Total Value Locked (TVL) plays a crucial role in evaluating cryptocurrency investments. It offers insights into a token’s long-term potential. However, relying solely on TVL can sometimes lead to misleading conclusions. Therefore, investors still need to use other metrics for optimal analysis results. In this article, we explore the additional metrics that should be considered and how to effectively use TVL as a key investment indicator.

Article Summary

- 🔬 TVL is a key indicator in DeFi that measures the total amount of locked crypto assets. It provides valuable insights into the trustworthiness and growth potential of a protocol, serving as a reference point for assessing the prospects of a DeFi project.

- 🪙 In addition to TVL, stablecoin liquidity and the market cap to TVL ratio are also important factors. Both ensure organic growth and assess whether the protocol is overvalued or undervalued.

- 🎯 TVL is a useful indicator, but it should not be used in isolation to value a native token. Other metrics, such as the number of locked tokens, user activity, and smart contract interactions, should also be considered to get a more accurate analysis.

About TVL

TVL is the total amount of crypto asset value stored and available in the Decentralized Finance (DeFi) protocol. It applies exclusively to DeFi blockchains, excluding blockchains like Bitcoin. TVL encompasses staking, liquidity pools, decentralized lending, and market-maker activities.

As a metric, TVL is commonly used to measure the trustworthiness of a DeFi protocol. However, it can serve as an investment key to determining whether a protocol is worth investing in or not.

You can learn more about what TVL is in the following article.

Why TVL is a Key Crypto Investment Indicator Crypto Investment Key?

TVL can be a benchmark in seeing how much capital is being used for profit and the usefulness of a DeFi application. There are at least three things that can be taken by making TVL an analysis indicator:

- ⭐ Trust Indicator. A protocol with a high TVL number shows high investor interest. This means that investors trust the prospects and safety of the protocol.

- 📈 Protocol Growth. A steady upward trend in TVL indicates the protocol is recording positive growth. This also suggests that more users are participating and locking their assets in the protocol.

- 🛡️ Risk Assessment. A high TVL is considered safer because it shows high investor confidence. A low TVL is considered more risky because there is still low investor confidence or the protocol has not been tested.

Factors to Consider in TVL

The following are some factors to consider when using TVL as a key indicator for investment:

1. TVL Number

Investors in the traditional financial industry, such as banks, will look for banks with the highest deposits. The higher the deposit volume, the stronger the level of investor confidence. In the DeFi industry, the same concept applies.

The higher the TVL of a DeFi protocol, the higher the level of investor confidence. This is because more investors are depositing their funds in the protocol. In addition, the TVL value also affects the protocol’s liquidity pool or market makers. If the TVL is high, the existing liquidity pool will be stronger, and the slippage will be smaller.

Beware of protocols with small TVL numbers but offer high staking APY figures. A small protocol generally also has few depositors. So the high rewards offered are suspect as it could be just a marketing strategy or a rug-pull attempt.

2. Stablecoin Liquidity

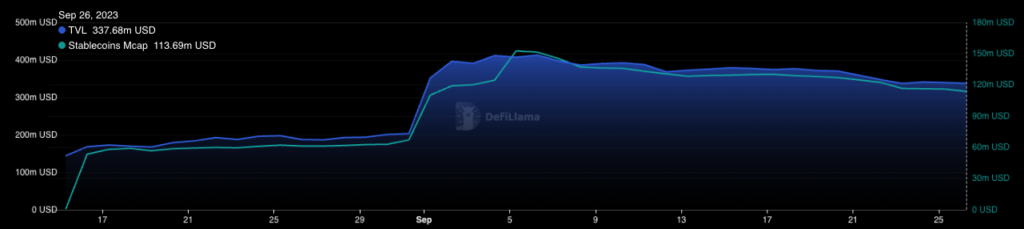

Does a drastic increase in TVL indicate that the protocol is rising and will be the next big player? Not necessarily. Don’t be tempted and believe everything you see. Keep in mind that an increase in the TVL number does not always mean more tokens in the chain. The TVL number can also increase when the token price also increases.

To ensure that TVL value growth is organic, check the liquidity of the stablecoin on the network. This is an indicator that calculates how much stablecoin is available. You can easily do this by comparing the stablecoin liquidity chart accessible via DeFi Llama.

If rising TVL numbers are followed by increasing stablecoin liquidity, then this indicates that the growth is organic. This shows that users are also bringing new tokens to the network.

In addition to stablecoin liquidity, there are also four other types of stablecoin analysis. Find out how to use them here.

