MakerDAO is one of the most significant projects in the DeFi (Decentralized Finance) ecosystem. As of May 2023, the MakerDAO protocol’s total value is nearly 7 billion US dollars! It makes Maker the second largest dApps after LIDO by TVL. Within the protocol, the MKR token serves as both a utility and governance token. This article will discuss Maker (MKR) tokenomics and its potential as an investment asset.

Article Summary

- Maker is one of the first DeFi projects to offer crypto asset lending and runs on the Ethereum network.

- MKR is a governance and utility token on the Maker Protocol. MKR functions as a reward in the protocol, risk controller, protocol stability, and others.

- The Endgame Plan is a proposal that aims to improve Maker’s governance and tokenomics, and is also a major update to the Maker ecosystem. The Plan aims to increase efficiency, resilience, and participation in the Maker ecosystem.

- The Endgame project focuses on upgrading the DAI and MKR tokens with new tokens, providing AI project funding, and implementing a “NewChain” hard fork.

Overview of Maker

Maker is one of the first DeFi projects to offer crypto asset lending and runs on the Ethereum network. The platform offers loans in the form of DAI stablecoins with excess crypto assets collateralized and locked in smart contracts. Maker uses two token models, namely DAI and MKR stablecoins.

MakerDAO governs all Maker activities and developments. MKR holders are essential in ensuring the platform’s stability, transparency, and efficiency.

You can read more about Maker and how it works in this article.

Maker (MKR) Tokenomics

MKR is the governance and utility token of the Maker Protocol. MKR also has essential roles in Maker. Here are the Maker tokenomics as follows:

- Governance Token: MKR is the governance token of Maker. MKR holders can participate in the decision-making process. Voting power is proportional to the amount of MKR held, allowing token holders to influence the direction and decisions of the protocol.

- Risk Management: MKR tokens are essential in managing the Maker’s risk. If the value of the DAI collateral falls below a certain threshold, MKR tokens are auctioned off to restore the system and cover losses. This mechanism helps maintain stability and protect against bankruptcy.

- Stability Fees: MKR is used to pay stability fees within Maker. Stability fees are paid by users who generate DAI stablecoins and are paid in MKR. This fee serves as an incentive for MKR holders to maintain the stability of the system.

- Token Burning: MKR tokens can be burned to reduce the total supply. Burning occurs when MKR is used to pay stability fees or bought back from the market during collateral auctions. The burning process helps to maintain scarcity and potentially increases the MKR price over time.

- Governance Rewards: Active MKR holders participating in voting and decision-making processes may receive governance rewards through MKR.

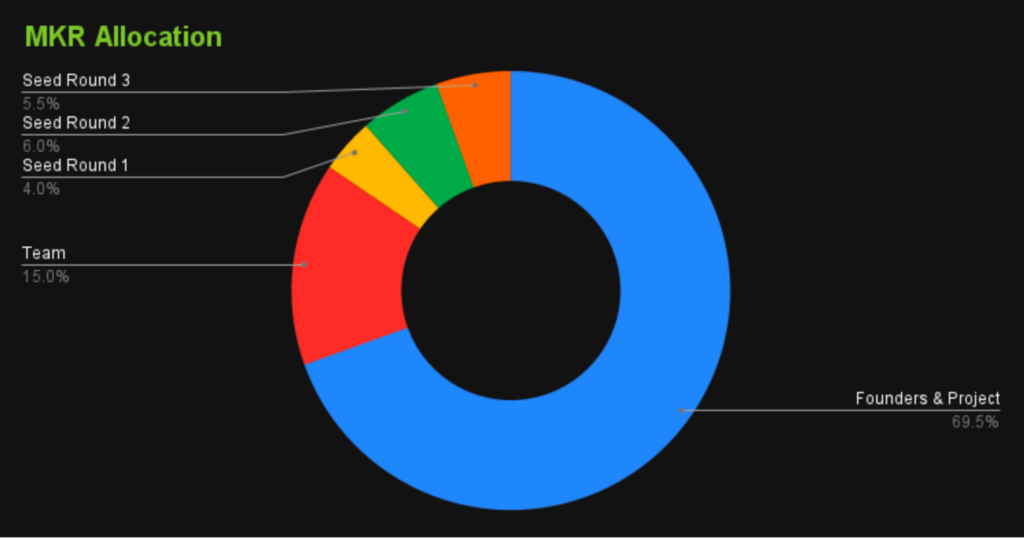

Data from Coingecko, Maker has a total supply of 1,005,577 MKR. Founders and Maker projects hold approximately 70% of the MKR tokens, while the team is allocated 15% of the MKR tokens. The allocation may change at any time according to the agreement of MakerDAO members.

MKR as an Investment

As of May 18, 2023, MKR price was at 635 US dollars with a total trading volume of over 13 million US dollars in 24 hours. Maker holds the 66th rank in terms of market capitalization, totaling 611,278,139 US dollars.

Maker has shown consistency in growth and has become one of the most prominent DeFi protocols regarding total value locked (TVL). It also has a reliable development team and a strong community. Collaborations with major partners such as Coinbase and Gemini have helped expand the adoption and use of DAI.

