Winklevoss who thinks that the next bull market will start in Asia. The Hong Kong government’s stance on opening up to the crypto industry is the foundation for this narrative to take off.

Alchemy Pay (ACH), Conflux (CFX), and Filecoin (FIL) are some of the crypto projects being targeted by investors looking to get in on the China narrative hype. These three projects have strong ties to Hong Kong and China. Alchemy Pay is a crypto payment project already operating in Hong Kong while Conflux is the only official crypto project based in China.

Unlike the AI narrative, the China narrative is still holding strong as of early April (for some assets). This narrative is likely to continue until the June 1 implementation of Hong Kong’s crypto policy.

3. US Government Crackdown on Crypto Industry

Since the FTX incident, the rhetoric of some US officials towards crypto has turned more extreme. The SEC (Securities and Exchange Commission) is particularly insistent on categorizing some cryptocurrencies as securities so that it can declare them illegal and ban them from being traded in the US.

Furthermore, the SEC began its assault in early 2023 with a series of enforcement actions against regulated US crypto entities including Kraken and Coinbase, while the Commodity Futures Trading Commission (CFTC) sued Binance over BUSD. Kraken and Coinbase were forced to shut down the staking services they offered while Binance spoke out that it would not only focus on BUSD (by necessity).

Many in the crypto community think that the US government’s efforts are part of a strategy to crush legal crypto players. Some call it “Operation Choke Point 2.0” meaning that the US government wants to “choke” the crypto industry through the Bank sector which will complicate the off-ramp and on-ramp system.

With the presidential election in 2024, the US will be the battleground of pro and anti-crypto politicians. Some crypto businesses in the US are already planning to support pro-crypto politicians and lobby within the US legislative body. This will be decisive as the US is home to dozens of large crypto companies with millions of users.

4. Ordinals NFT on Bitcoin

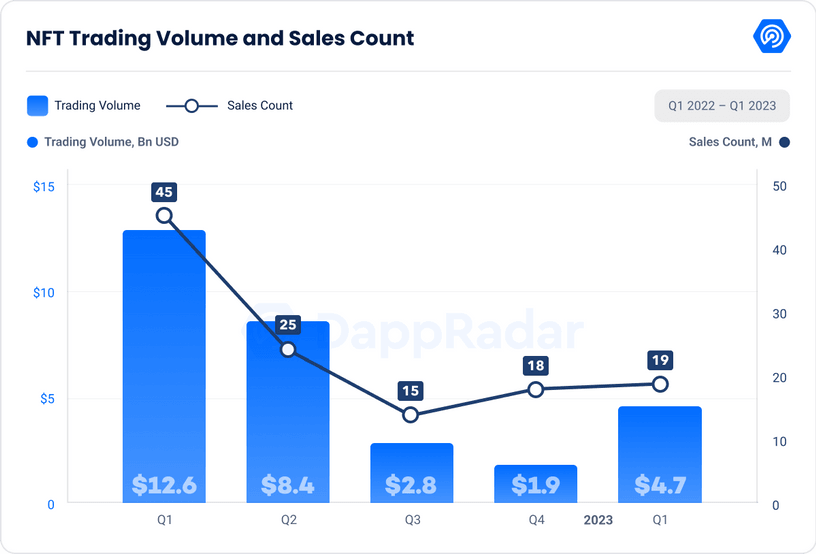

In early 2023, the NFT industry finally come to life due to the hype of the newest NFT marketplace, Blur. Blur was the newest player in the NFT digital market landscape and it had an interface catered to experienced players in the NFT world. As a result, Blur managed to attract thousands of users to its platform and even briefly overtook OpenSea’s dominance. The transaction volume on Blur exceeded that of OpenSea from late December 2022 until now. In addition, there is a new trend in NFT, namely NFTs in Bitcoin.

The Dappradar data above shows that the NFT market saw a 137% increase in trading volume in the first quarter of this year, with a value reaching $4.7 billion US dollars. The first quarter of 2023 also saw a total of 19.4 million NFT sales, an 8.56% increase from the last quarter of 2022. Quoting Dappradar, this increase was partly due to the token farming period by Blur in February 2023. Blur rewards traders who trade NFTs on its platform with tokens.

Ordinals is a platform that enables the identification and creation of NFTs in Bitcoin. This innovation instantly creates a trend where many NFT creators rushed to find ways to create their own collections. Some Ordinals NFT collections even have prices of over 1 BTC.

What is Ordinals and how does it work? Read here to learn more.

The popularity of Ordinals has also boosted the price of some of Bitcoin’s layer 2 crypto assets such as Stacks (STX). STX experienced a price increase of more than 400% due to this Ordinals trend. Furthermore, STX did not experience too sharp a price correction and managed to maintain momentum.

