The Federal Reserve has once again raised its interest rate by 75 bps on Wednesday last week. This increase in interest rates was followed by a weakening of the crypto market. However, the decline did not last long and Bitcoin (BTC) bounced back soon after.

Pintu’s team of traders has collected various important data about the movement of the crypto market over the past week, which is summarized in this Market Analysis. However, you should note that all the information in this Market Analysis is for educational purposes, not financial advice.

Market Analysis Summary

- 🏦 The United States Central Bank (The Fed) raised its benchmark interest rate by 75 basis points. The Fed is likely to remain hawkish, or tighten monetary policy, before inflation reaches its peak.

- 📉 Equity markets slumped on the Fed’s hawkish stance, with the S&P, the Dow and Nasdaq down 4.6%, 2.6% and 6.8%, respectively.

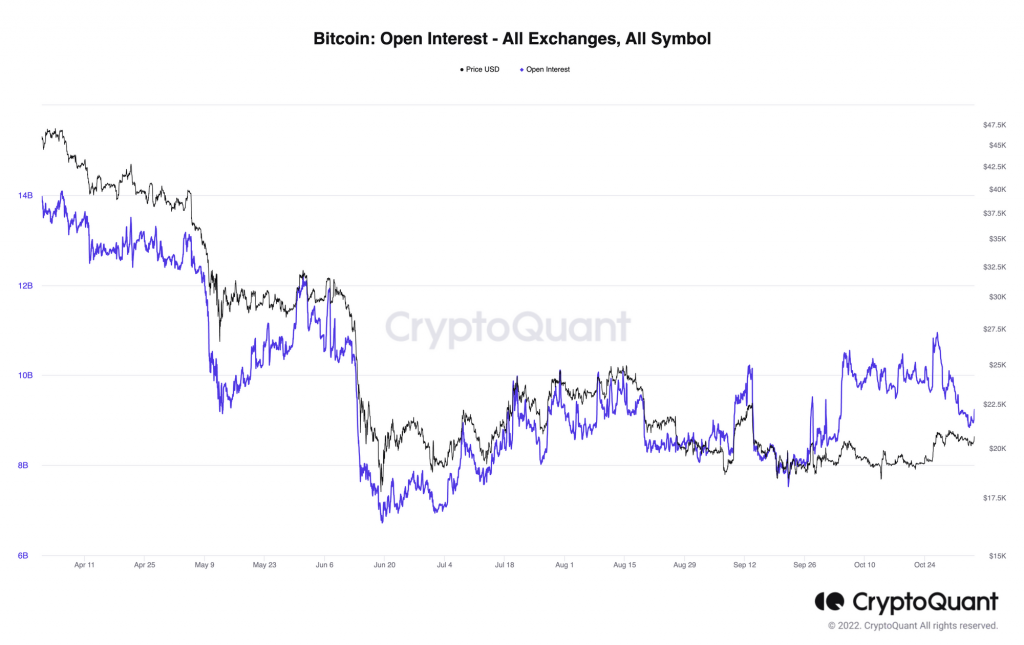

- 🔎 Open interest for Bitcoin (BTC) decreased from 10.7 Billion USD on October 26 to 9.2 Billion USD on November 4.

- 📊 BTC had mixed reactions following the Fed’s policy. BTC had experienced a decline after the Fed’s hawkish stance, but recovered and bounced back after that.

Macroeconomic Analysis

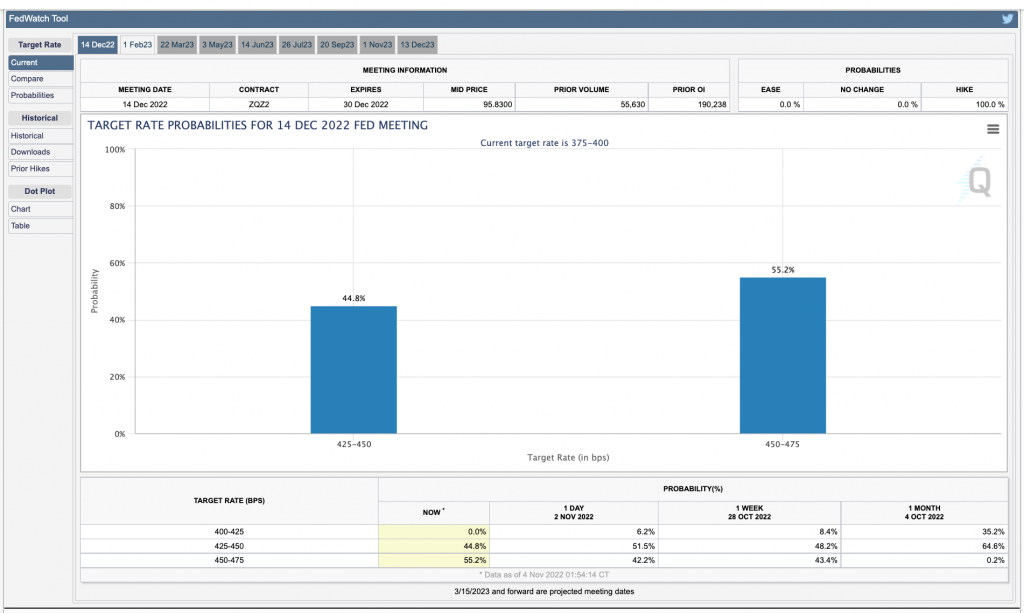

The Federal Reserve (the Fed) raised interest rates this week by an additional 75 basis points, bringing the goal range of 3.75–4% to its highest level since the 2008 recession.