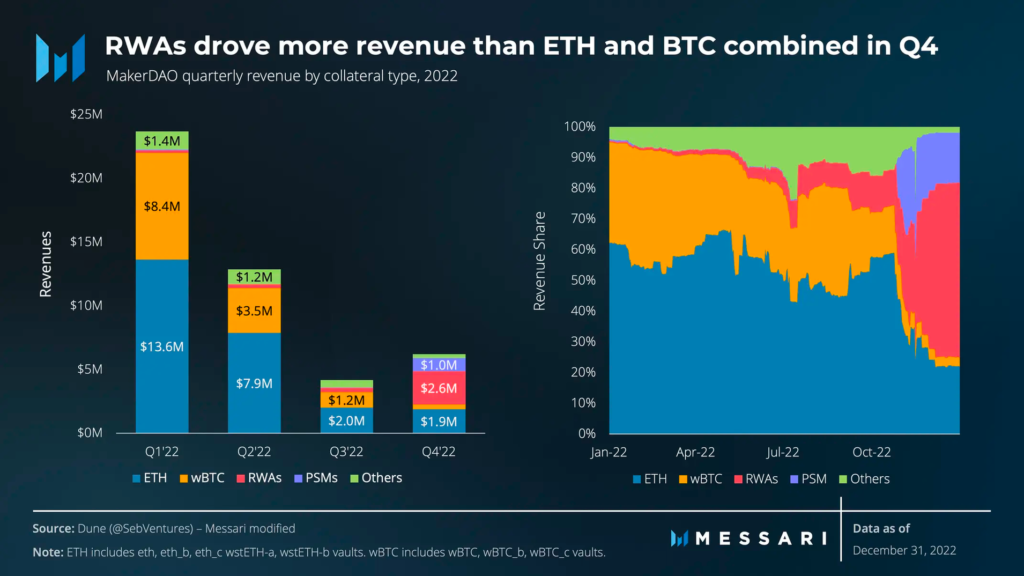

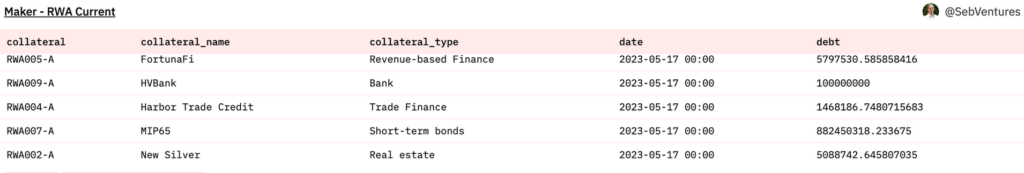

Quoted from Messari, Maker generated more than 6 million US dollars in interest revenue in Q4 2022. Interestingly, this RWA (real-world asset) loan revenue comprised much of the protocol’s quarterly revenue. Some methods that measure revenue within the network do not count this non-crypto revenue earned through legal entities outside the blockchain network.

RWA (real-world assets) in Maker Protocol are real-world assets used as collateral to acquire DAI. Some examples of RWAs are real estate, trade finance, short-term bonds, and others.

In Q4 2022, the Peg Stability Module (PSM) in Maker Protocol recorded over 1 million US dollars in revenue. One of the contributing factors to the revenue was MakerDAO’s decision in October 2022 to approve a proposal from Gemini. According to the proposal, MakerDAO would receive 1.25% interest on the GUSD (Gemini USD) deposited in the PSM. However, to qualify for interest, the GUSD balance at the end of the month must exceed 100 million US dollars. This revenue earned from PSM shows that PSM is becoming a significant source of revenue for MakerDAO apart from DAI.

PSM (Peg Stability Module) is a Maker Protocol module related to DAI. PSM enables an easy and fast exchange between DAI and other stablecoins, including GUSD (Gemini Dollar) and USDC.

Read also What is Stablecoin?

Maker Roadmap

In May 2023, MakerDAO announced it would make a major system update called The Endgame Plan. Rune Christensen, the founder of Maker itself, proposed this project.

The implementation of the Endgame update introduces five roadmap phases, as follows.:

- Beta Launch

- SubDAO Launch

- Launch of Governance AI Tools

- Governance Participation Incentive Launch

- Launch of NewChain

Some of the key focuses of the update include the introduction of two new tokens that are upgraded versions of DAI and MKR, namely “NewStable” and “NewGovToken.” The “NewGovToken” will have token-gated access to Governance AI Tools and Governance Participation Incentives. Then, in the AI sector, Maker with Purpose Fund will fund the development of free, open-source AI models and tools to help social impact projects.

Read also Decentralized Artificial Intelligence: Integration of Blockchain and AI.

In addition, MakerDAO will launch “NewChain.” This chain will be a hard fork as a governance mechanism. It aims to address governance issues, providing a high level of governance security to users and protocols that rely on DAI and “NewStable.”

This MakerDAO roadmap aims to provide a secure and flexible governance infrastructure for the future of DeFi. At the same time, the short-term goal is to grow into the largest and most used stablecoin project within three years and ensure that its growth runs on an autonomous DAO economy.

Conclusion

MKR investments can provide strong exposure to the rapidly growing DeFi market. However, before investing, do your own research (including Maker tokenomics), consider risk factors, and consult a financial advisor if needed. Maker offers potential growth and stability in the DeFi ecosystem, making it an attractive investment option for those interested in the market.

How to Buy MKR Token on Pintu?

You can start investing in MKR by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for MKR.

- Click buy and fill in the amount you want.

- Now you have ID as an asset!

In addition, Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn more crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- John_TotalValue_Locke and Peter Horton, State of Maker Q4 2022, Messari, accessed 18 Mei 2023.

- Chirag Mehta, Tokenomics 101: MakerDAO, Tokenomics DAO, accessed 18 Mei 2023.

- Rune, The 5 phases of Endgame, Forum MakerDAO, accessed 18 Mei 2023.

- Tristan Greene, MakerDAO publishes 5-phase roadmap featuring funding for open-source AI projects, Cointelegraph, accessed 18 Mei 2023.