If infrastructures like Ordinals and Stacks can maintain their momentum towards BTC halving, this trend is not impossible to continue. The best-case scenario is that infrastructure like Stacks could give birth to a vibrant DeFi ecosystem on the BTC network.

5. Layer 2 Ethereum Surges

Since the end of 2022, many have predicted that 2023 will be the year for Ethereum layer 2 technology. Optimism and Arbitrum are two layer-2 projects that have attracted the attention of many investors on the Ethereum network. Both projects even have TVLs that already rival Polygon, an Ethereum layer 2 that has been around since 2017. Arbitrum has a TVL of $2.3 billion dollars and Optimism $966 million dollars (April 18, 2023). In addition, Optimism already airdropped OP tokens in late 2022 while ARB just did so on March 23, 2023.

According to data from Web3 Development Report (Q1 2023) released by Alchemy as seen above, the number of users "bridging" tokens to Layer 2 in Q1 2023 increased by 44% over the previous quarter, and by 518% over the same period last year. This shows that users like the convenience and lower fees offered by Layer 2, and this could be a driver for both individual and institutional crypto adoption.

ARB’s token airdrop was a catalyst for the layer 2 sectors to regain attention from investors. Shortly after Arbitrum’s announcement, zkSync, a zero-knowledge project, also announced plans to launch a mainnet. The zkSync announcement also coincided with other ZK projects such as Polygon and ConsenSys. These ZK projects will make Ethereum’s layer 2 sectors very competitive.

Want to know more about Arbitrum? Read here to learn about its potential and the ecosystem.

Currently, there are two competing scalability technologies on Ethereum: optimistic rollup and ZK-rollup. Optimism and Arbitrum have the advantage that many DApps projects can directly migrate to the network. Meanwhile, the ZK project promises performance and transaction fees that are much cheaper than all existing scalability solutions. 2023 will be a good time to see which of these two technologies successfully takes the lion’s share of the Ethereum community.

6. LSD and Ethereum Shapella

Ethereum Shapella was originally scheduled for March 2023 but was pushed back to April 12. Interestingly, conversations about Shapella (originally just called Shanghai) actually started in early 2023. The talk of Shapella naturally involves decentralized staking platforms that also act as liquid staking derivatives such as Lido Finance. Lido alone dominates the staking TVL DeFi leaderboard, with $12.4 billion dollars in total locked funds (April 17, 2023).

Lido Finance and other liquid staking platforms are expected to be the biggest winners from the Shapella upgrade. This is because Shapella makes ETH staking more attractive to many investors and LSD platforms like Lido provide additional benefits. This has caused the crypto assets of various ETH liquid staking platforms to increase in price since early January 2023. LDO (Lido Finance), FXS (Frax Finance), and RPL (Rocket Pool) have increased by more than 200% since the beginning of January.

Read more: What is Ethereum Shapella?

One of the other exciting things is the birth of the LSDfi or LSD finance sector which builds financial activities from liquid staking assets such as stETH and frxETH. If the LSD sector manages to absorb the majority of ETH from staking, LSDfi protocols could stand to gain from the expansion.

What’s in store for Q2 2023?

After four consecutive red quarters in 2022, Q1 2023 provided recovery time for the crypto market. The first quarter closed very positively for BTC and the crypto market as a whole. Many investors will be hoping that Q2 at least provides some stability where BTC doesn’t experience too sharp of a correction.

The first quarter also provided hope for BTC’s strength. Despite a lot of negative news about the crypto industry such as Binance being sued, Bitcoin could still maintain its positive momentum. This is the opposite of 2022 where the slightest bad news will bring down the price of BTC.

BTC vs. ETH

The Bitcoin dominance chart above also provides important information about the crypto market. In early April, Bitcoin took over the market and soaked up liquidity, as evidenced by BTC’s (BTCD) dominance rate of 48.92%. This is the highest figure since August 2021. This signaled the onset of Bitcoin season. In this scenario, altcoins like ETH would normally stagnate or even decline.

However, Bitcoin’s dominance rate reversed to coincide with Ethereum Shapella. It has now dropped back to 46.5% after ETH’s post-Shapella strength. If the dominance continues to decline but the BTC price stabilizes, ETH and other altcoins could rally. Some in the crypto community have even called for an altseason. However, it might be too early given the fairly stagnant stablecoin supply numbers (indicating no new money coming in).

A high BTCD number usually signals a bitcoin season where Bitcoin absorbs liquidity from the market. Meanwhile, if BTCD continues to fall while BTC price only experiences a minor correction, it usually signals altseason. This is a pattern that has been happening in the crypto market for the past few years.

