The Fed has raised its key interest rate by 25 bps. The Fed also warned that bank failures could negatively impact economic growth. From the crypto market, despite the overheated market, BTC maintained its strong momentum.

As usual, the Pintu trader team has collected various crypto and macroeconomic data to analyze the crypto market movements over the past week. However, you should note that all information in this Market Analysis is for educational purposes, not financial advice.

Market Analysis Summary

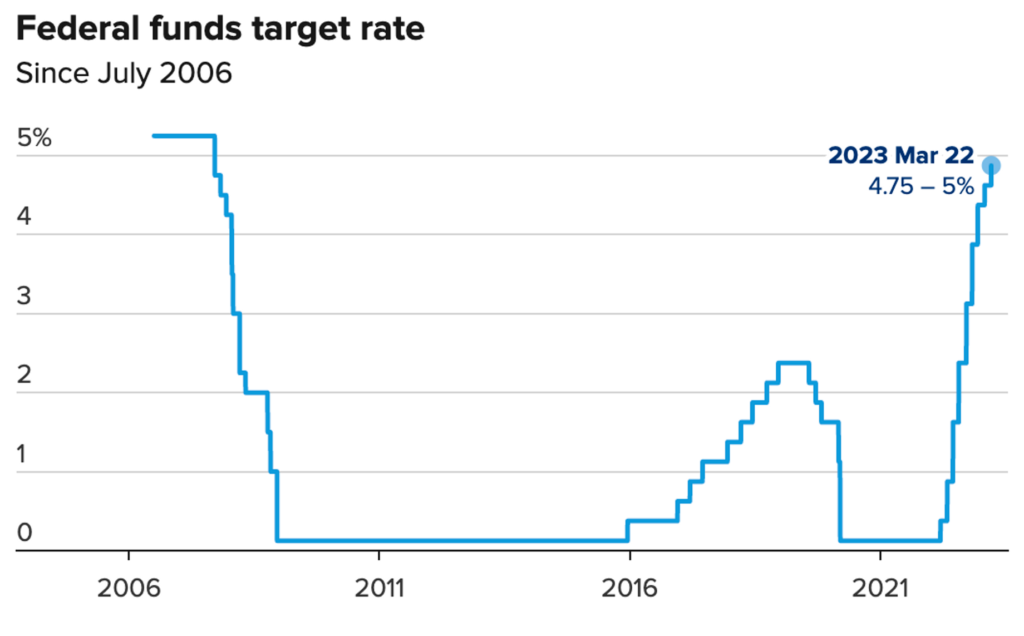

- 📈 The Fed has boosted its key rate by 25 bps, bringing the current Fed Funds target rate to 4.75%-5% and described the banking system as sound and resilient.

