In the crypto cycle, there are always new projects born at each phase. Historically, most projects launch their products in a bear market. These projects usually hope they get mainstream attention by the time the bull market phase comes again. Aptos is one of the new blockchain projects in 2022. Since its launch, many have started talking about Aptos and its potential. This article will explain what Aptos is, what makes Aptos different, how Aptos works, and various other aspects.

Article Summary

- 🌐 Aptos is a layer-1 blockchain with high scalability and modular architecture, which makes it very upgradable. These two properties make Aptos a blockchain platform that can fulfill various uses.

- 👥 Aptos was created by Mo Shaikh and Avery Ching who previously developed a blockchain project for Facebook called Diem.

- 💻 Aptos is a blockchain that utilizes a proof-of-stake consensus mechanism with novel technologies from the Aptos team such as Aptos BFT, BlockSTM, and Move.

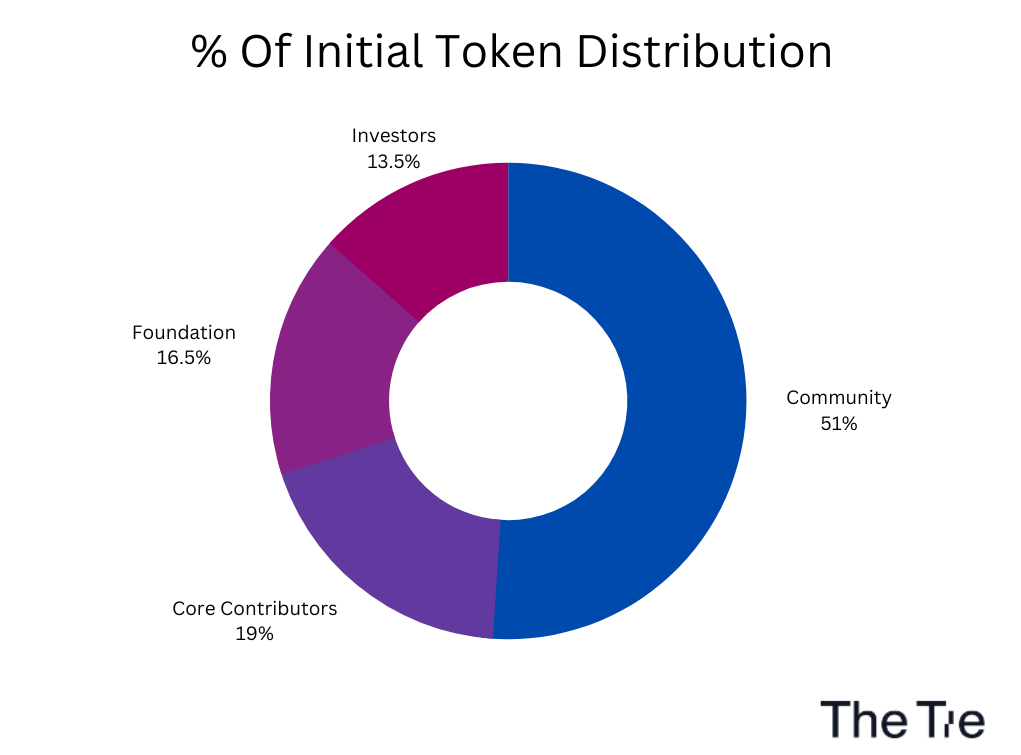

- 🪙 The maximum supply of Aptos’ native coin, APT, is 1 billion. In the APT tokenomics diagram, 51.02% is for the community and 48.98% for investors, Aptos Labs, and the Aptos Foundation. The majority of these tokens are locked with a different distribution schedule.

- ⚖️ All new crypto projects are high-risk in nature. So, you need to be careful before investing in APT and weigh the potential benefits and risks.

What is Aptos (APT)?

Aptos is a layer-1 blockchain designed with high scalability and modular, so it is highly upgradeable and flexible. These two properties make Aptos a blockchain that can fulfill various uses related to crypto and Web3. The Aptos white paper explains that the underlying principles of the Aptos blockchain are “scalability, safety, reliability, and upgradeability”. In addition, the Aptos blockchain utilizes a proof-of-stake system. The Aptos blockchain token is APT.