Fed turned hawkish as the Fed chair mentioned, “We still have some ways to go, and incoming data since our last meeting suggest that the ultimate level of interest rates will be higher than previously expected.”This indicates that Fed might ultimately move rates higher than previously thought.

The tune has changed 180 degrees as CPI raised more sharply than expected in the last 2 months, suggesting that Fed might have more work to do before inflation peaked. The chart below indicated that Fed will hike to 4.75% by the end of this year and is projected to hike to a top rate of 5% by next year.

The equity market sank on Fed’s hawkishness, with S&P losing 4.6%, Dow losing 2.6%, and Nasdaq losing 6.8% at this point of writing. Nevertheless, we believed that Fed officials will be public in less hawkish terms soon, eventually toning down Jerome Powell’s hawkishness. As previously mentioned last week, expect a flip in both congress and senate in the coming mid-term election. This coupled with the Christmas rally, expects the equity market to be boosted towards the end of the year.

The dollar once again rallied after the Fed’s announcement of a Fed rate hike, only to fall on Saturday, reaching its support of 55 weeks EMA.

Bitcoin Price Analysis

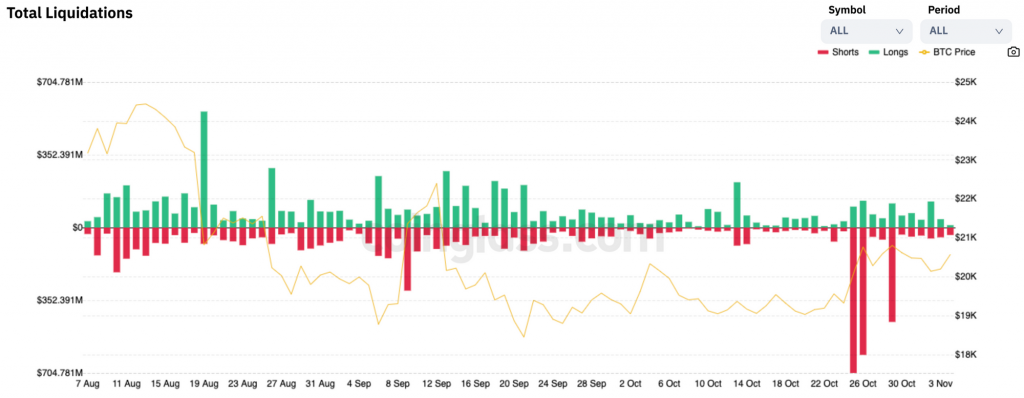

Over the past week, crypto derivatives recorded the largest short squeeze since mid-2021. On both days, 25th and 26th of October, a total of 1.3 Billion USD worth of shorts are liquidated. However, these short squeezes had a minimal impact on crypto prices.

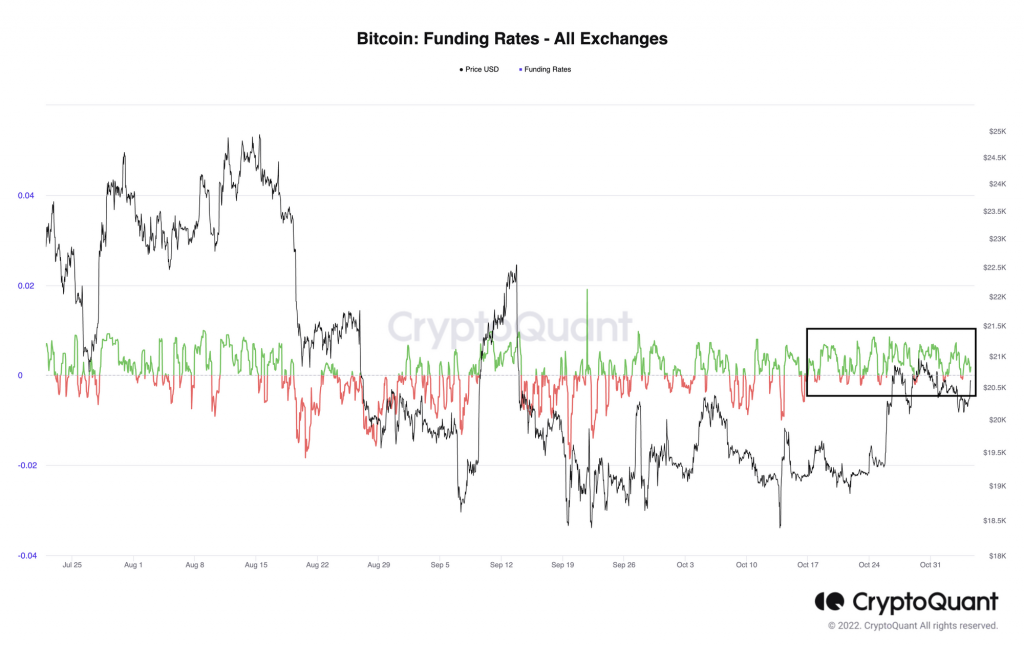

Open Interest for BTC decreased from 10.7 Billion USD on 26th October to 9.2 Billion USD on 4th November. The market has slightly deleveraged due to last week’s short squeeze as explained above. While this is a good signal, Open Interest still remained elevated.