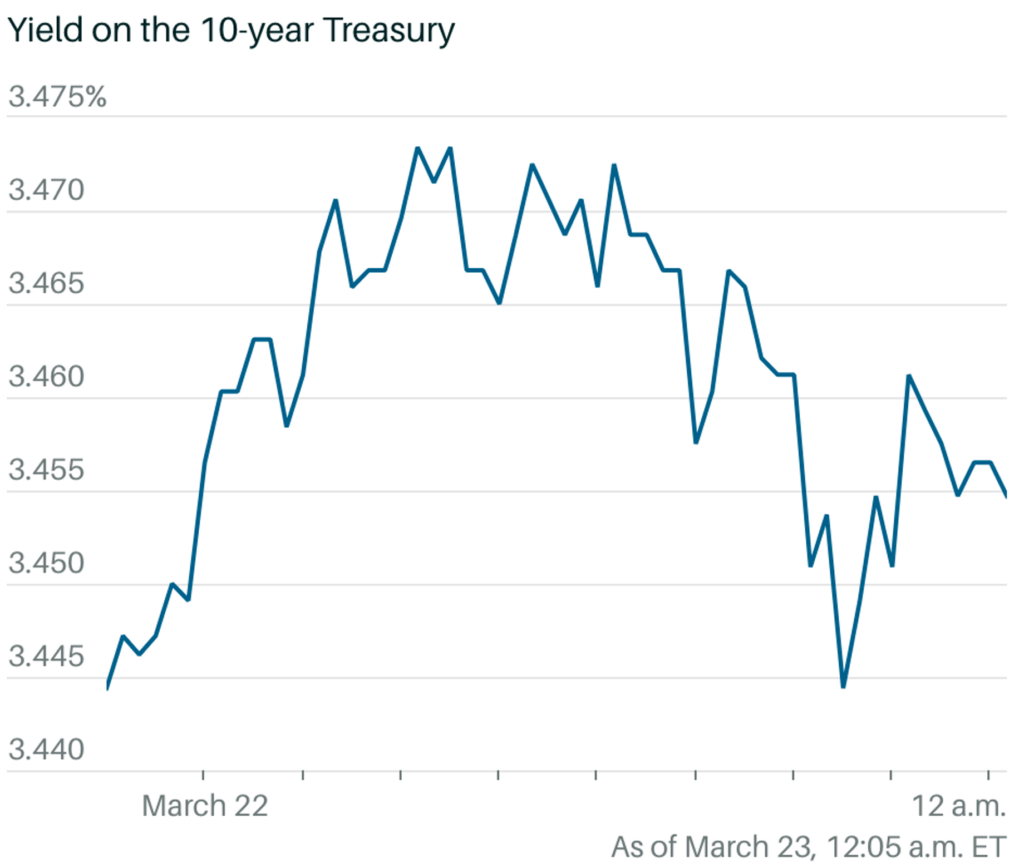

- 🏦Following the FOMC’s announcement, Treasury bonds experienced a rally on Wednesday afternoon, resulting in a decrease in yields across the curve. Specifically, the yield for the 10-year Treasury dropped to 3.46%, while the yield for the two-year Treasury decreased to 3.93%. It’s worth noting that bond yields and prices have an inverse relationship.

- 🚨 Coinbase has received a Wells notice from the SEC regarding its crypto offering. In addition, the SEC also charged Tron founder Justin Sun with offering and selling unregistered securities and engaging in TRX price manipulation.

- ✨ BTC reached a resistance point at the 0.236 Fibonacci retracement line (28,300 US dollars) over the week. A healthy short-term pullback is expected for BTC to find its price support.