💡 A modular blockchain is a blockchain in which each of its components can be changed, replaced, and updated independently without disrupting the operation of the network as a whole. Examples of modular blockchains are Cosmos, Ethereum, and Polkadot.

Aptos uses a virtual machine technology called Move, originally created for Facebook’s blockchain project (Meta) but was later scrapped. Move is a virtual machine inspired by Rust, the programming language of NEAR, Polkadot, and Solana.

Naturally, Move VM is a new programming language that will compete with Ethereum VM and others. Furthermore, Aptos explained that Move has various advantages that will make it easier for developers to build applications.

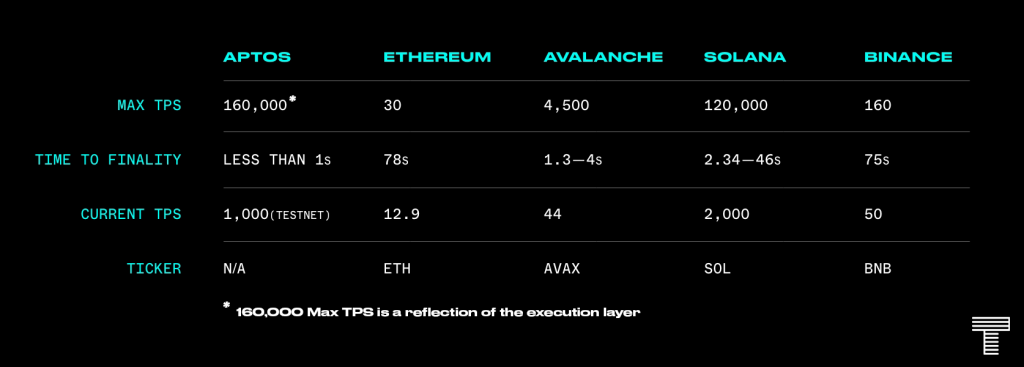

In addition, Aptos also said that its blockchain architecture can process 160,000 transactions per second (TPS). This is because of several novel technologies in the Aptos transaction process. We will dive deeper into the technology and workings of Aptos that enable it to provide high throughput and fast transaction processing.

Who is the Creator of Aptos

The two people behind Aptos are Mo Shaikh and Avery Ching who now serve as CEO and CTO. Both are former development teams of the Facebook (now Meta) blockchain project, Diem. Mo and Avery also had a role in the creation of the Move VM. Mo Shaikh has a Masters’s degree in Business Administration while Avery has a PhD. in computer science. In addition, Mo has worked for large companies such as Consensys, Blackrock, and Meta while Avery was the lead engineer at Facebook for over 10 years.

💡 Mo Shaikh and Avery Ching are one of two former Diem teams who are now moving into the blockchain and crypto industry. The other team is Evan Cheng, Adeniyi Abiodun, Sam Blackshear, and George Danezis who are building a layer-1 blockchain called Sui.

Mo and Avery have been building Aptos for four years. During 2022, Aptos raised $350 million in two rounds of funding, $150 million in March, and $200 million in July. Several large crypto investors participated in the funding such as A16z, FTX Ventures, Binance, and Multicoin Capital. Currently, Aptos Labs handle the development of the Aptos network.

Then, what technological innovations does Aptos bring to the blockchain industry? We will discuss this below.

How Does Aptos Work?

Aptos, like newer generation layer-1 blockchain, uses a proof of stake system as its consensus mechanism. This makes Aptos rely on validators to process transactions, upload new blocks, and secure the network. Aptos also uses Aptos BFT, a new iteration of BFT the team claims to have the lowest latency and the most advanced. The Aptos BFT technology is derived from Hotstuff, the consensus protocol previously used by Diem.

💡 What is Byzantine Fault-Tolerant or BFT?

BFT is a technological innovation that solves a decentralized network problem commonly known as the Byzantine Generals Problem. BFT ensures a decentralized network can still run even if 1/3 of validators/nodes are offiine or misbehaved.

Aptos also uses a modular blockchain architecture, where every component of the network can be updated. This ensures that Aptos can easily upgrade its network according to the needs and problems encountered. In addition, this modular system also enables an on-chain governance system in which APT owners can participate.