The dynamic between BTC, BTCD, and ETH is being discussed a lot as investors want to see whether it is safe to invest in altcoins or not. The second quarter will provide a clearer picture of Bitcoin’s dominance and ETH’s position.

Ethereum Shapella

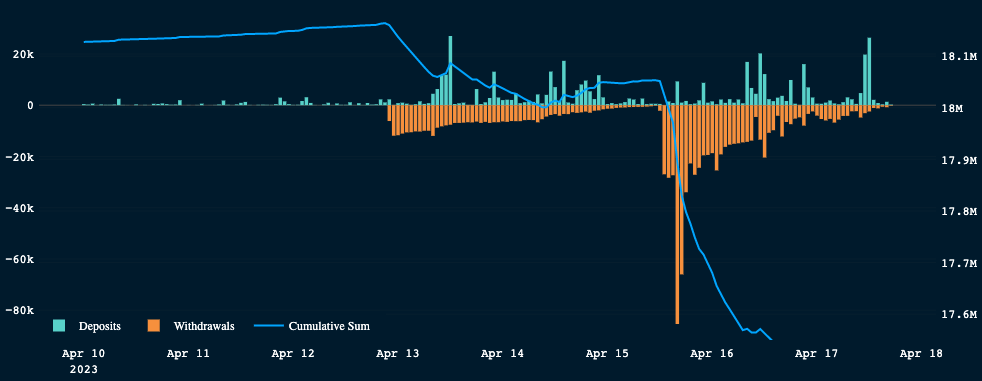

ETH deposit vs. withdrawal. Source: Nansen.

Shapella was successfully implemented on April 14, 2023, and ETH survived potential selling pressure from validators withdrawing staking assets. The data above shows that the biggest selling pressure came on April 15. However, ETH managed to break through the strong resistance at $2,000 dollars and stayed in that range until today (April 17, 2023). While ETH was able to hold on, the number of ETH deposits has increased since April 17.

Furthermore, TVL figures on liquid staking platforms such as Rocket Pool and Frax Finance continue to climb. Rocket Pool saw a 30% increase in the last 30 days while Frax’s frxETH saw a 20% increase in TVL. Meanwhile, Lido Finance saw a 12% increase in TVL in the past week.

These data show a trend where LSD platforms are increasingly dominating the ETH staking system. This is not surprising, especially considering that LSD platforms typically offer much higher staking rates than CEX and have no centralization risk.