Macroeconomic Analysis

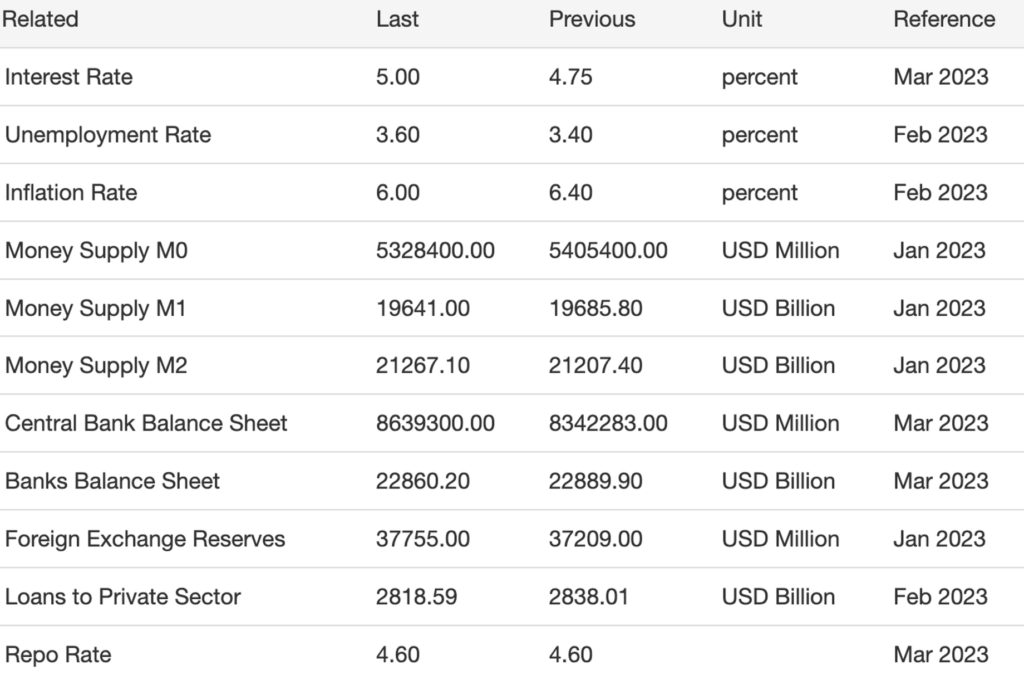

The Fed has boosted its key rate by 25 bps, bringing the current Fed Funds target rate to 4.75%-5% and described the banking system as sound and resilient. However, the central bank also cautioned that the consequences of bank failures could negatively impact economic growth in the coming months. In an effort to stabilize prices, the Fed has steadily increased borrowing costs. Nonetheless, the substantial surge in interest rates since last year has caused pressure in the banking system. SVB and Signature Bank recently collapsed due in part to difficulties created by higher interest rates. There are apprehensions regarding the worth of bonds owned by banks, as surging interest rates could decrease the value of these bonds.

During a press briefing, Jerome Powell suggested that additional tightening measures could be implemented by the central bank following the rate hike on Wednesday. He further stated that if necessary, the Fed will raise rates beyond initial projections of 5%-5.25% (based on Dec’s meeting). Despite the bond market indicating otherwise, officials do not anticipate reducing rates this year.

Following the FOMC’s announcement, Treasury bonds experienced a rally on Wednesday afternoon, resulting in a decrease in yields across the curve. Specifically, the yield for the 10-year Treasury dropped from 3.603% at Tuesday’s close to 3.46%, while the yield for the two-year Treasury decreased from 4.175% to 3.93%. It’s worth noting that bond yields and prices have an inverse relationship. Additionally, the two-year Treasury’s yield is strongly correlated with the terminal rate, which indicates where short-term rates will be once the Fed completes its rate-tightening initiative.

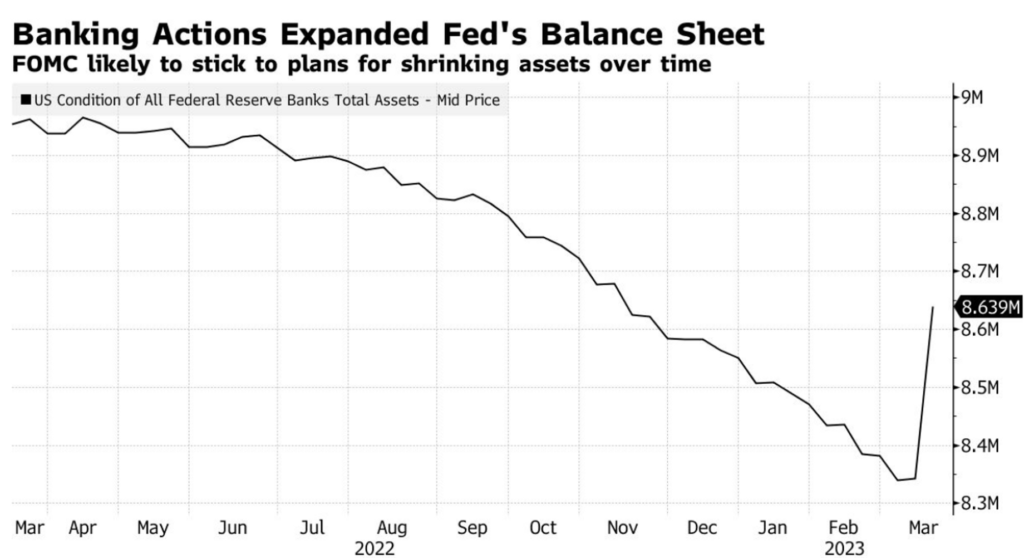

The Federal Reserve had been gradually reducing its holdings of Treasuries and mortgage-backed securities, causing its balance sheet to steadily decline. However, recent emergency actions to support the banking system have caused the balance sheet to rebound to nearly $8.6 trillion.