The Aptos BFT consensus protocol can finish processing transactions under one second. Theoretically, Aptos can reach a maximum of 160,000 transactions per second (TPS). This number represents the maximum potential the network can reach. Currently, Aptos Explorer shows that the Aptos network processes approximately 9 transactions per second (7 November). This is because the activity of users in the network is still minimal.

Some of the key technologies from Aptos are the Move programming languages and BlockSTM.

Move

Move is a programming language that forms the basis for writing smart contract code for applications on the Aptos network. Inspired by the Rust programming language, Move has various additional features that make it easier for crypto application developers. The Aptos team explained that Move was made with flexibility and security in mind. Move also consists of a compiler, virtual machine, Move Module, and other developer tools.

One of the important components of Move that makes it more secure is the Move Prover, a formal verification protocol. Move Prover checks the code written in the smart contract and makes sure it is safe and working as intended. Move Prover is also useful in the testing phase of an application to reduce the risk of human error and ensure that the running smart contract does not have fatal security loopholes.

💡 Move uses a structure similar to the Rust programming language. Therefore, Aptos has to compete with blockchains that use Rust (such as Solana and Near) to get the best developers in the talent pool.

The move also has several additional features for users as well as developers. One of them is an on-chain private key management. In addition, each resource (objects such as tokens, etc.) has a linear logic attribute that ensures each element cannot be duplicated to prevent problems such as double-spending. The Move module is a network component in charge of determining the rules and managing its associated resource such as printing, deleting, and moving coins. All resource-related rules can only be set by the respective Move module to prevent external parties from changing and duplicating code from certain resources.

BlockSTM

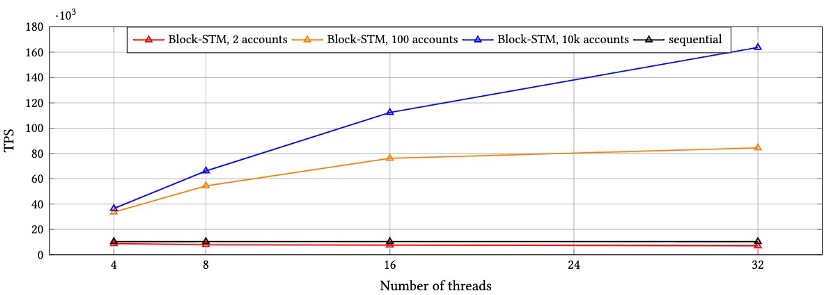

Aptos explained that it could reach a maximum of 160,000 TPS. In order to reach this number, Aptos executes transactions in parallel. Transactions are also bundled up in batches, similar to the optimistic rollup of some layer 2. These two techniques ensure that the Aptos transaction processing engine can work more efficiently. The Aptos team creates BlockSTM to help with this process.

STM in BlockSTM stands for Software Transactional Memory. This engine basically handles all potential conflicts when executing transactions while maximizing the parallel verification system. If any transaction fails, BlockSTM will try to process it one more time along with all the transactions it has dependencies on. If successful, the transaction will be collected and processed together in parallel (also called lazy commit). BlockSTM technology helps Aptos reach 160,000 TPS.

In addition, Aptos separates the process of transaction ordering and processing from the consensus stage. So, transactions will be sorted and processed independently without the need for consensus from the entire network. After this is done, the consensus component will be involved. This speeds up the transaction verification process and shortens the time to finality. The role of BlockSTM technology is to check and ensure that no conflicts occur in the parallel transaction execution process.

You can read Aptos the white paper by yourself. In addition, Aptos also explains in more detail the BlockSTM system.

