Bitcoin is the most popular cryptocurrency around, and it’s so dominant that people use an index called “BTC Dominance” to measure how much it’s taking over the crypto market compared to other coins. Understanding BTC dominance can help investors make better choices about their cryptocurrency investments. In this article, we will explore what BTC dominance is, how it is calculated, and how it can help investors make better investment decisions.

Article Summary

- 🪙 BTC dominance is the ratio between Bitcoin’s market capitalization and the crypto market capitalization. It is an indicator that can be used to measure Bitcoin’s dominance in the crypto market against other crypto assets.

- 🌟 BTC dominance can be used to determine whether an altcoin season will occur and where the price trend of BTC or altcoins is headed.

- ❓ Some criticisms that question the reliability of BTC dominance are that it does not consider the growth of stablecoins or count scam projects and Bitcoins that have been lost.

What is BTC Dominance?

BTC dominance is the ratio between Bitcoin’s market capitalization and the crypto market capitalization. Meanwhile, crypto market capitalization is the total of all tokens in the crypto market. BTC dominance is an indicator used to measure Bitcoin’s dominance in the crypto market against altcoins.

Why is it important to know BTC dominance? Bitcoin is often considered the “king” of the crypto market. Its dominance has been an important factor in shaping the crypto industry. This indicator is often used to track how Bitcoin affects the crypto market as a whole. The higher the BTC dominance, the more influence Bitcoin has on the crypto market. If the BTC dominance value is low, more alternative coins can compete with Bitcoin in the crypto market.

In the following article, you can learn more about altcoins, an alternative investment to Bitcoin.

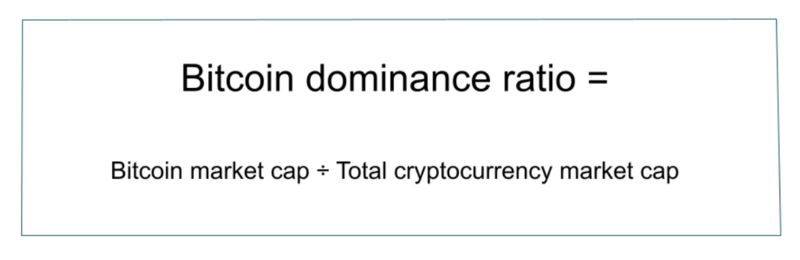

How to Calculate BTC Dominance?

BTC dominance is calculated by dividing the Bitcoin market capitalization by the total crypto market capitalization. Market capitalization refers to the entire value of a cryptocurrency. It is determined by multiplying the total number of tokens in circulation by the current market price. In simple terms, BTC dominance is a measure of Bitcoin’s market share compared to all other crypto assets combined.

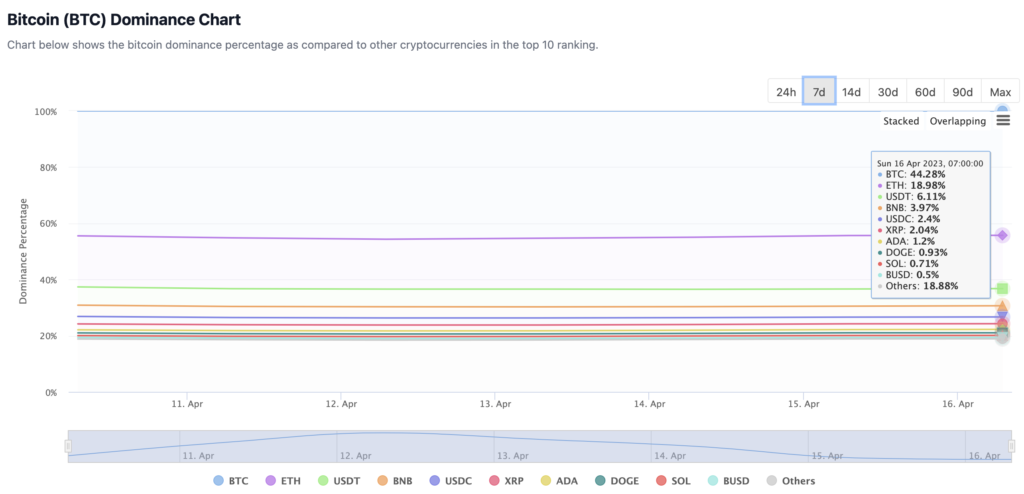

For example, at the time of writing on 13 April 2023, Bitcoin’s market capitalization was US$584.46 billion. Then, the crypto market capitalization is US$ 1.25 trillion. If US$584.46 billion is divided by US$1.25 trillion, the result is 46.76%. Thus, BTC dominance is currently at 46.76% compared to the overall crypto market capitalization. The figure is the highest since May 2021 and has increased from the 38% level in early January.

Why BTC Dominance Could Change?

Initially, Bitcoin’s dominance over altcoins could be very high. Before 2017, the figure could reach 80%, even more than 90%. However, slowly, BTC dominance is fading. This is inseparable from the growing popularity of altcoins. It all started with the massive initial coin investment (ICO) moment that occurred in 2017. At that time, investors began to look at Ethereum and other altcoins, making BTC dominance decline.