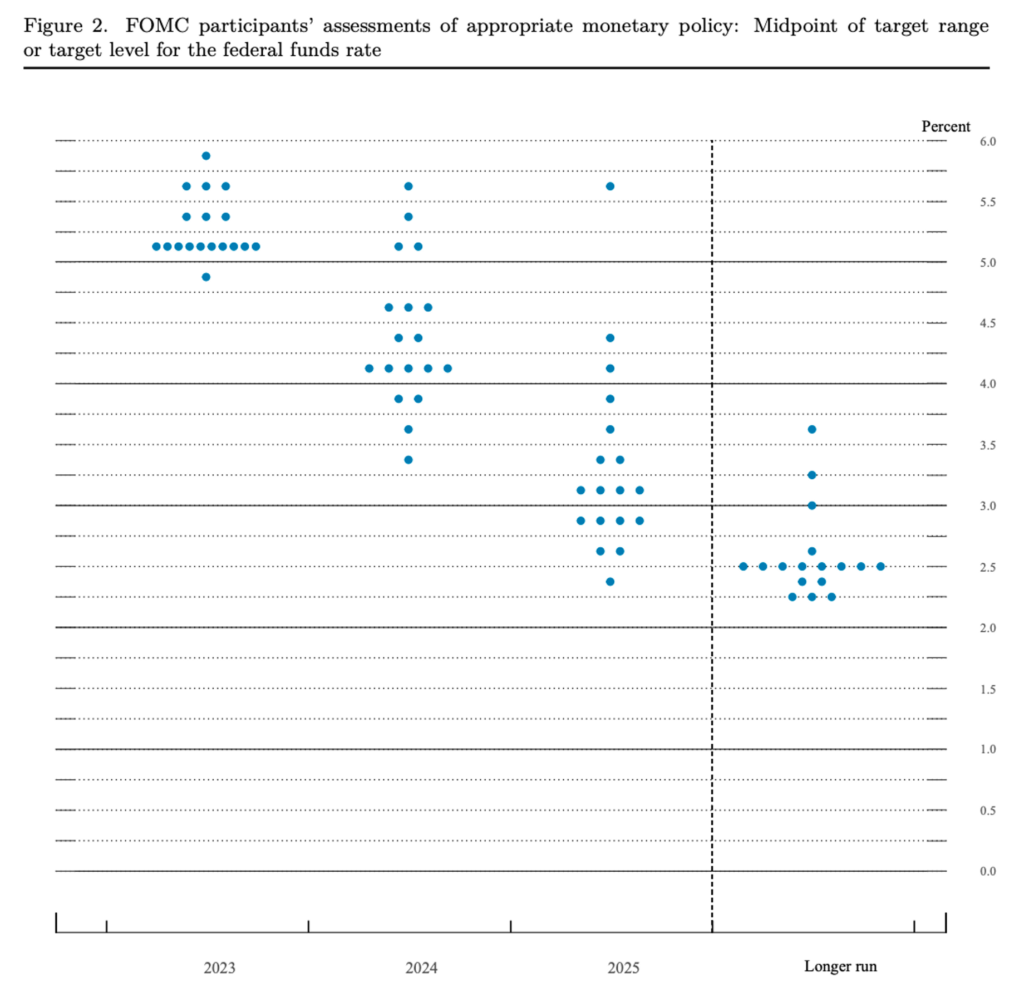

Fed’s March dot plot from the March’s Summary of Economic Projections (SEP) is out. According to the dot plot, interest rates are expected to continue rising in 2023, albeit only by a small amount. The benchmark interest rates are projected to peak at 5.1% this year, which is in line with the Fed’s previous December projection. Among the officials, seven members anticipate rates to increase beyond 5.25% this year, while one member expects rates to reach as high as 6%.

None of the officials are projecting rate cuts this year, but they do expect rates to decrease to 4.3% in 2024, which is slightly higher than the rate forecasted to finish next year at 4.1% in December. However, the expectations for rates next year were more broadly distributed this month compared to December.

The Fed has notably indicated the possibility of ending its aggressive rate hike cycle, removing the language for “ongoing rate increases” in interest rates and stating that “additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time.”

According to the SEP, the Fed anticipates core inflation to peak at 3.6% this year, which is higher than the 3.5% projected in December, before easing to 2.6% next year and 2.1% in 2025.