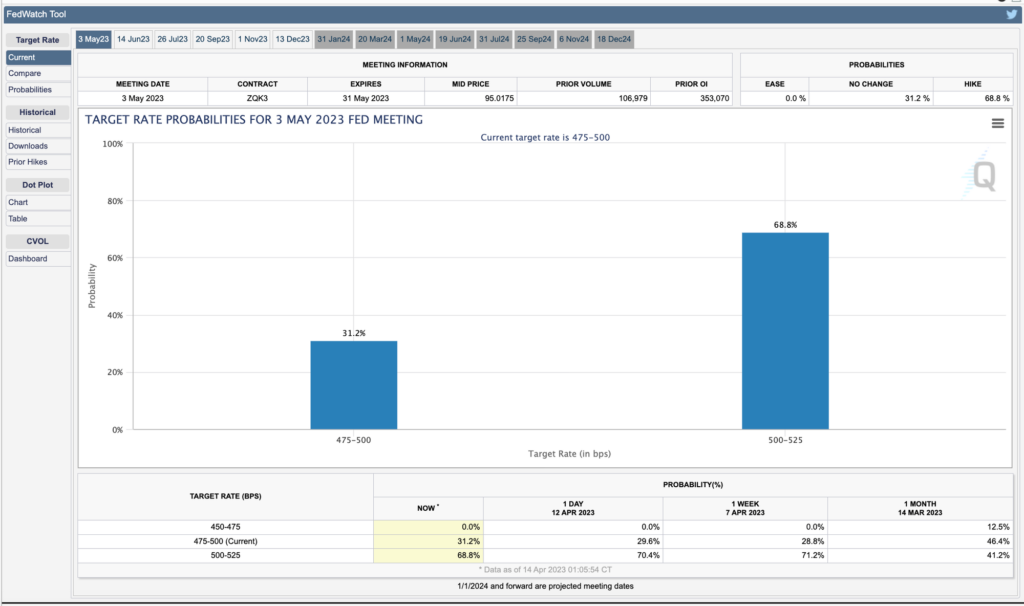

Upcoming Fed Policy

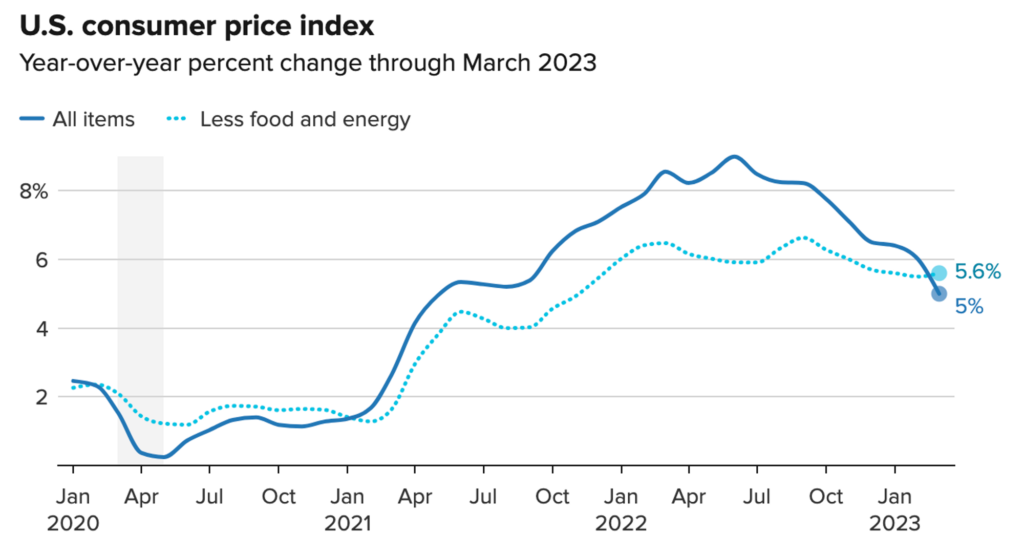

One of the questions for the second quarter of 2023 is about the Fed’s next policy. CPI figures in January, February, and March show a slowdown in inflation. In addition, the year-over-year increase in CPI is currently the smallest since June 2021. This data is a clue to what the Fed will do at the next FOMC in May 2023.

As shown in the figure above, 68.8% agreed that the Fed will increase interest rates by 25 bps or 0.25% at the May meeting. This is a relatively low number which suggests that market participants are not too sure about the Fed’s next move. However, the Fed is expected to continue raising interest rates despite concerns about a possible recession. The Fed needs to get strong signals that inflation has been successfully tamed before it starts to pause rate hikes.

Conclusion

The crypto market experience a lot of positive growth in the first quarter of 2023. Investor buying sentiment also returned after seeing Bitcoin manage to maintain its positive price movement. Although still overshadowed by various negative sentiments from the world economy, various altcoins can still experience price increases of up to hundreds of percent. Bitcoin’s price stability creates various narratives that become golden opportunities for investors who can recognize and look for crypto projects with great potential.

The second quarter of 2023 will be an important moment to see if the crypto market can maintain momentum from the first quarter. Furthermore, the Fed’s May policy and the latest CPI data could have a significant influence on the crypto market. We also need to look at the price movement of BTC vs ETH and the BTC dominance chart which can tell us the trend of the asset in the near future.

How to Buy Cryptocurrency at Pintu

Are you interested in investing in crypto assets? Take it easy, you can buy various crypto assets such as BTC, ETH, SOL, and others safely and efficiently. Furthermore, Pintu has subjected all its crypto assets to a thorough evaluation process, emphasizing the importance of prudence.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to executing transactions, in the Pintu Apps, you can also learn crypto through various Pintu Academy articles updated weekly! All Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Crypto Market Recap Q1, 2023, CryptoRank, accessed on 13 April 2023.

- Lucas, Automuro, Q1 2023 On-Chain. Diving into crypto’s strong quarter and…, Medium, accessed on 13 April 2023.

- CMC Research, Crypto Market Frontier According to CMC Q1 2023, CoinMarketCap, accessed on 13 April 2023.

- Shaurya Malwa, Here’s Why Artificial Intelligence Focused Cryptocurrencies Are Vastly Outperforming Bitcoin, Coindesk, accessed on 14 April 2023.

- Ivan Cryptoslav, Explaining The Crypto China Narrative | CoinMarketCap, accessed on 17 April 2023.

- Darren Matsuoka, Eddy Lazzarin, 2023 State of Crypto Report: Introducing the State of Crypto Index, A16Z, accessed on 17 April 2023.

- Kevin Reynolds, U.S. Crypto Crackdown Sure Looks Like an Attempt to Kill a Promising Industry, Coindesk, accessed on 17 April 2023.

- Tom Blackstone, Ethereum layer 2 bridging up sixfold year-on-year in Q1 — Alchemy, Coin Telegraph, accessed on 17 April 2023.

- Web3 Development Report (Q1 2023), Alchemy, accessed on 18 April 2023.