The graph above shows that when the ICO run went crazy in 2017, altcoin investment gained traction, and BTC dominance fell to a low of 35%. However, in the bearish period of 2018, BTC dominance slowly began to rise again to touch the 70% level. This is also inseparable from the many altcoins that went bust and vanished into thin air. In early 2021, BTC dominance started to decline again as altcoin investment rallied following the negativity of Bitcoin’s energy use and China’s crypto mining ban.

In addition, the growing demand for stablecoins also contributed to the decline in BTC dominance. Many investors choose stablecoins such as USDT and USDC because of their stability. When the market is bearish, investors tend to convert their Bitcoin or altcoins to stablecoins to protect their portfolios. Stablecoins also offer an on-ramp from fiat money to crypto exchanges, which makes them even more preferred by investors. With more funds flowing into stablecoins, the crypto market capitalization will eventually increase while reducing BTC dominance.

Find out more about stablecoins and their role in the crypto market in the following article.

How to Use The Bitcoin Dominance

As an indicator, here are some uses of BTC dominance for investors:

Spotting Altcoin Season

BTC dominance has a close relationship with altcoins. They are like two sides of a coin. If BTC dominance is high, investors prefer Bitcoin and leave altcoins.

However, sometimes there are periods where altcoins become the primadonna and make them dominate the crypto market. It’s also known as altseasons. This condition is an opportunity for investors to explore investment opportunities from altcoins.

When altseasons occur, investors tend to move their portfolios from BTC to altcoins. Under these conditions, in terms of performance, altcoins also far outperform Bitcoin’s performance. For those of you who want to take advantage of the altseasons momentum, the sign of the altseason is when the BTC dominance index is strengthening, but the Bitcoin price trend is falling.

Determining the Price Trend

Investors can also use BTC dominance to help make investment decisions. This is because BTC dominance can provide signals to sell or buy. You just need to understand the trend comparison between the BTC dominance index and the Bitcoin price trend. Here is the cheat sheet:

| BTC Dominance Index | Bitcoin Trend Price | Signal |

|---|---|---|

| 📈 Uptrend | 📈 Uptrend | Most likely that BTC is performing better than altcoins. Positive sentiment is inclined towards Bitcoin. Signal to buy BTC. |

| 📈 Uptrend | 📉 Downtrend | Most likely that altcoins are performing better than BTC. However, there is a bearish trend ahead. Signal to sell altcoins. |

| 📉 Downtrend | 📈 Uptrend | Most likely that altcoins are performing better than BTC in the bullish market. Signal to buy altcoins. |

| 📉 Downtrend | 📉 Downtrend | Most likely that BTC and altcoins are both performing poorly. A signal to cash out. For more risk-averse investors, it could be a signal to buy the dip BTC when the price is bottoming. |

How Reliable is BTC Dominance?

BTC dominance has become a commonly used analytical tool when investing in crypto. However, this indicator has been criticized for its reliability. The following are some of the factors that may affect the value of the Bitcoin dominance index:

- It doesn’t consider the growth of stablecoins. Sometimes BTC dominance shrinks when investors move their funds significantly to stablecoins in a big way. While stablecoins fall into the altcoins category, their token value is not expected to change. To see Bitcoin’s relationship with speculative altcoins, it’s best to calculate BTC dominance without including stablecoins.

- It can’t count the projects that are scams. Every time a new token is listed in the crypto market, it affects the total market capitalization. In fact, some new tokens are created only for scams, rug pulls, or pump&dump. However, their presence still counts and can affect the BTC dominance percentage.

- It doesn’t count Bitcoin that has been lost. It is currently unknown exactly how much Bitcoin is stuck in wallet addresses that cannot be withdrawn. However, many estimates that at least 20% of the BTC supply has been “lost” and cannot be recovered.

Look at the six best crypto analysis tools that can enhance your research skills and assist you in determining your investment strategy.

Conclusion

BTC dominance in the cryptocurrency market could decrease as other coins gain popularity. Some critics argue that the large size of the altcoin market makes using BTC dominance data irrelevant. Nevertheless, Bitcoin’s position as the leading cryptocurrency means it will continue to shape the industry. Therefore, BTC dominance will remain a relevant metric for market participants.

As a tool, BTC dominance can make it easier for investors to read trends in the market. As a result, BTC dominance can help determine investment strategies. Just keep in mind that this indicator cannot guarantee future movements. Therefore, it would be much better if investors combined it with other indicators.

Buy Crypto Asset at Pintu

Interested in investing in crypto assets? Take it easy, you can buy various crypto assets such as BTC, ETH, SOL, and others safely and easily. Furthermore, Pintu has subjected all its crypto assets to a thorough evaluation process, emphasizing the importance of prudence.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to executing transactions, in the Pintu Apps, you can also learn more about crypto through various Pintu Academy articles updated weekly! All Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

Adam Morgan, Bitcoin Dominance Jumps to Its Highest Point in Almost Two Years. The Block, accessed on 13 April 2023.

Josiah Makori, What Is BTC Dominance and Is It Declining? Coin Gecko, accessed on 13 April 2023.

Temitope Olatunji, What Is BTC Dominance? How To Use it in Your Crypto Trades, Make Use Of, accessed on 13 April 2023.

World Coin, BTC Dominance: Why It Matters, accessed on 13 April 2023.