According to Corporate Finance Institute, the FOMC (Federal Open Market Committee) dot plot, alternatively called the Fed's dot plot, is a chart that summarizes the FOMC's outlook for the federal funds rate. It is published quarterly and watched closely by investors and economists for indications on the future trajectory of the federal funds rate

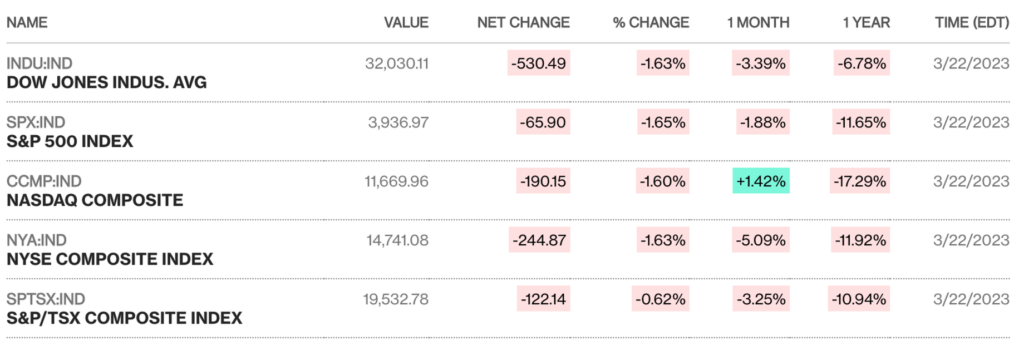

On Thursday, the Asian equities market did not move much. The declining value of the dollar, which had been decreasing for six consecutive days, was viewed as easing the impact of global banking turmoil, especially in emerging markets, on Asia.

The tone in the US however, differed greatly from that in Asia as traders experienced an initial rally and then a reversal after the US treasury mentioned that they did not intend to provide “blanket” deposit insurance to stabilize the banking system. This is further amplified when Fed chief Jerome Powell expressed his readiness to continue raising rates until signs of cooling inflation emerge.

As a result of this news, the S&P 500 experienced a widespread sell-off, dropping 1.7%, with all 22 stocks in the KBW Bank Index (benchmark stock index of the banking sector) declining and the index measuring US financial heavyweights falling nearly 5%.

The contradicting comments from both Fed and Treasury sparked market confusion. During the Fed chairman’s press conference, the Treasury secretary appeared before a Senate subcommittee, causing the market to experience fluctuations. Traders attempted to interpret remarks related to various topics such as the economy’s condition, interest rate trends, the status of banks, and the extent of government support for depositors. As a result, the S&P 500 initially decreased, then increased, returned to its original level, and finally dropped once more.

Powell and Yellen need to strike a delicate balance between avoiding further disruption and reassuring the public that the government will assume responsibility for any potential private risks.