Funding remained positive since mid-October, this would mean that the long-position traders are dominant and are willing to pay funding to short traders.

Over the week, BTC has fallen with the announcement of the Fed’s interest rate rise, coupled with Jerome Powell’s hawkish stance. However, this does not last long as we found support on the 21 and 55 weeks EMA and bounced, breaking above the 100 days EMA. Let’s find out more about whether we can stay above the 100 days EMA as a support line.

On the weekly chart, we are trying to break through the resistance of 21 weeks MA at 20,500. If we close the weekly candle above this price point, expect more positive momentum for the rest of the week.

Over the past week, we have managed to break through the 0.236 Fibonacci retracement line, which coincided with the 200 weeks EMA line. We then found support at this line and try to break through the 21 weeks EMA but to no avail. Resistance was at 1610.

On-chain Analysis

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

- 👨🏻💻 Miners: Miners are selling holdings in a moderate range compared to their one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-chain: More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom. Long-term holders’ movement in the last 7days was lower than the average. They have the motive to hold their coins. Investors are in a Capitulation phase where they are currently facing unrealized losses. It indicates the decreasing motive to realize loss which leads to a decrease in sell pressure.

- 🏦Derivatives: Long-position traders are dominant and are willing to pay short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest decreases, it indicates investors are closing futures positions and the possibility of trend reversals. In turn, this might trigger the possibility of long/short squeeze caused by sudden price movement or vice versa.

- 🔎 Technicals: RSI indicates a Neutral condition. Stochastic: It indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

Altcoins News

- 🖼 Beeple Will Launch ‘Immersive 3D NFTs’ on Solana. World’s best-selling NFT artist, Beeple, will bring NFT to Solana blockchain via Metaplex and Render Network. Stephen Hess, CEO of Metaplex Studios—creator of the Solana NFT standard—brided the news on Sunday, November 6, 2022. “Working closely with Render Network, we are delighted to welcome Beeple to Metaplex and Solana,”Hess announced, adding that Beeple will “launch future front of streaming and immersive 3D NFT.”

- 🎮 GALA Drops 20% Following Hacking Issue. Gala Games created panic last Thursday due to fears of a potentially billion dollar hack, that sent its native token, GALA, down by 20%. Meanwhile, a company that appears to be linked to the play-to-earn platform said that Gala was actually deliberately attacking themselves to prevent malicious actors from escaping with users’ money. This concern grew after a single blockchain address appeared and minting more than $1 billion worth of GALA tokens.

More News from Crypto World in Last Week

- ⚠️ Binance to Sell Remaining Holdings of FTX Tokens. The founder & CEO of crypto exchange Binance, Changpeng ‘CZ’ Zhao, on Sunday admitted to selling the remaining native tokens FTX (FTT) they own. In his tweet, CZ said that the move would be conducted in a manner that would “minimizes market impact”and could take “several months to complete.”The move follows concerns over the financial health of Alameda Research, the trading company founded by Sam Bankman-Fried, CEO of FTX.

- 🔗JPMorgan executes first DeFi trade. Global financial giant JP Morgan completed its first cross-border transaction using DeFi on a public blockchain with the help of the Monetary Authority of Singapore’s (MAS) Project Guardian. DBS Bank commenced test trading of foreign exchange (FX) and government securities using a DeFi liquidity pool. In addition to JPMorgan and DBS Bank, the Bank for International Settlements also said that the automated market-making technology in DeFi could serve as “the foundation for a new generation of financial infrastructure.”

References

- Fajar Nugraha, Pemilu Midterm AS: Empat Medan Pertempuran Senat yang Penting, Medcom.id, accessed on November 6, 2022

- Tracy Wang, Binance to Sell Rest of FTX Token Holdings as Alameda CEO Defends Firm’s Financial Condition, CoinDesk, accessed on November 7, 2022

- Prasant Jha, JPMorgan executes first DeFi trade on a public blockchain: Finance Redefined, Cointelegraph, accessed on November 7, 2022

- Krisztian Sandor, $1B Crypto Hack Fears Spur 20% GALA Plunge, but Firm Implies It Attacked Itself as a Safeguard, CoinDesk, accessed on November 7, 2022

- Stephen Graves, Beeple Is Bringing ‘Immersive 3D NFTs’ to Solana, Decrypt, accessed on November 7, 2022