APT Tokenomics

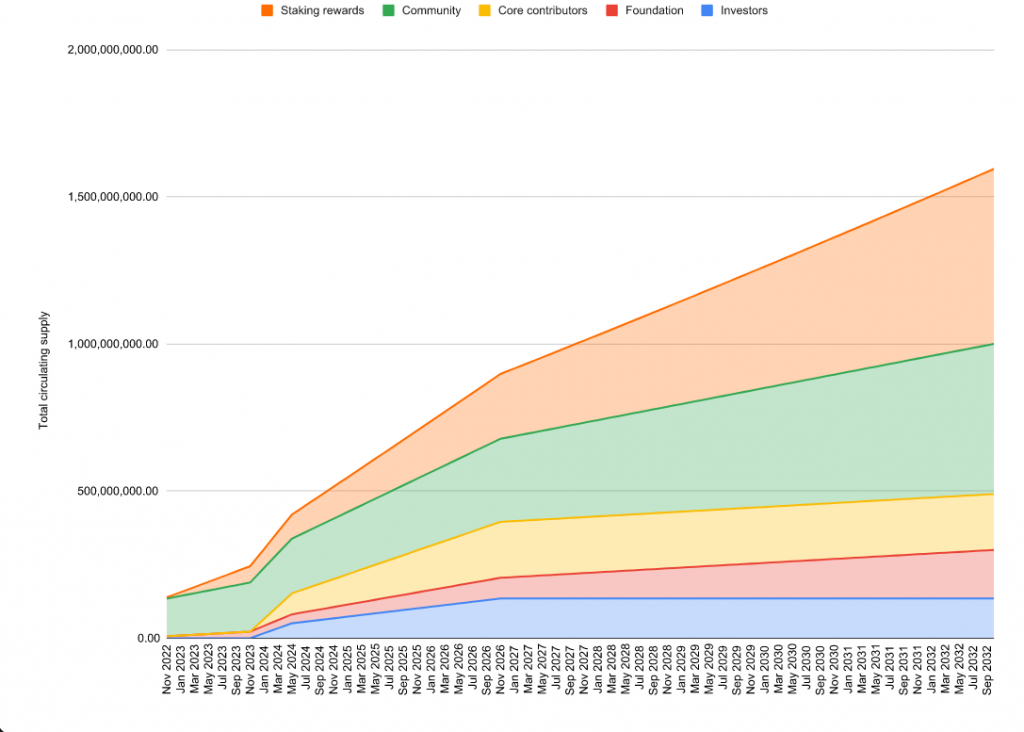

The maximum supply of APT is 1 billion. As in the diagram above, 51.02% (approximately 510 million) is allocated to the community with a 10-year vesting period, and as much as 125 million is unlocked. The remaining 48.98% is for investors, Aptos Labs, and Aptos Foundation with vesting periods of 10 and 4 years. For team and investor tokens, there is a token unlock from the 13th month which will continue to be distributed every month thereafter. In addition, Aptos Labs explained that 82% of APT’s initial supply is locked in staking.

However, in the explanation of APT tokenomics, there are interesting things about the 51% community distribution. The majority of these tokens (410,217,359,767) are held by Aptos Foundation and a smaller portion (100,000,000) is held by APTOS Labs. The token is will unlock over a ten-year vesting period. The foundation and labs will use these APT tokens to support the ecosystem and other growth initiatives.

As we can see, 51% of the supply for the community in the APT distribution diagram is essentially controlled by Aptos Labs and its foundation. Aptos does not allocate APT for retail investors via ICO or airdrop. So, it is very likely that Aptos will use the supply of APT in the community as funds to develop its ecosystem, which means it will be sold.

This APT token distribution scheme will most likely put huge selling pressure on APT tokens, along with token sales by Aptos which will increase following the development of the ecosystem. If you want to invest in Aptos, you need to pay attention to APT’s vesting schedule.

Aptos Apps and Ecosystem

Application Made by Aptos Team

- Aptos Explorer: Aptos Explorer is a tool created by the Aptos team. Through this platform, you can find out the total APT supply, and TPS numbers, and search for transactions.

- Aptos Names: Aptos Names Service (ANS) is a protocol for adding names to your Aptos digital wallet. Just like the Ethereum Names Service (ENS), this will make it easier for you to access an easy-to-remember digital wallet. Currently, ANS has a 1-year rental system.

- Petra Wallet: Petra is a flexible digital wallet made by Aptos Labs. You can use Petra for many transactions including NFT and DeFi transactions. It also has an easy-to-use interface.

Aptos NFT Marketplace and DeFi

- 🌊 Blue Move: Blue Move is an NFT marketplace for Aptos and Sui. Currently, Blue Move already has dozens of NFT collections on Aptos.

- 🥞 PancakeSwap: PancakeSwap is an AMM platform and other DeFi products from the BNB Chain. PancakeSwap expands its product to Aptos. According to DeFiLlama, PancakeSwap now has the highest TVL on Aptos.