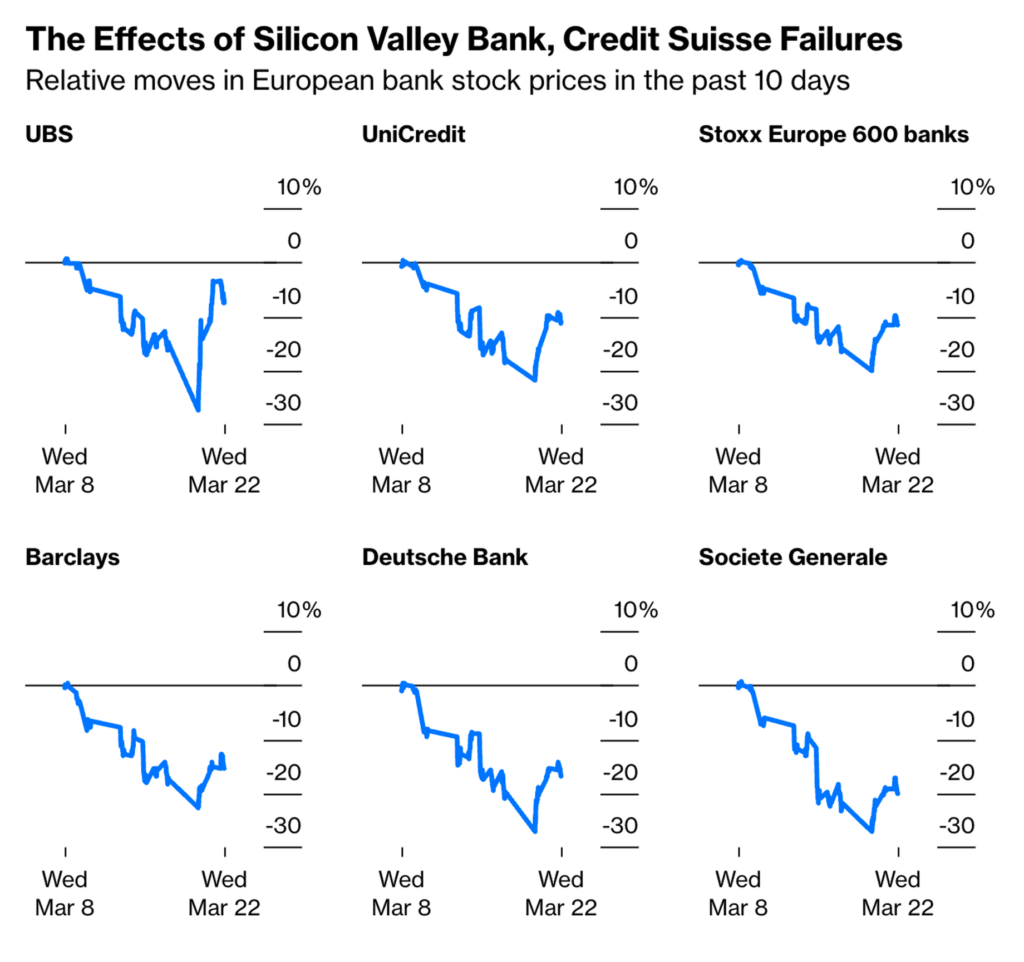

In a bid to prevent financial market turmoil triggered by the collapse of two American banks earlier this month, UBS, Switzerland’s largest bank, has entered into an emergency rescue agreement to acquire its struggling competitor Credit Suisse for 3 billion Swiss francs ($3.25 billion)

Despite the initial panic receding and bank shares rebounding from their decline, the world has undergone a shift – and not just due to Credit Suisse. European banks are confronted with a new reality following the recent acquisition of SVB by the US government, merely 10 days ago. The Stoxx Europe 600 banks index has dropped by over 10% in the aftermath.

The effect of this banking crisis is felt around the globe, with every country trying to manage and contain bank systemic risk internally.

SEC Tightening Crypto Regulations in the US

Coinbase announced on Wednesday that it has received a Wells notice from SEC, which pertains to certain areas of its exchange, including a portion of its listed digital assets, as well as its staking service, Coinbase Earn, and Coinbase Wallet. A Wells notice is typically issued at the conclusion of an investigation, and companies are given an opportunity to refute any allegations made by the agency. Although Wells notices may result in legal action or settlements and penalties, not all of the concerns raised in the notice necessarily lead to such consequences.

On Wednesday, the SEC charged Justin Sun, the founder of Tron, and his company, The Tron Foundation, with offering and selling unregistered securities and engaging in price manipulation

TRX experienced a significant drop today following allegations by the SEC of market manipulation, fraud, and other charges against the founder of the blockchain project. TRX decreased by approximately 12%, while BTT, a token linked to BitTorrent, dropped by over 1%.

Read also What is Tron (TRX)?

BTC Analysis

BTC met with resistance in its 0.236 Fibonacci retracement line (28.300 USD) over the week.

Crypto run-up has been supported by the narrative of Fed easing interest rate hike in order to control the impending bank crisis. What’s next for crypto? Given that 0.25 bps rate hike has been priced into the current crypto market, our take is that BTC needs to find a strong support at the 200 weeks support line before rallying up, confirming the bottom is over.

There have been issues with SEC, Coinbase and Tron Foundation, which do not really affect crypto prices given its effects are not significant as compared to Fed’s rate hike this week. As we can see, the crypto market has been going strong, even after what most considered to be a short-term overheated crypto market. Expect a short-term healthy pull back for BTC to find its price support.

On-Chain Analysis:

Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7days was lower than the average. They have a motive to hold their coins. Investors are in an anxiety phase where they are currently in a state of moderate unrealized profits.

Derivatives: Short position traders are dominant and are willing to pay long traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend.

Technicals: RSI indicates an overbought condition where 81.00% of price movement in the last 2 weeks have been up and a trend reversal can occur. Stochastic indicates an oversold condition where the current price is close to its high in the last 2 weeks and a trend reversal can occur.

Altcoin News

- Uniswap has launched on the BNB Chain. It enables access to new markets and liquidity, lower fees, and greater accessibility for users within the Web3 space. The move aligns with the DeFi industry’s need for cross-blockchain compatibility.