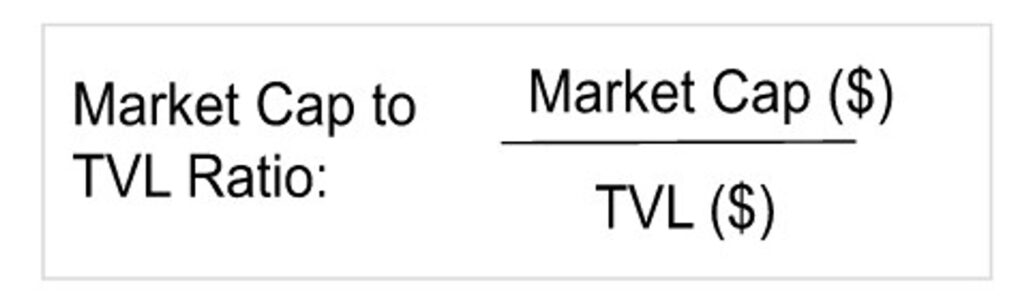

3. Market Cap and TVL ratio

In addition to looking at the TVL number, pay attention to the ratio between the market cap and TVL. The method is to divide the market cap value by the TVL value. If the result is above 1.0, then the protocol is considered overvalued, and there will be a chance of correction in the future. Meanwhile, if the result is below 1.0, the protocol is considered undervalued, and the price may increase.

For example, a protocol has a market cap of US$5 million with a TVL of US$30 million. Then, the ratio is 5/30 or 0.16. Given that the value is below 1.0, it means the protocol is undervalued.

Of course, this indicator is not absolute. If a protocol has a market cap and TVL ratio value above 1.0, it does not mean that it is not worth investing in. As there is a chance that the protocol has good performance potential in the long run. Likewise, for those below 1.0, if not optimally developed, the long-term prospects may be uncertain.

With the ratio of market cap and TVL, at least investors can sort out thousands of DeFi protocols whose value is still undervalued. After that, investors can do more in-depth research to determine which protocols have the most potential in terms of fundamentals or prospects.

Are TVL Indicators Reliable?

TVL should not be relied on as the sole indicator for analysis. It is important to use other indicators to ensure accurate and comprehensive results. Additionally, focusing solely on TVL in USD may lead to misleading results, especially given the high volatility of crypto assets.

To give you an idea, imagine that the price of LIDO in US dollars drops by 50%. This means that LIDO's TVL figure in US dollars will also drop by the same amount. Despite the drop in valuation, the LIDO protocol can continue to grow at the TVL value in LIDO or other metrics.

Therefore, be sure to also check the TVL in native tokens for more accurate analysis. Also, consider other important metrics such as user activity, number of tokens locked, and unique wallet addresses within the protocol, especially if you want to measure long-term potential.

The Cardano chart below is a good example. It can be seen that since October 2022, Cardano’s TVL in USD has moved up and down with the price of the ADA token. But TVL in ADA valuation shows a significant upward trend. This indicates the growth of ADA network activity and the trust of its users. In terms of prospects, this gives a positive signal. It is different if the case is that TVL in USD and ADA are both down; of course, it is a negative sign.

Hence, a protocol can be considered to still have potential long-term prospects as long as:

- The total number of tokens locked up continues to grow.

- The number of transactions processed continues to rise.

- The new wallet addresses and the interaction of smart contracts within the protocol are still growing.

- The volume of transfers and trades measured in crypto tokens is still increasing.

Find out about other methods and ways to conduct on-chain analysis in the following articles.

Conclusion

TVL offers valuable insights into the trustworthiness, growth, and risk profile of a DeFi protocol. However, it should not stand alone as the sole parameter for analysis. Other factors such as stablecoin liquidity, market cap and TVL ratio, and native token value analysis are also important to avoid misleading interpretations due to crypto asset price volatility.

In addition, a high TVL number does not necessarily reflect the quality and potential of a protocol. While TVL is a valuable supplementary analytical tool for assessing DeFi protocols, exercising caution and employing it in conjunction with other considerations remains crucial.

Buy Crypto Assets on Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

Reference

- Unchained, What Is TVL in DeFi? A Guide to Total Value Locked, accessed on 22 September 2023.

- Sygnum, Total Value Locked: Measuring DeFi growth correctly, accessed on 22 September 2023.

- Deebs DeFi, You See a Rising TVL, But There’s One Big Problem, accessed on 22 September 2023.

- Use TVL for Better Crypto Investments — All about Total Value Locked, Medium, accessed on 22 September 2023.