- 🛥️ Tortuga: Tortuga is a liquid staking platform for APT tokens with a 7% APY. After using liquid staking, you will get tAPT. Since DeFi protocols on Aptos is still limited, you can only use tAPT on Aux and Argo platforms.

- 📊 Aux Exchange: Aux Exchange is a decentralized exchange platform or DEX. You can trade and become a liquidity provider on this platform.

- 💰 Liquidswap: Liquidwap is the AMM platform on Aptos. Users can exchange various tokens on Liquidswap like other DEXs and also exchange stablecoins like on Curve. Liquidswap is working with Layer Zero to bridge other blockchains to Aptos.

APT As Investment

The APT token itself launch on October 19, 2022. At first, it managed to rise to $10 US dollars from $7. However, as in the chart above, it experienced a significant correction to the $7.5 mark. Since this token has just been released, performing a technical analysis of APT is quite difficult. Therefore, we better look at the fundamental side of Aptos and APT.

As explained in the how it works section, Aptos has powerful technology that overcomes the shortcomings of previous-generation blockchains. With a new programming language that is familiar to many developers, Move can be the choice for new crypto teams. However, the technological novelty will not have much effect if there is no adoption of new users entering the Aptos network.

Avery Ching shares some Aptos blockchain stats seven days after the mainnet launch. On 21-28 October 2022, Aptos processed 10 million transactions with 20% of them related to NFT. There are also 1.5 million accounts that are actively sending transactions.

💡 There is little information about the Aptos roadmap going forward. The only thing that could be found was an explanation of the implementation of the sharding system to improve Aptos’ scalability even further.

Through its official Twitter account (@Aptos_Network), Aptos announces various applications built on its network. However, some applications have quite significant implications. Among these are PancakeSwap and Layer Zero. PancakeSwap is one of the largest DEXs in the crypto industry and its product development has the potential to attract a large number of users. Meanwhile, Layer Zero is a cross-chain messaging protocol that can connect Aptos to other blockchains, providing a much-needed interoperability tool.

Fundamentally, Aptos has cutting-edge technology with clear uses and a team of experts in their field. Now, we just need to see if it can drive more users.

You can also watch Coingecko’s video about Aptos below!

Aptos Risk

All new crypto projects carry a fairly high risk. At the start of its launch, there was some controversy about Aptos regarding tokenomics and the clarity of the APT token. On the day of the launch of APT on Binance and FTX, investors did not have access to information on APT tokenomics. This creates a bad image regarding the transparency of the team. Then, the crypto community was also quite surprised to see that the 51% figure for the community is actually for Aptos Labs and the Foundation. This investor and team-oriented APT distribution also have the potential to put huge selling pressure on the APT token. Lastly, new crypto projects like Aptos will have high price volatility.

In the end, you need to be careful before investing in APT and weigh the potential benefits and risks.

How to Buy Aptos (APT)

You can start investing in Aptos (APT) by buying it in the Pintu app. Here’s how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for APT.

- Click buy and fill in the amount you want.

- Now you have APT as an asset!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by CoFTRA and Kominfo.

You can also learn more crypto through the various Door Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Aptos White Paper, accessed on 31 October 2022.

- Aptos Team, accessed on 31 October 2022.

- David Shuttleworth, Aptos: A highly scalable and decidedly modular Layer 1 blockchain, ConsenSys, Accessed on 1 November 2022.

- Gustavo Lobo, Diving into the Aptos Network, The Tie Research, accessed on 1 November 2022.

- Built for Speed: Under the Hoods of Aptos and Sui, Amber Group, accessed on 2 November 2022.

- The Aptos Vision. By: Avery Ching, Aptos Medium, accessed on 2 November 2022.

- Block-STM: How We Execute Over 160k Transactions Per Second on the Aptos Blockchain, Aptos Medium, accessed on 3 November 2022.

- Aptos Tokenomics Overview, accessed on 3 November 2022.

- Gustavo Lobo, Aptos vs Sui, The Tie Research, accessed on 4 November 2022.

- Aptos vs. Sui: a detailed comparison, Pontem Network, accessed on 4 November 2022.