- zkSync Era: A new Era has dawned with the launch of the first Ethereum Virtual Machine compatible ZK rollup, enabling projects like Uniswap, Sushi, MakerDAO, Curve, etc to easily port over for scaling. It also allows for faster, cheaper transactions.

Crypto News

- Do Kwon, former CEO of Terraform Labs, has reportedly been arrested in Montenegro. He is allegedly being one of the most wanted fugitives. Do Kwon was detained at the airport with falsified documents. He has been the subject of several investigations, including one by Interpol, after the collapse of stablecoin terraUSD and its 40 billion US dollars ecosystem caused shockwaves in the crypto markets last year.

- NFT marketplace Magic Eden launched a Bitcoin NFT marketplace on March 21, 2023. It supports the growing popularity of Bitcoin-based Ordinal NFTs. Traders can purchase inscriptions using Bitcoin wallets Hiro and Xverse. Magic Eden teamed up with Taproot Wizards, Inscribed Pepes, and Bitcoin Bandits to onboard users to Bitcoin-based NFTs.

Read also What Are Ordinals? Bitcoin NFT Innovation.

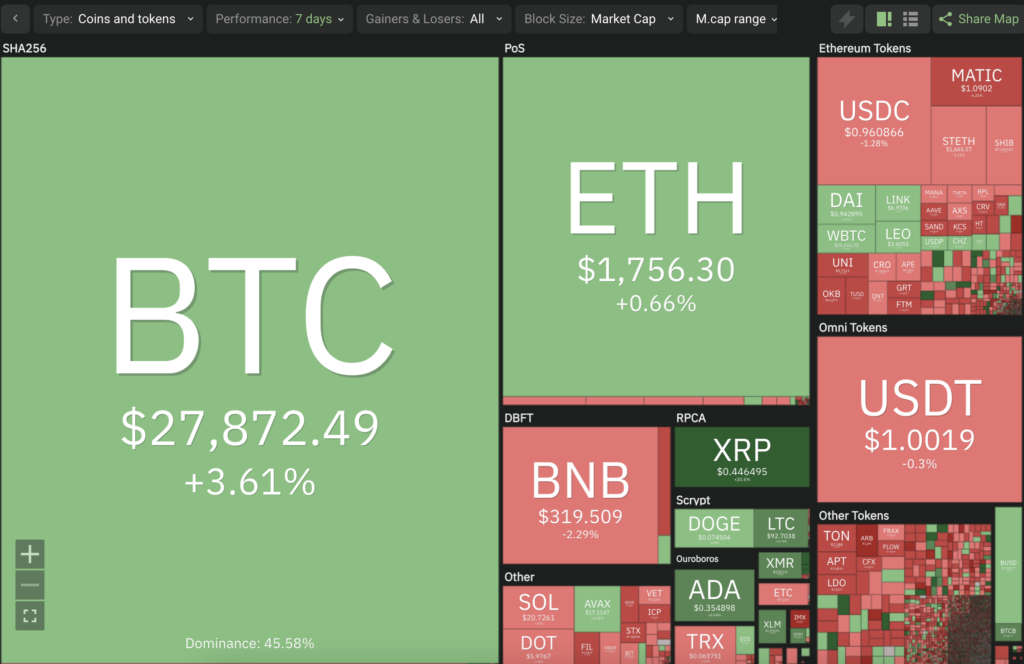

Best and Worst Performers of the Crypto Market

Best Performers

- Ripple (XRP) +14.74

- Litecoin (LTC) +11.96%

- Dash (DASH) +6.01%

Worst Performers

- Arbitrum (ARB) -89.01%

- Immutable (IMX) -24.01%

- Optimism (OP) -14.45%

References

- Parikshit Mishra and Jack Schickler, Do Kwon Arrested in Montenegro: Interior Minister, Coindesk, diakses 25 Maret 2023.

- Cam Thompson, Magic Eden Embraces Ordinals, Releases Bitcoin NFT Marketplace, Coindesk, diakses 25 Maret 2023.

- Andrew Fenton, zkSync Era launches with Uniswap and Sushi — First zkEVM on mainnet, Cointelegraph, diakses 26 Maret 2023

- Amaka Nwaokocha, Uniswap launches on BNB Chain ecosystem to drive growth and liquidity, Cointelegraph, diakses 26 Maret 2023