Wash trading is a common practice in financial markets, including crypto and NFT trading. If you are not careful and fall into the trap of wash trading, you may experience financial losses. To avoid this, it is better to learn about wash trading and how to identify it to avoid unwanted losses. Let’s learn more about wash trading through the following article.

Article Summary

- 🌊 Wash trading is a manipulative practice when a party purposefully trades the same asset with itself to inflate trading volume.

- 🤑 The motive of wash trading is to propel the price of an asset and create the impression that it is popular and liquid. By doing this, they intend to make a profit from it. Then, it also aims to create a high trading volume to make it look like there is trading activity.

- ⛔ How to avoid wash trading is through in-depth research on transaction and price history, being selective in choosing crypto assets, NFT collections, and a reliable platform.

What is Wash Trading?

Wash trading is a manipulative practice when a firm or party intentionally trades the same asset with itself to create false trading volume. In the context of cryptocurrency, wash trading is done as an attempt to make asset prices rise and create a perception of high liquidity. When the asset price rises, followed by high volume, it is expected to attract investors to buy the asset.

For example, a firm called ABC has 2,000 X tokens. Then, they sell and buy back all these tokens using different accounts they control. This buying and selling create the illusion of high trading volume. If reckless, investors will see the signals of high trading volume and the skyrocketing price of the asset as an opportunity to buy. In reality, those investors are buying at the “top,” and after that, the price will drop. ABC can make a profit by going short or selling its assets when the price is at the “top.”

Actually, the practice of wash trading has been going on for a long time in various financial markets, such as stocks and commodities. However, now there are regulations that make wash trading practices no longer occur in both markets. However, since the crypto market does not yet have a clear regulatory, wash trading in the crypto market remains a common practice.

In addition to wash trading, also read about the types of crypto attacks and how to avoid them through the following article.

Why Wash Trading Can Happen?

There are two main reasons behind wash trading. First, to boost the price of an asset and create the impression that it is popular and liquid. This is generally associated with pump and dump schemes; in other words, the motive is to make a profit.

Second, to create high trading volumes and to manipulate to make it appear that there is trading activity. In the second motive, the culprit is the crypto exchange. They do this to give the impression that their exchange is more active and liquid than it actually is. The hope is to convince and attract investors to believe their exchange is superior to competitors.

Based on a report issued by the National Bureau of Economic Research (NBER), it was found that wash trading practices accounted for at least 77.5% of all transactions from unregulated crypto exchanges. Meanwhile, the study researched 29 exchange exchanges grouped into regulated and unregulated exchanges. While on regulated exchanges, the study did not find wash trading practices.

Wash Trading in NFT Space

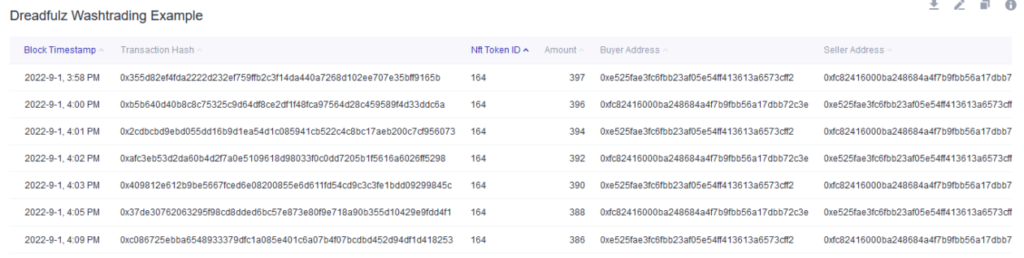

Not only in cryptocurrency, wash trading is also common in the Non-Fungible Token (NFT) market. Data from Dune Analytics shows transactions in the NFT marketplace worth US$ 31.2 billion out of US$ 73.8 billion, or around 42%, were reported as wash trading. In the context of NFTs, wash trading is a transaction of NFTs made by the same person. It means the same person owns the buyer and seller addresses.

For example, the transaction above shows the same NFT collection (ID 164) being traded back and forth by the same wallet address on the same day. This transaction process is then recorded. It creates the illusion that someone is interested and willing to pay for those NFTs. The illusion gets stronger when more accounts are involved, and the transaction process is longer.

In terms of motive, NFT wash trading has the same goal: to create the illusion of liquidity or increase the value of a particular NFT collection. By doing so, wash traders can pump and dump and take advantage of trapped investors. Meanwhile, another goal is to earn rewards from NFT marketplace platforms. Marketplaces like X2Y2 reward active users with tokens based on their trading volume.

One of the most trusted NFT marketplace platforms is Opensea Pro. Read more here.

Losses Incurred by Wash Trading

As a form of market manipulation, wash trading is a practice that harms investors, just like a scam or rug pull of a crypto project. Those unaware of engaging in wash trading may find themselves trapped in illiquid assets, leading to price drops. Not only for crypto asset trading but the exact impact is also caused by wash trading on NFT collection.

Various exchanges that engage in wash trading, so they appear to have high transaction volumes, will also damage the integrity of the crypto market. This unfair and non-transparent practice contributes to a negative perception of the market. Thus, reducing investor confidence and interest in the crypto market.

How to Avoid Being a Victim of Wash Trading

To detect and avoid wash trading, you must be vigilant and thorough. Here are some tips that can be done:

- Do in-depth research. Learn about the asset you are interested in, whether a crypto asset or an NFT collection. Check its background, development team, transaction history, and price history. Don’t be tempted by sudden spikes in trading volume with no news or apparent reason.

- Be selective. Think carefully when getting into new crypto or NFT projects, as well as crypto with small market capitalization. This is because new projects and small market capitalizations do not get enough volume for trading. Thus, it makes them vulnerable to being infiltrated by wash traders to boost prices and volume.

- Use a trusted platform. Learning from the NBER report above, the risk of wash trading is greater on unregulated exchanges and lacks transparency. So choose a regulated and trusted exchange with a wash trading prevention mechanism.

You can buy crypto assets through a decentralized exchange platform. Here is how to do it.

Conclusion

Wash trading poses a significant issue in the crypto market and NFT space. However, by being informed and cautious, we can make smart investments and shield ourselves from this deceptive behavior. It’s crucial to conduct thorough research and resist the temptation of unrealistic high trading volumes. Keep in mind that knowledge is the ultimate tool for success and security in investing.

Buy Crypto Assets in Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

James Chen, Wash Trading: What It Is and How It Works, With Examples, Investopedia, accessed on 16 May 2023.

Jennifer Sor, What is wash trading, the fraudulent practice that some experts say accounts for 70% of transactions on crypto exchanges? Markets Insider, accessed on 16 May 2023.

Token Insight, Many Exchanges Continue to Engage in Wash Trading, Wash Trading Research Shows, Medium, accessed on 16 May 2023.

Andy Lian, The scourge of NFT wash trading — and how not to get suckered in, Forkast, accessed on 16 May 2023.

Gareth Jenkinson, 4 out of 10 NFT sales are fake: Learn to spot the signs of wash trading, Coin Telegraph, accessed on 16 May 2023.

Hildobby, NFT Wash Trading on Ethereum, Dune, accessed on 16 May 2023.